Yeah, that’s fair on the FTC. Was more cartooning, but the auto cycle starting to turn does make for an interesting setup against the backdrop of…everything else in the world

06.05.2025 01:28 — 👍 0 🔁 0 💬 1 📌 0

So…MAX 🚀🚀🚀?

06.05.2025 01:21 — 👍 0 🔁 0 💬 1 📌 0

I have been very full on the fun-nançe side, not the other stuff quite yet

06.05.2025 01:19 — 👍 1 🔁 0 💬 0 📌 0

Come on, @transverseslice.bsky.social you had to have intentionally tried not to read any of my ‘love for one small bank in particular’ tweets…

16.01.2025 01:01 — 👍 1 🔁 0 💬 1 📌 0

You sure???

07.01.2025 03:27 — 👍 1 🔁 0 💬 1 📌 0

I’m getting follows from the same bots. It’s brutal.

07.01.2025 03:09 — 👍 0 🔁 0 💬 1 📌 0

But don’t sleep on how much public equity value is coming from strategics buying PE portcos. NFP ($13B), McGriff ($8B), and Assured ($14B) sold to strategics (~$35B of EV going to public markets combined). Just Q4. That’s the other big channel.

07.01.2025 02:50 — 👍 2 🔁 0 💬 0 📌 0

Yes to bigger cos after longer holds. Just look at insurance broking in Q4: Alliant sold a sizable stake at a $25B EV. Ardonagh at $14B. Howden rumored not far behind. Hub, Acrisure, etc. have previously. All will be public, but get there at $20B+ TEV. That’s a ton of new publicly traded value.

07.01.2025 02:49 — 👍 2 🔁 0 💬 1 📌 0

I feel better about the second response than the first here, but again, no real way to prove this that comes to mind

07.01.2025 02:26 — 👍 2 🔁 0 💬 1 📌 0

That scale M&A thing may sound trite, but reality is that a sector “discovered” by PE sees tons of consolidation and may produce fewer public cos. So it may be more: PE contributes more market cap to the public markets than it takes out, but in fewer companies and often as M&A targets

07.01.2025 02:25 — 👍 3 🔁 1 💬 1 📌 0

I have absolutely no satisfactory way to prove this, but yes, at some point. The big swing as to when will be scale M&A. Take insurance brokerage where Aon, Marsh, and Gallagher have recently taken out $7-15B PE portcos that could have gone public (well NFP definitely and McGriff maybe/AP no chance)

07.01.2025 02:23 — 👍 3 🔁 0 💬 1 📌 0

Short answer is a few, although you are mostly right that most are sour grapes and mad about marks (credit to Cliff Asness for giving the fair and good faith anti-PE view). One caveat is the annuity carrier movie could end badly, but that should be more whimper than bang, especially industry-wide.

31.12.2024 04:17 — 👍 1 🔁 0 💬 0 📌 0

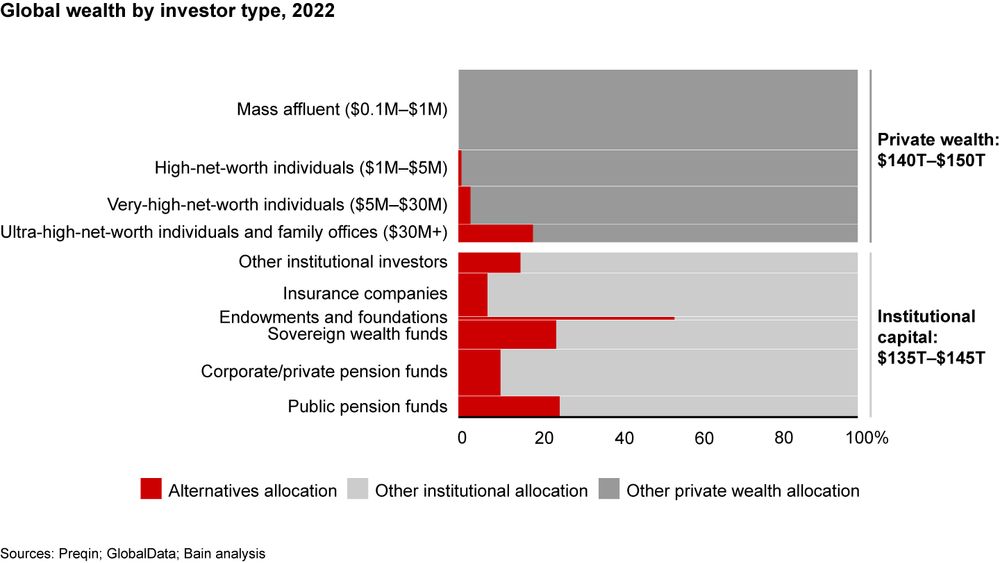

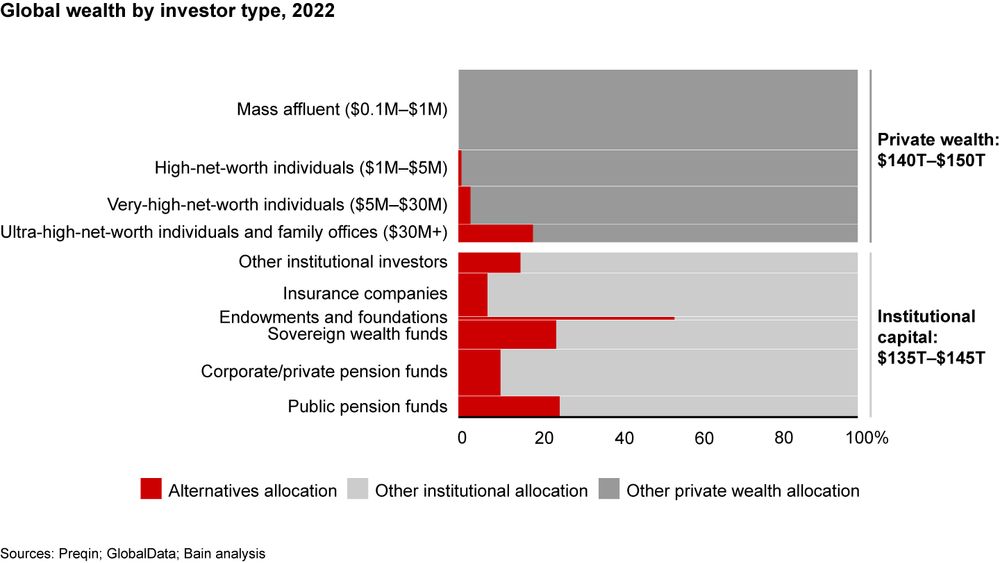

Just to be that guy over here too: imagine being a PE permabear with this chart (and functionally no ERISA money in the asset class either). And after an R sweep. Lmao.

31.12.2024 03:36 — 👍 4 🔁 0 💬 1 📌 0

occasional bass player, ex-antique salesman, former ft reporter and eu l/s equity analyst. rts ≠ opinions. all views my own.

“Good theory indicates how to carve a system at the joints.”

Equities, ex-credit, they keep forcing me to cover semiconductors, Final Fantasy, cats

Posting about insurance trends

Author of Calculated Risk economics blog. https://www.calculatedriskblog.com/

Real Estate Newsletter at http://calculatedrisk.substack.com

https://themagicbakery.substack.com/

NOT investment advice. Retweets/likes not endorsements. Entertainment and sass only. NOT to be taken seriously. Personal account.

Pittsburgh investment manager since 2014. Buying the weirdest and wildest.

alluvial.substack.com

tactilefund.com

Def Not Commercial Real Estate; Advocate for AI Proptech and Other Made Up Things; Opinions are someone else’s

https://ihatemoney.beehiiv.com

There's always money in the banana stand.

1) If you have no edge, correct position size is 'don't buy”. 2) Position sizing is determined by downside. 3) All great investing records employed leverage.

Fintwit refugee. Random observations. Sometimes finance-related. Shitposter with a Bloomberg. Night 🦉and wearer of pointy hats and flower garlands. Avant gardener

Cruise ship Zumba instructor. Lapsed CFA Charterholder. Banned from Boat Owners Forum (unjustly)

I invest in unrecognized/underappreciated excellence. Marathon AM: Trying to spot a great manager remains a game very much worth playing.

Reading SEC filings intensively and obsessively for 20+ years. Home of the Friday Night 💩. Learn more at footnoted.com. Brooklyn-born and raised, but now an Angeleno with a soupçon of Paris.

Signal: footnoted.90