AI and the economy: your questions answered

In this interactive webinar, our economics experts from around the world will cover our latest insights on the impact of AI on economic growth and labour markets, as well as our proprietary upside and...

Are you worried about the AI bubble bursting? Do you want to know if AI is already driving productivity growth?

Then join us tomorrow at 2pm GMT for a webinar on the economic impacts of AI, primarily dedicated to answering your questions!

Register here: www.oxfordeconomics.com/webinar/ai-a...

09.02.2026 09:12 —

👍 1

🔁 0

💬 1

📌 0

What seems to have been happening here is that in order to get the fair to middling improvements in output, it has become necessary to throw much more compute at every query, at a rate which has increased faster than the learning curve for the tokens themselves. That ... ain't good.

09.08.2025 17:46 —

👍 52

🔁 23

💬 2

📌 1

Ticket barriers at Stansted Airport train station. Is it snowing in hell?

01.07.2025 20:14 —

👍 2

🔁 0

💬 0

📌 0

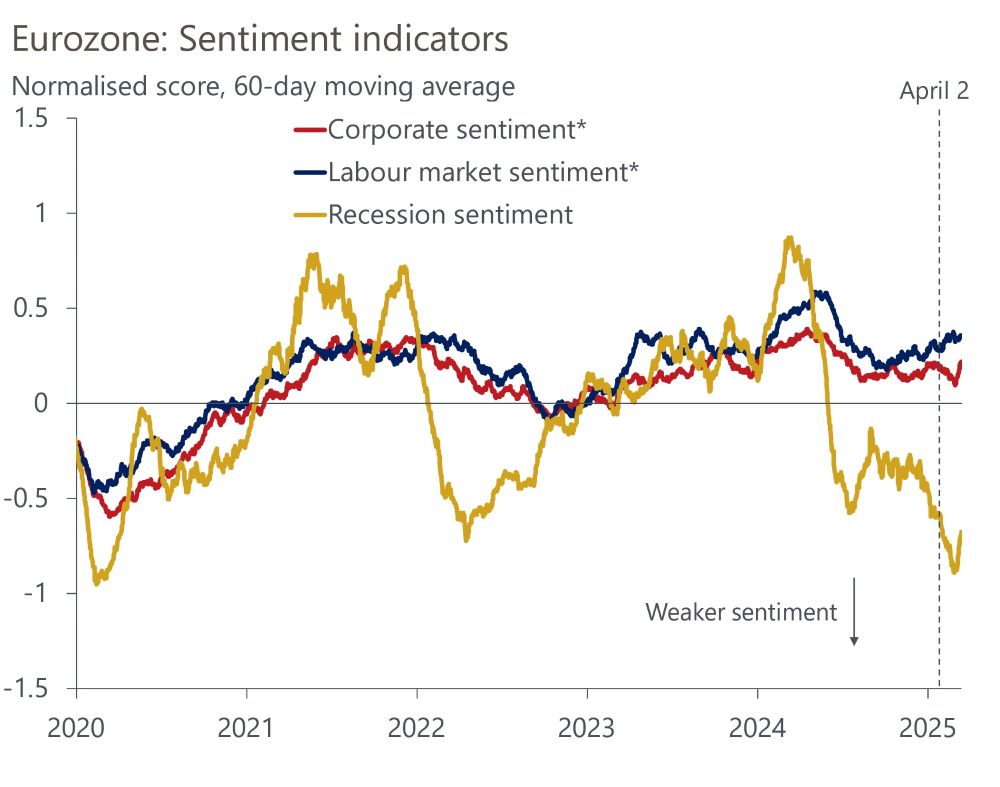

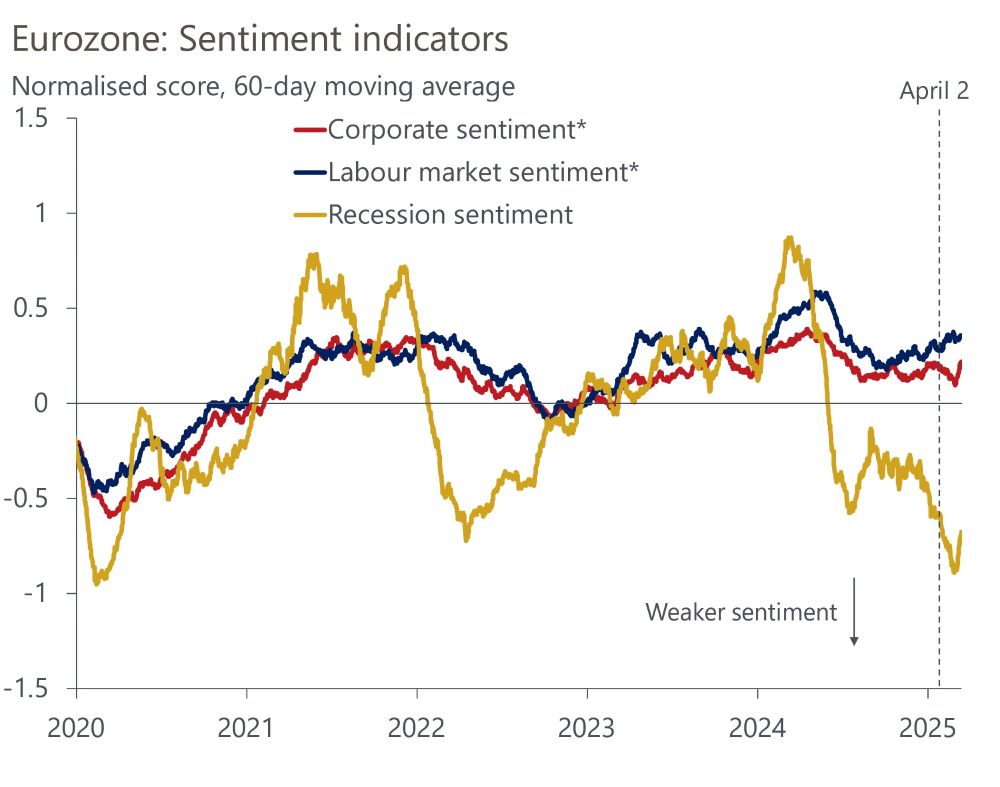

But it's not all doom and gloom: despite the heightened levels of uncertainty, double digit tariff rates being sounded off on the daily and recession fears, both consumer and business confidence seem to be holding up relatively well, as evidenced by our NLP-based proprietary sentiment data!

10/11

27.05.2025 10:56 —

👍 1

🔁 0

💬 2

📌 0

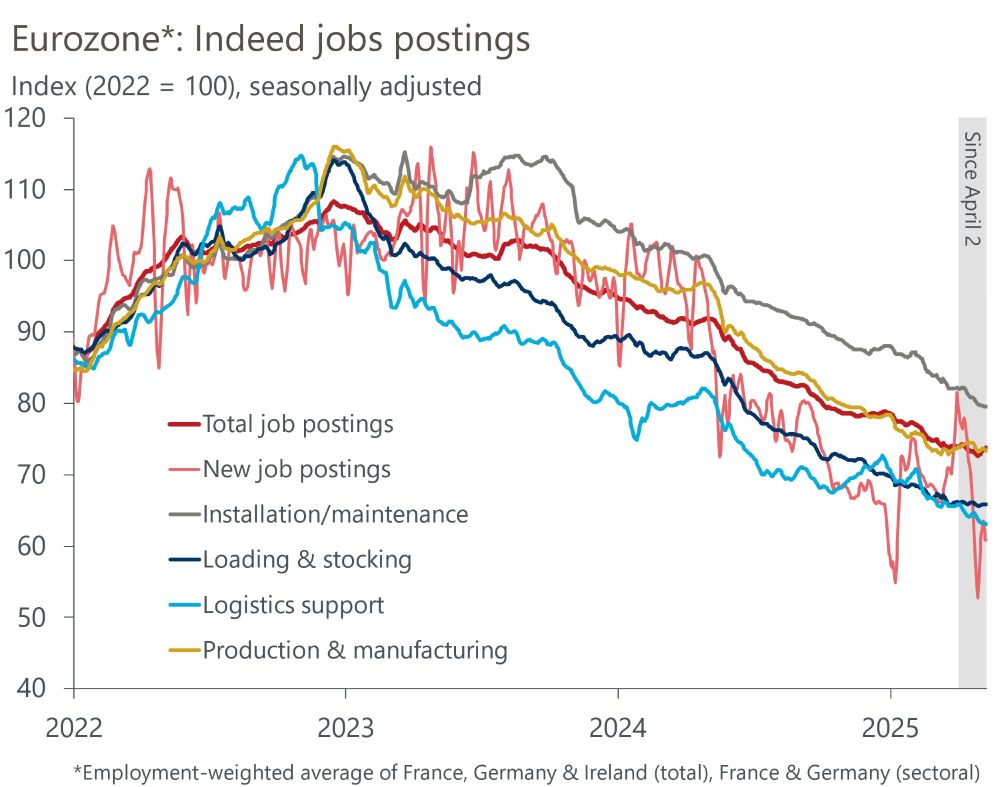

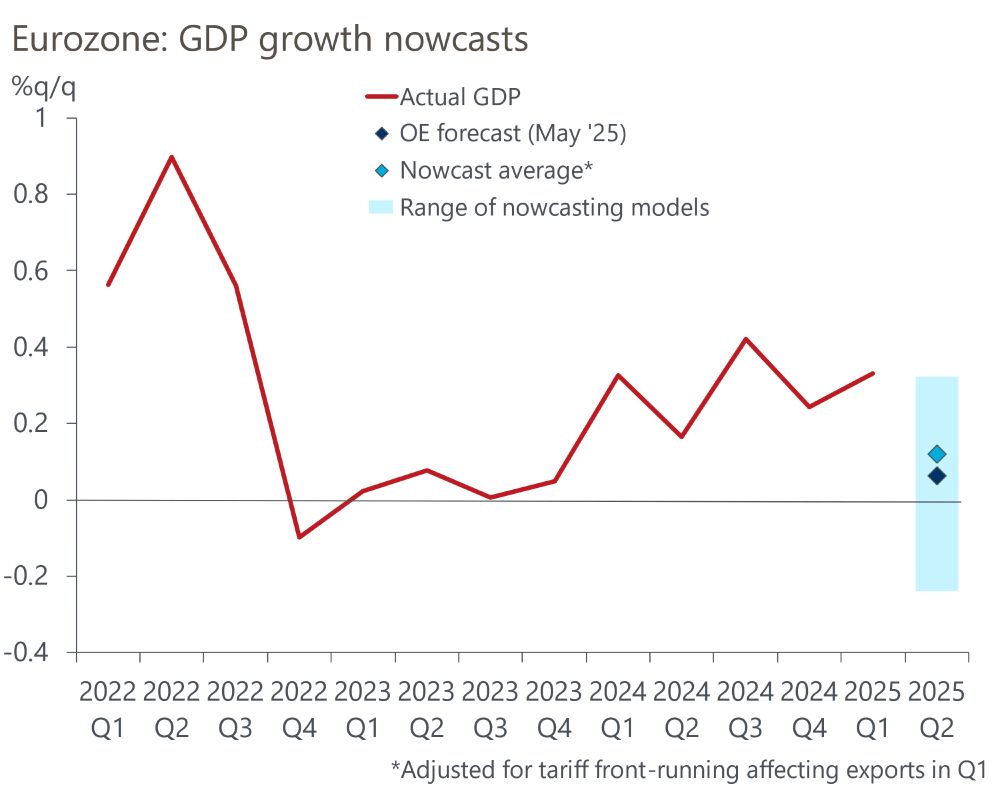

Labour market is key. Our baseline is for hiring to grind to a halt, but for firms in aggregate to hold on to workers. But a larger deterioration in the job market would dent consumer spending even more and put the Eurozone economy uncomfortably close to a recession.

9/11

27.05.2025 10:56 —

👍 0

🔁 0

💬 1

📌 0

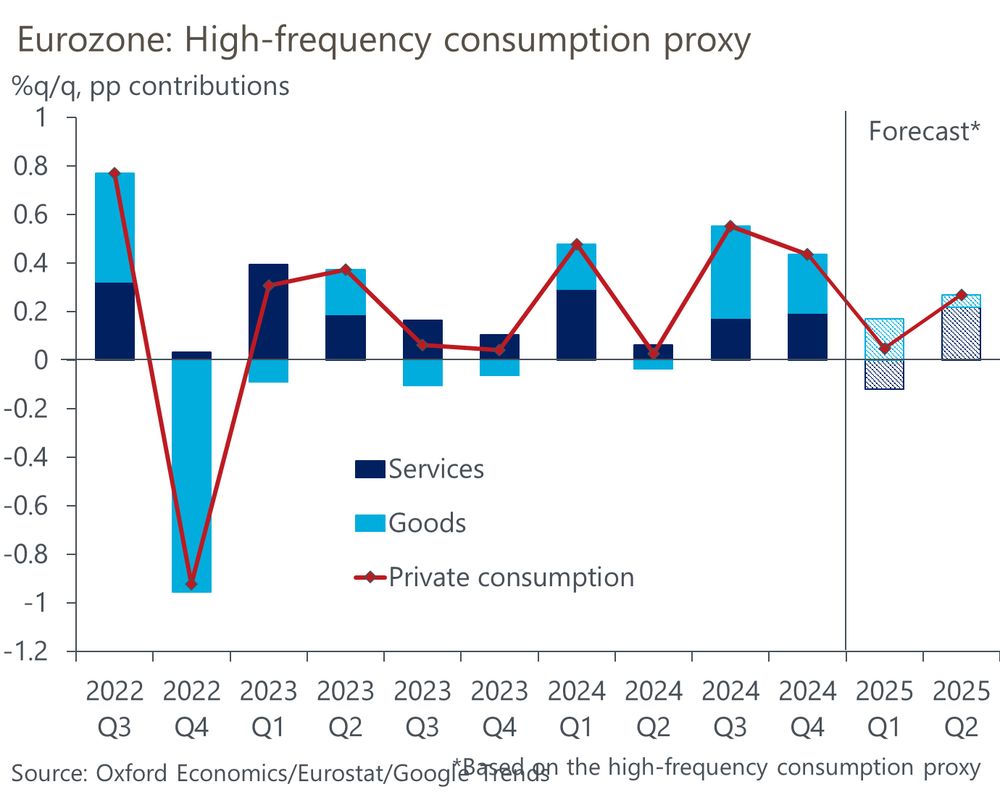

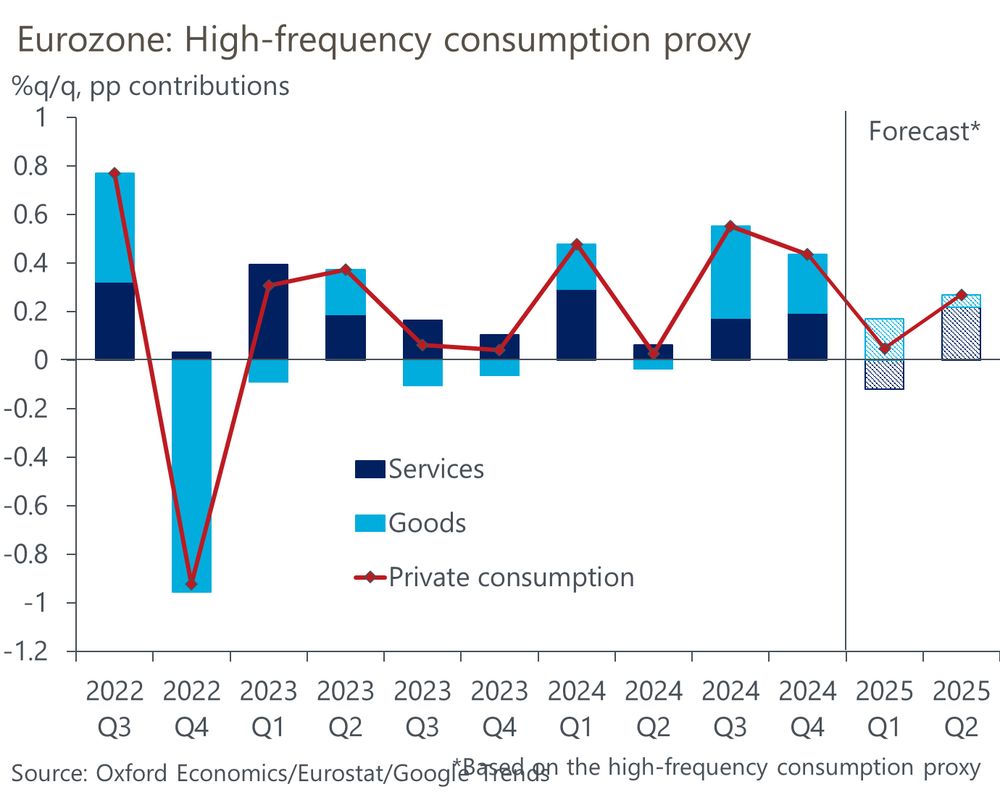

Data from online searches shows consumer spending, the key driver of growth in the eurozone over the past 18 months, is slowing down. While we tend to think of uncertainty as mainly affecting firms' investment decisions, consumers don't like it either.

8/11

27.05.2025 10:56 —

👍 1

🔁 0

💬 1

📌 0

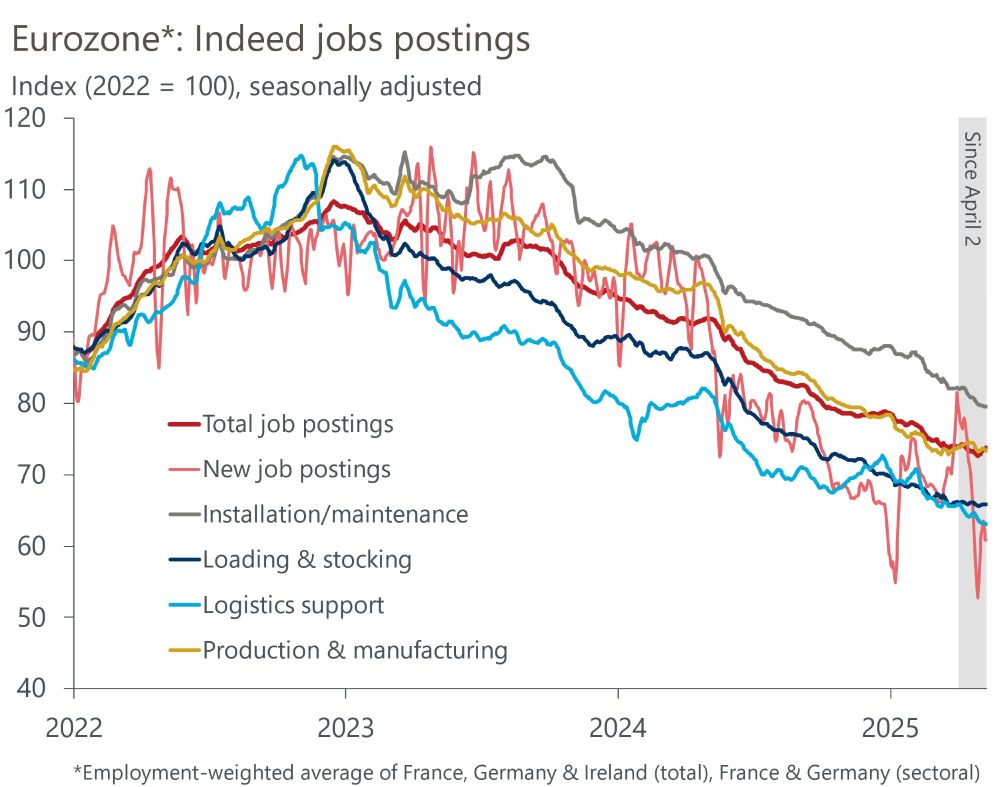

Online job postings have dipped sharply around "Liberation Day", but have bounced back since, although they remain on a downward trend. Crucially, this trend isn't any more pronounced for manufacturing or logistics jobs which are more exposed to tariffs.

7/11

27.05.2025 10:56 —

👍 1

🔁 0

💬 1

📌 0

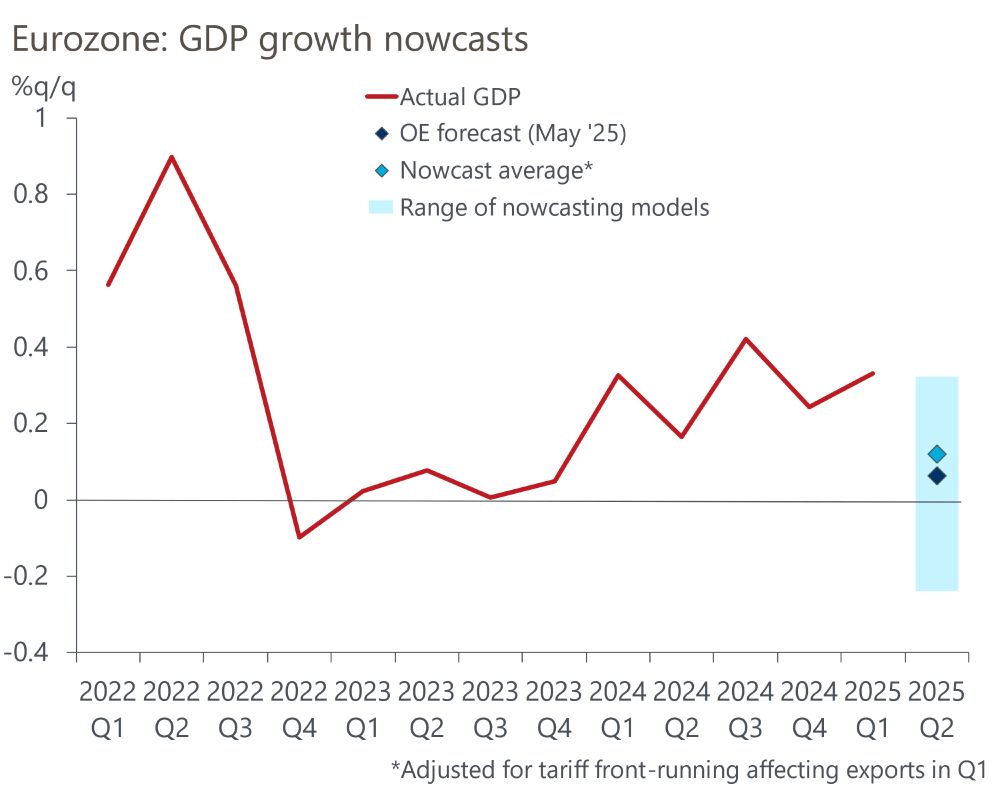

Electricity consumption data correlate well with industrial production, and they are showing a decline in manufacturing output in April & May after tariffs have been imposed - though tariff front-running in Q1 is likely overstating the scale slightly.

6/11

27.05.2025 10:56 —

👍 0

🔁 0

💬 1

📌 0

This is why at Oxford Economics we also track a variety of high frequency alternative data for a glimpse into the economy in near-real time. Such data is unofficial but nonetheless useful in tracking economic activity - and they're already showing signs of the tariff impact.

5/11

27.05.2025 10:56 —

👍 1

🔁 0

💬 1

📌 0

Consider this - we'll only get flash Eurozone GDP growth numbers for Q2 in early July. Consumer spending data a month later still. Industrial production numbers for April? We'll get those mid-June. At a time of rapid economic changes, this simply isn't good enough.

4/11

27.05.2025 10:56 —

👍 1

🔁 0

💬 1

📌 0

These tariffs are already applied, and that chain reaction is already feeding through the economy. The problem is, waiting for that to show in the standard macroeconomic data will take quite a long while.

3/11

27.05.2025 10:56 —

👍 0

🔁 0

💬 1

📌 0

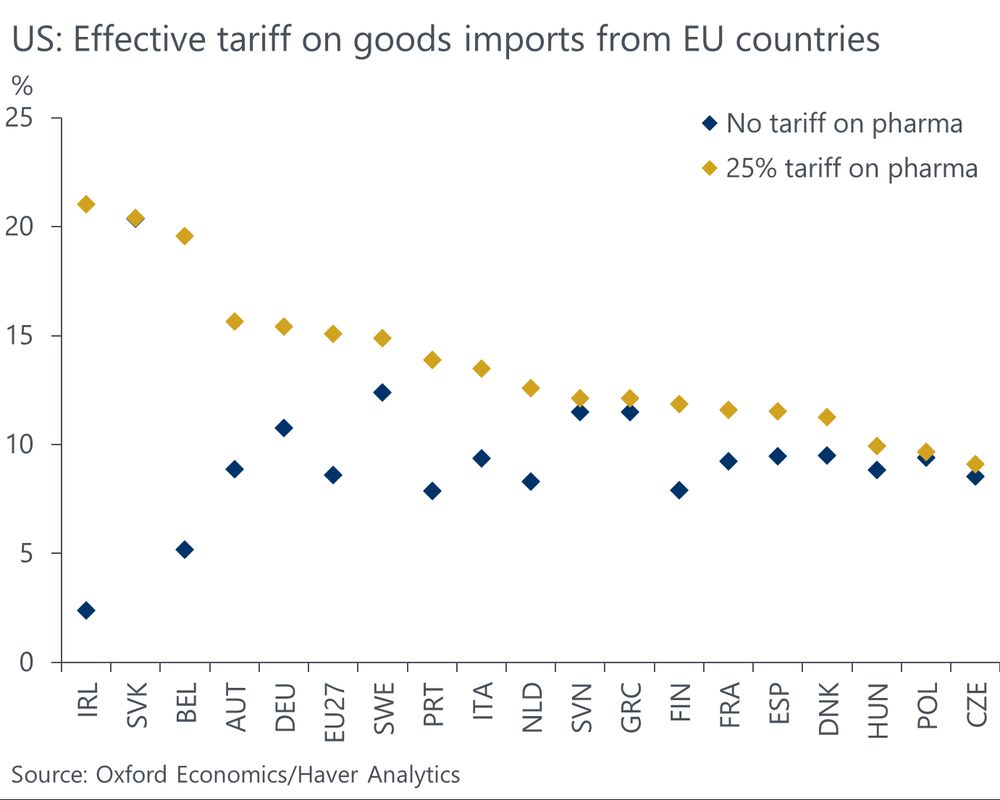

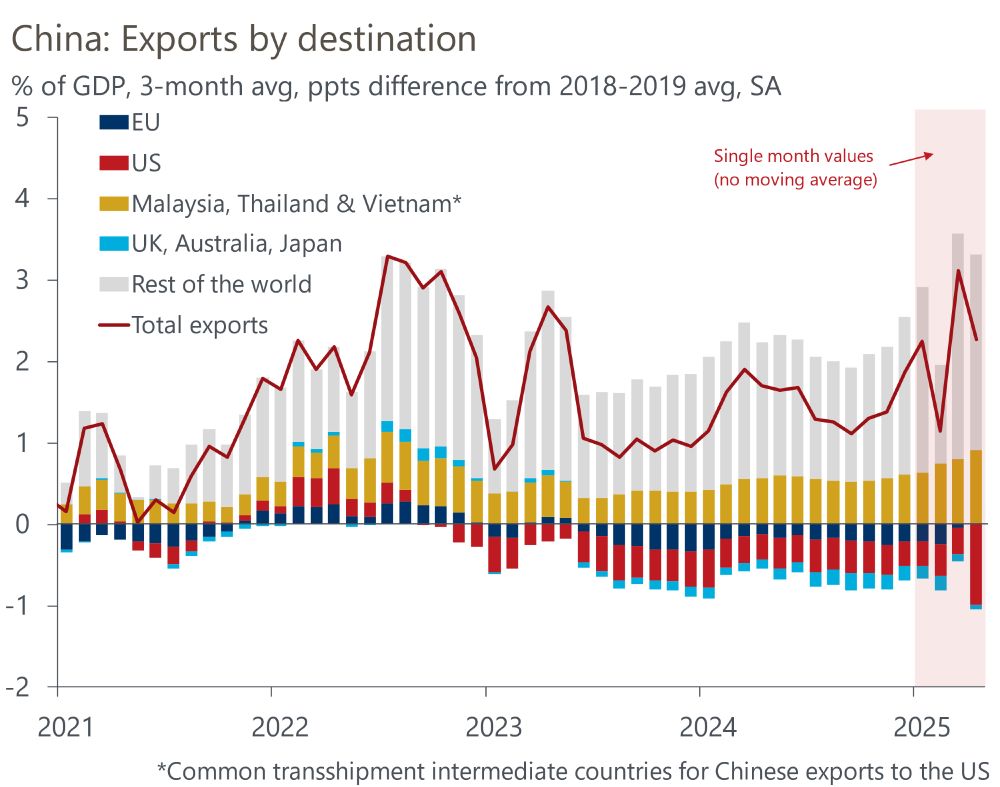

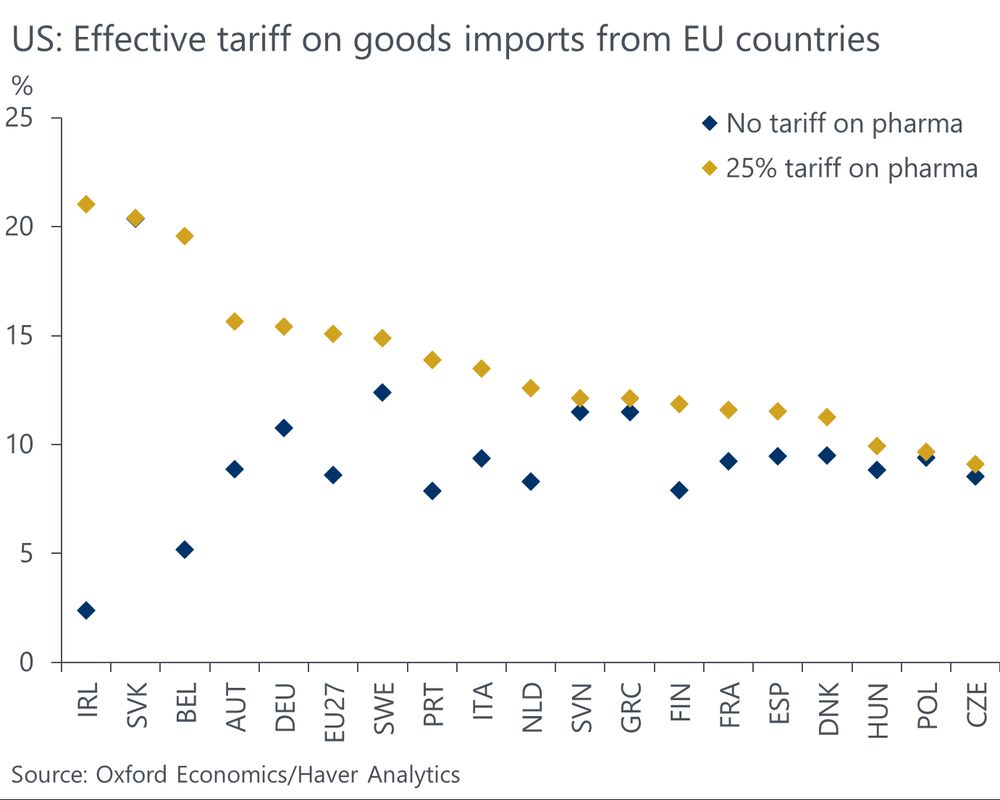

In fact, the current trade-weighted tariff rate is about 9%, accounting for all the exceptions and higher rates on specific goods such as metals or cars. It could rise to 15% if pharmaceuticals are also tariffed.

2/11

27.05.2025 10:56 —

👍 1

🔁 0

💬 1

📌 0

US tariffs are already having a harmful economic impact in Europe - but you won't see it in traditional data for months.

You'd be forgiven for not knowing what tariffs the US is charging. Is it 10%, the "reciprocal" 20% or are we at 50% now? Or from June? Or is that July?

1/11

27.05.2025 10:56 —

👍 1

🔁 0

💬 1

📌 0

Congratulations, well deserved! (Not sure the same can be said about Spurs though)

23.05.2025 10:03 —

👍 1

🔁 0

💬 0

📌 0

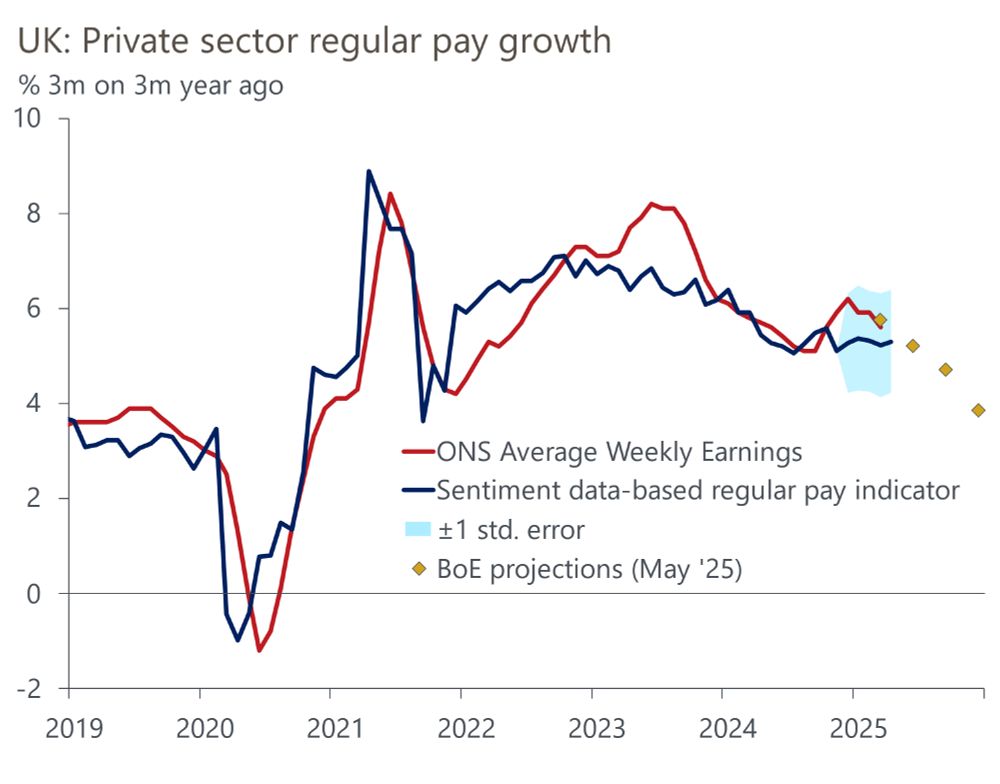

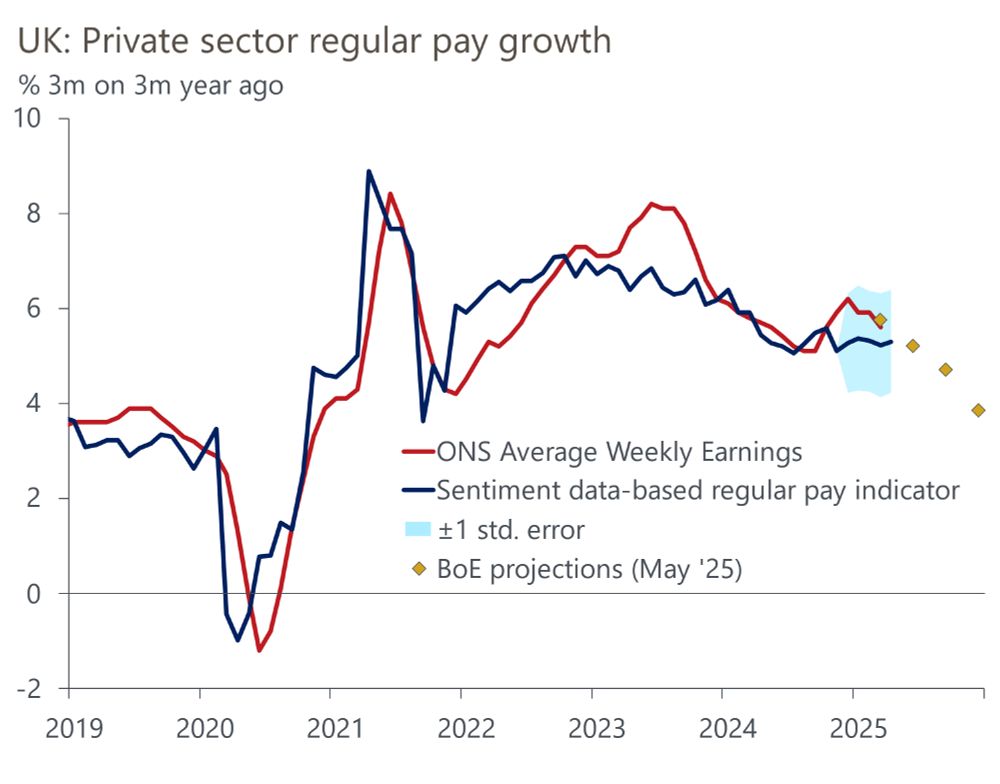

Our pay nowcast suggests private sector regular pay growth will stabilise in Q2, rather than fall as the BoE expects. As the MPC puts a high weight on pay as an indicator of underlying inflation pressures, this is likely to reinforce the caution around the pace of rate cuts.

7/8

23.05.2025 09:56 —

👍 0

🔁 0

💬 1

📌 0

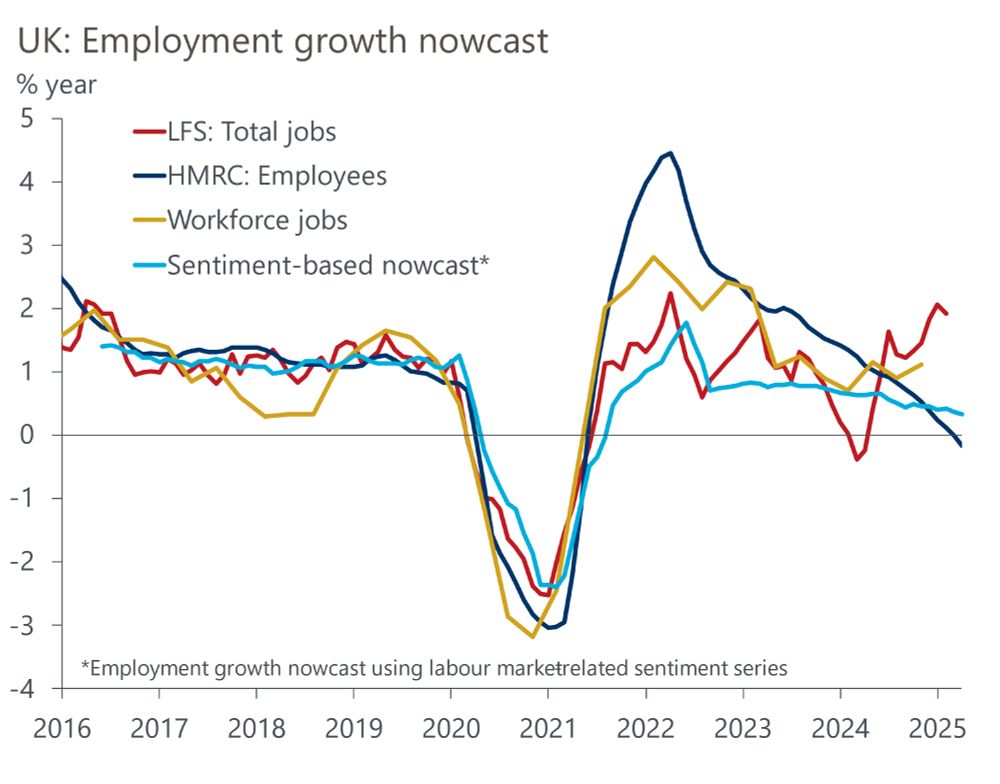

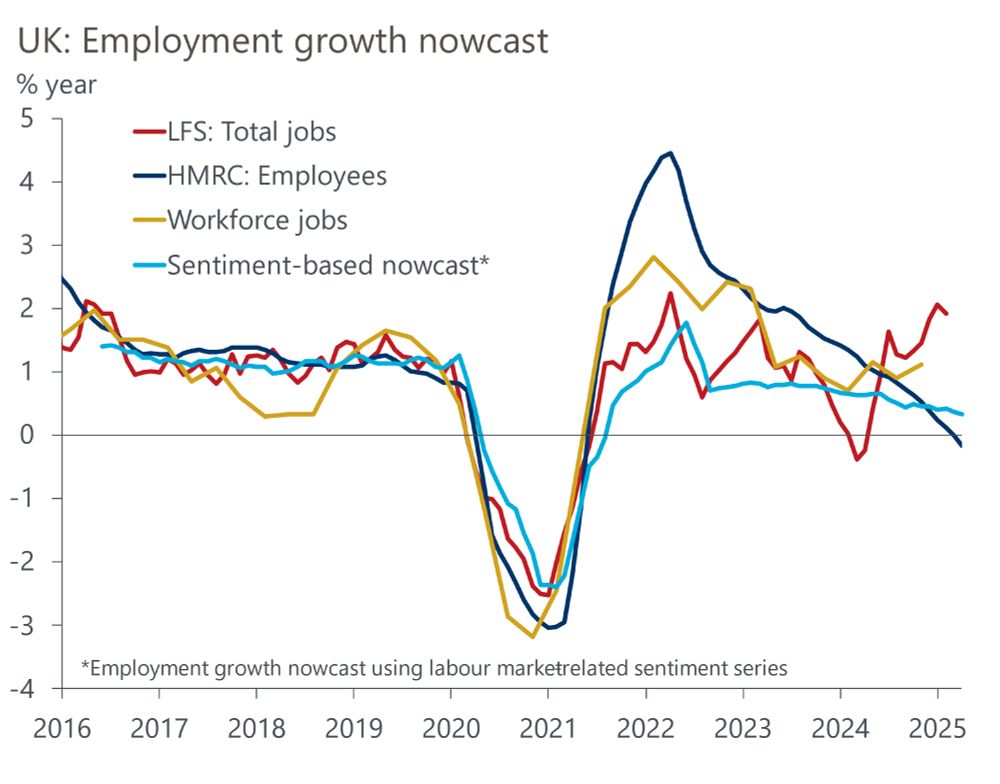

Our measure of labour market sentiment has stabilised at very low levels. The detailed results continue to suggest that firms are prioritising retention over recruitment, though encouragingly the score for expansion plans has progressively strengthened in the past six months.

6/8

23.05.2025 09:56 —

👍 0

🔁 0

💬 1

📌 0

What's the data saying at the moment then? UK employment growth has continued to slow in recent months. But as yet, there is no evidence that last month’s increases in employers’ NICs and the national living wage have triggered large-scale job losses.

5/8

23.05.2025 09:56 —

👍 0

🔁 0

💬 1

📌 0

We have been using proprietary NLP-based sentiment data (developed with Penta) to successfully nowcast UK's wage and employment growth long ahead of the official data releases. The granular sentiment data also provide a timely glimpse into the labour market.

4/8

23.05.2025 09:56 —

👍 0

🔁 0

💬 1

📌 0

Yet the impact on hiring and wage growth is crucial for the Bank of England to set monetary policy, particularly as it still has to contend with sticky services inflation - wage costs are a large component of services prices.

Regular macro data just don't cut it in this case.

3/8

23.05.2025 09:56 —

👍 0

🔁 0

💬 1

📌 0

Good case in point is the UK, where the employers' NICs and National Living Wage hikes went into effect recently. Waiting to assess the impact using traditional employment & wage data will take months. And the labour market data in particular are suffering from poor quality.

2/8

23.05.2025 09:56 —

👍 0

🔁 0

💬 1

📌 0

Traditional macroeconomic data is slow - collected at low frequency and released with a long lag. This means that policymakers are effectively flying blind when making decisions.

At Oxford Economics, we use a variety of timely alternative data to get around this problem.

1/8

23.05.2025 09:56 —

👍 0

🔁 0

💬 1

📌 0

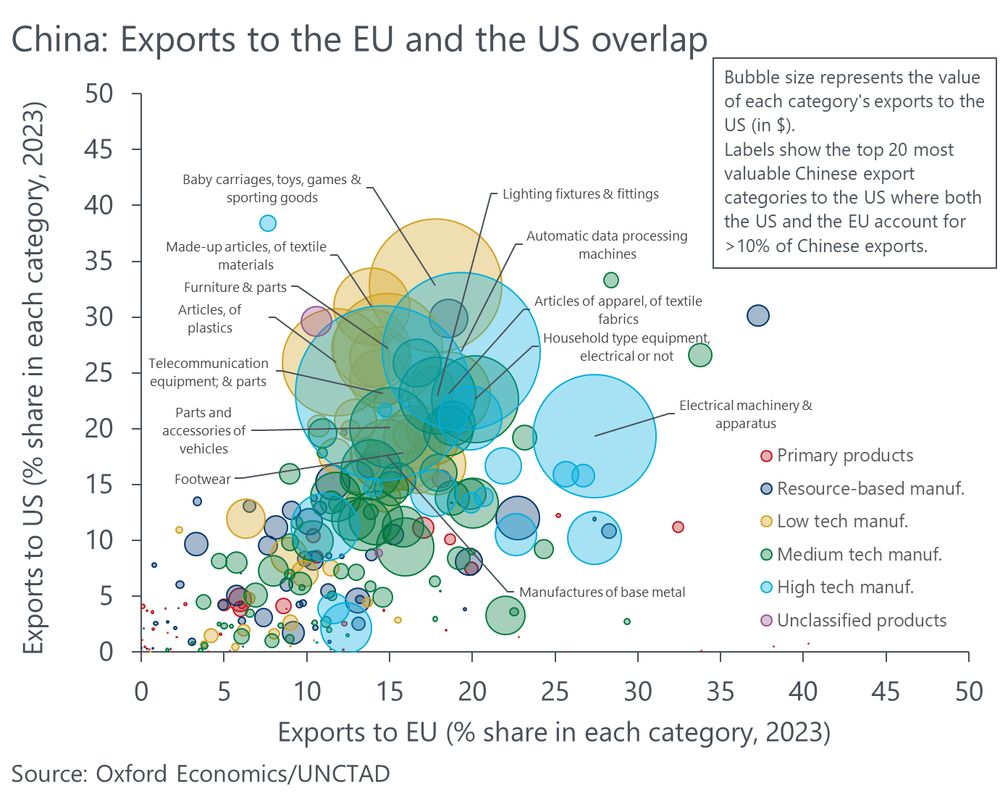

There are of course two sides to this coin - EU producers might well supplant Chinese exports in the US, thanks to lower *relative* tariffs. We estimate the ceiling of that to be $150bn (5% of the EU's manufacturing GVA). This highlights the variety of shift tariffs bring to global trade.

10/10

21.05.2025 08:51 —

👍 0

🔁 0

💬 0

📌 0

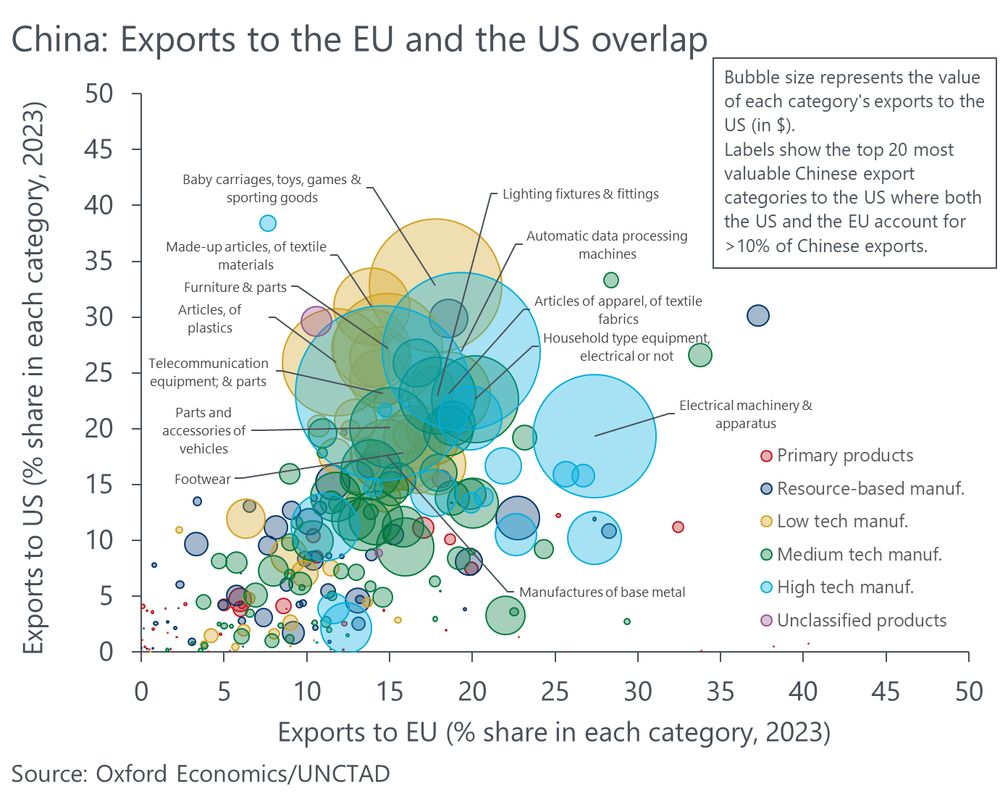

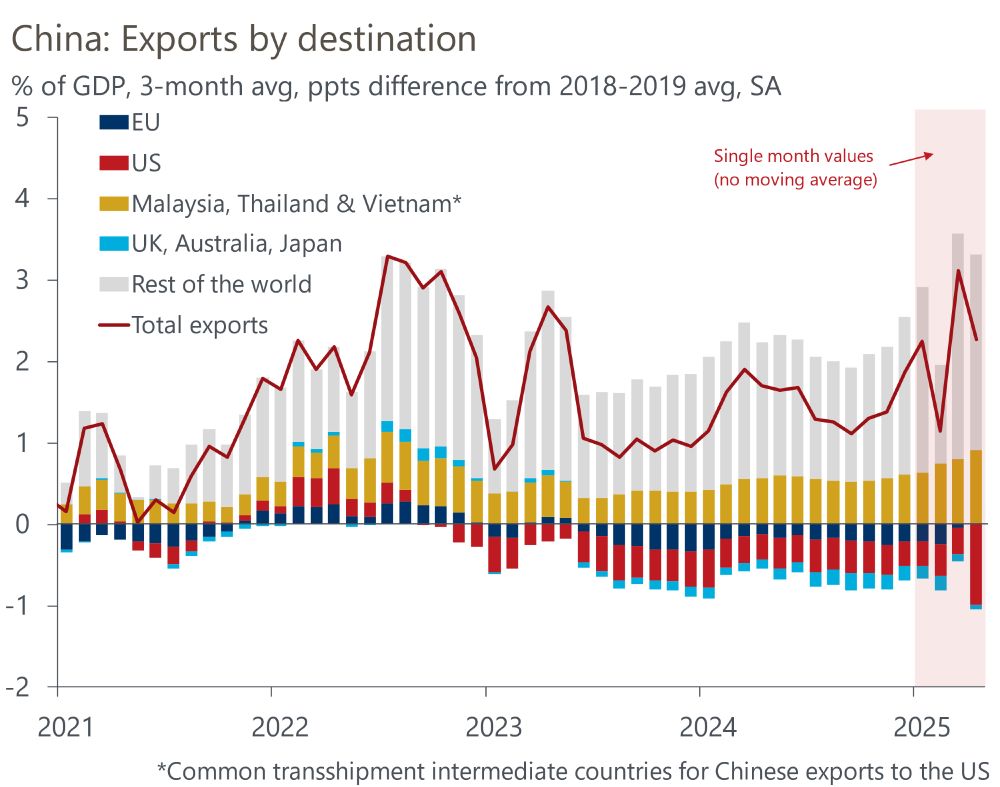

There is a substantial overlap between the Chinese exports to the US & the EU but we remain sceptical about the flooding of EU markets.

Chinese firms' profitability is already low and the government stimulus efforts seem to be focused elsewhere. Plus the EC might always respond with tariffs.

9/10

21.05.2025 08:51 —

👍 0

🔁 0

💬 1

📌 0

On the downside, the most commonly cited risk is China flooding the EU markets with its surplus capacity it might no longer be able to export to the US. There has been a steady rise in Chinese exports to the EU in the latest data.

8/10

21.05.2025 08:51 —

👍 0

🔁 0

💬 1

📌 0

New supply chains forced by tariffs are unlikely to be as efficient as those forged by market forces.

Restricted US market access will reduce firms' returns to scale, resulting in higher prices globally.

Firms might also dilute the US tariff surcharge in their global pricing.

7/10

21.05.2025 08:51 —

👍 0

🔁 0

💬 1

📌 0

We think there are two-sided risks on supply-driven inflation.

Any tariff retaliation will inevitably push prices higher. As businesses adjust & reorient complex global supply chains, various pressures might yet emerge - though US-EU supply chain linkage is relatively low.

6/10

21.05.2025 08:51 —

👍 0

🔁 0

💬 1

📌 0

Similalrly, import & producer prices show little sign of supply pressures - if anything, it's the opposite, with price growth running well below 2%. Stronger euro also helps. It's still early days, but this is a relatively good position to enter the era of high tariffs from.

5/10

21.05.2025 08:51 —

👍 0

🔁 0

💬 1

📌 0