I agree. Seems like an overreaction / expecting more bad news to come during future updates?

02.07.2025 07:16 — 👍 0 🔁 0 💬 1 📌 0@jefke.bsky.social

Retail trying to not be fooled by randomness. nodeepdives.substack.com

@jefke.bsky.social

Retail trying to not be fooled by randomness. nodeepdives.substack.com

I agree. Seems like an overreaction / expecting more bad news to come during future updates?

02.07.2025 07:16 — 👍 0 🔁 0 💬 1 📌 0

No Deep Dives Q2 2025 letter

+10.34% vs 2% for S&P 500 (EUR)

nodeepdives.substack.com/p/q2-2025-po...

Pabrai says he got banned from a Vegas casino for beating blackjack.

His system? Bet small when losing, big when winning.

Cool story.

It's also just that. A story

nodeepdives.substack.com/p/ackchyuall...

New post on tactilefund.substack.com. A link to our first quarter letter and a recent conversation. Thanks for reading!

06.05.2025 18:02 — 👍 15 🔁 1 💬 1 📌 0

Curious to hear AerCap’s comments on the whole tariff situation and don't want to wait a whole day until their Q1 25 earnings? #AER

I got you.

open.substack.com/pub/nodeepdi...

No Deep Dives Q1 2025 letter

-0.13% vs -8.69% for S&P 500 (EUR)

nodeepdives.substack.com/p/q1-2025-po...

"Americans delay home improvements" (FT)

"Jeld-Wen forecast revenues would drop 4-9%"

"AO Smith forecast flat to modest sales growth"

"Home Depot forecast 1% rise"

"Trump’s eagerness to deport undocumented workers poses a particular threat" to construction

$JELD $AOS $HD

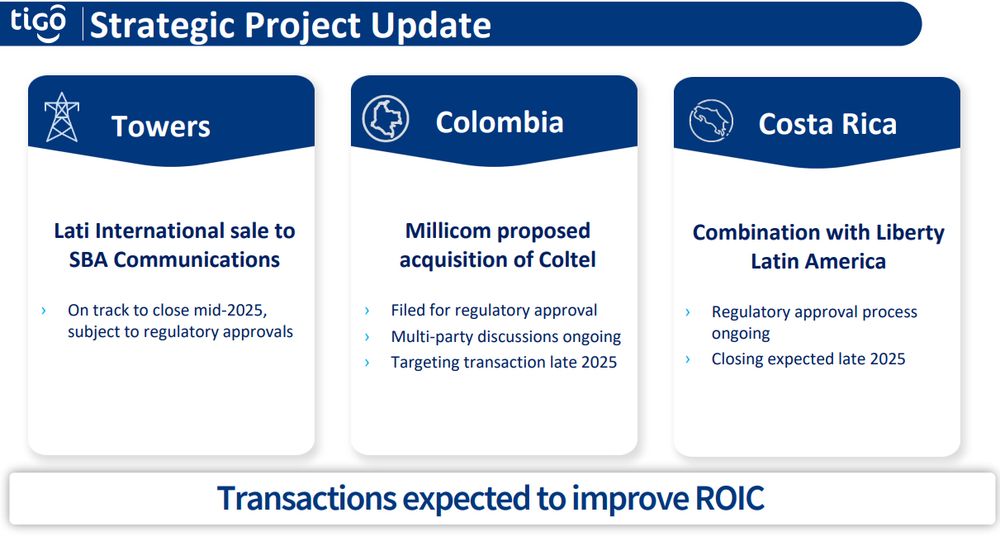

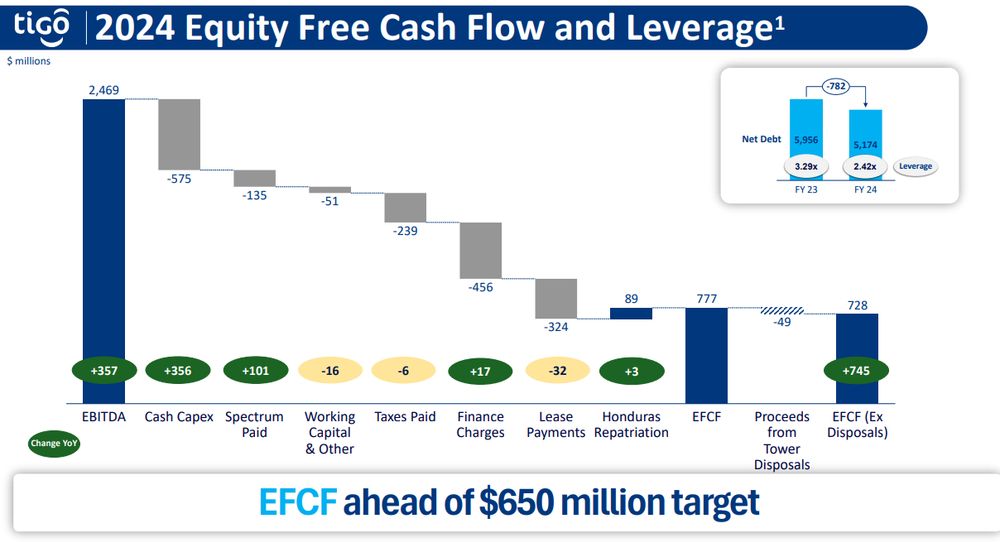

Millicom is at their leverage target and will pay out about $510m as dividends. That still leaves $240m "spare cash" for 2025 for potential special dividends or share buybacks.

And "The 2025 targets exclude net proceeds and any impact from strategic initiatives"

Millicom out with FY24 Results $TIGO

'24 FCF: $725m (vs estimates of $675m)

'25 FCF guidance: $750m (vs $703m est)

At $28, that's about 15.3% LTM FCF yield, 15.8% fwd

Reconfirming a quartertly $0.75 dividend to be sustained or grown

(That's $3 per year or 10.7% dividend yield)

Belgian squeeze‐out rules can be funny:

• Majority owner of Exmar holds > 88%, leaving a free float of just ~11.5%

• He tenders at €11.50/share

• To squeeze out, he must reach 95% of shares AND > 90% of the free float needs to tender

= a minority of 1.2% can block the deal

Oh wait, it's actually his pitch for the $HHH transaction

www.sec.gov/Archives/edg...

After Herbalife, Ackman is out with a new short!

- Economically sensitive business mode

- Limited ability to raise capital

- Always trades at a discount to NAV because NAV is not an appropriate benchmark

- Limited strategic options on a standalone basis

- Limited interest from potential acquirors

Goeie titel. Mag hij zijn bijzondere succesvergoeding van een half jaar geleden houden?

10.02.2025 11:43 — 👍 0 🔁 0 💬 0 📌 0

"The Tequila Boom Is Over. The Tequila Price War Has Begun" (WSJ)

"High-end brands incl. Diageo’s Casamigos and Bacardi’s Patrón have been lowering prices for more than a year"

Diageo "now positioning Casamigos at a lower price point than its Don Julio brand"

$DGE $DEO $BF.B

No Deep Dives' Q4 2024 "letter"

nodeepdives.substack.com/p/q4-2024-po...

#TIGO Millicom just announced their new capital allocation policy:

$3 regular yearly dividend paid in quarterly increments, to be sustained or grown

On a $25 share price, this is a yield of 12%!

How is this possible?

Because the stock is cheap AF and has a FCF yield of 16%+

Gamers know, so who's he actually trying to impress? :D

www.youtube.com/watch?v=FmEe...

The portfolio returned 27.8% in 2024, but that will be covered in a different post.

This one is just a quick word about each position in the portfolio at the start of 2025

Just published an overview of the 19 positions in the No Deep Dives model portfolio

nodeepdives.substack.com/p/model-port...

FYI, from the lastest All-In Podcast

bsky.app/profile/jefk...

Chamath is pitching short $V $MA again, and stablecoins taking off.

Mentions a 300bp drag to the economy & high APRs ;)

@keubiko.bsky.social

Not a good call (by me) so far, but BARN-SWX is the clearest trough on trough (multiple + margins) set-up I'm aware of

16.12.2024 15:36 — 👍 6 🔁 1 💬 2 📌 0I like $GTX, but I related thought I had was:

When 4 distressed funds own > 50% and want out, then why hasn't this company been taken private yet?

This could lead to some selling pressure, which seems like excellent timing to launch a share buyback program.

www.globenewswire.com/news-release...

However, the stock was down 4% on this announcement. How come?

Likely because Millicom also announced they will stop dual listing and delist the SDRs (Swedish shares).

Most of the volume is in the SDRs and presumaby some Swedish institutions would hold the SDR, but not the US listing.

Millicom (#TIGO) just announced:

- $150m buyback in 6 months (3.5%, or >7% annualized)

- special dividend of $1 in January (4% yield at $25), with the

intention of restarting a recurring dividend, to be approved at next AGM

I knew I recognized the name "Summit" from somewhere when I saw the headlines... but couldn't pinpoint it!

27.11.2024 10:28 — 👍 1 🔁 0 💬 0 📌 0

M&A Chatter in the UK:

Volex #VLX will make an offer on it's smaller peer TT Electronics #TTG

I wrote about it, but haven't pulled the trigger myself yet.

Curious to hear other opinions on the situation

nodeepdives.substack.com/p/tt-electro...

Some thoughts on #TIGO after the sale-leaseback with #SBAC

nodeepdives.substack.com/p/digesting-...

(Are cashtags a thing here? $TIGO $SBAC)