July Jobs Report: Labor Market Momentum Unravels As Revisions Reveal A Weaker Q2

The July jobs report reveals a sharp hiring deceleration with major downward revisions to previous months. Click here to read what investors need to know.

The Jul jobs report reveals a sharp deceleration in hiring, with major revisions to previous months and government workforce reductions weighing heavily.

Weak jobs data has dramatically shifted market expectations, with a Sep Fed rate cut now likely.

seekingalpha.com/article/4807...

01.08.2025 18:54 — 👍 0 🔁 1 💬 0 📌 0

June PCE: Inflation Reaccelerates Despite Tepid Spending And Income Gains (SPX)

June's spending & income growth missed forecasts; inflation ticked up to 0.3% MoM. Fed leans hawkish but rate pause odds for Sept rise to 60%.

Headline and core PCE inflation accelerated to 0.3% MoM, with goods prices rising, likely reflecting early impacts from new tariffs.

The disinflationary momentum seen earlier in 2025 has faded, keeping the Fed cautious and leaning hawkish on policy.

seekingalpha.com/article/4806...

31.07.2025 14:41 — 👍 0 🔁 0 💬 0 📌 0

From Allies To Adversaries: EU Settles For 15% Tariffs (NYSEARCA:VGK)

Explore the impact of the new EU-US trade deal with 15% tariffs, market reactions, and investor concerns over growth, energy, and key industries.

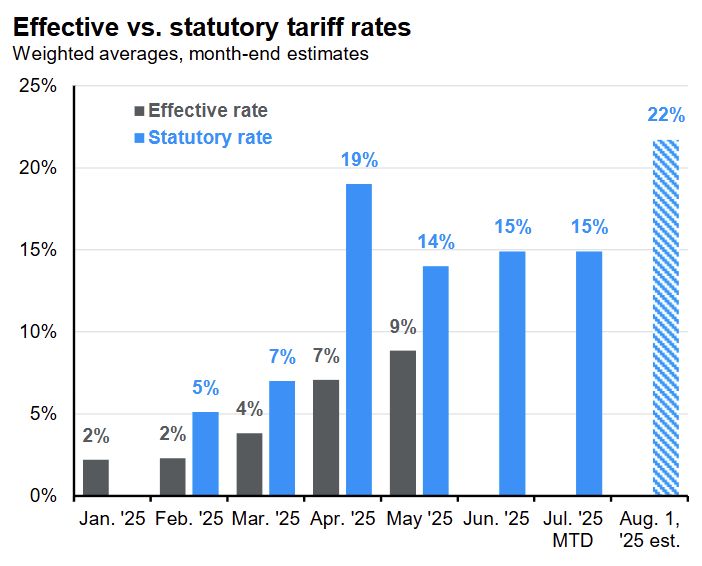

The EU-US trade deal sets a 15% baseline tariff on most goods, averting a trade war but ending free trade norms.

Despite reduced uncertainty, the deal leaves a lot in the air, with both sides reserving rights to renegotiate; ECB policy remains unsettled.

seekingalpha.com/article/4805...

28.07.2025 17:35 — 👍 0 🔁 0 💬 0 📌 0

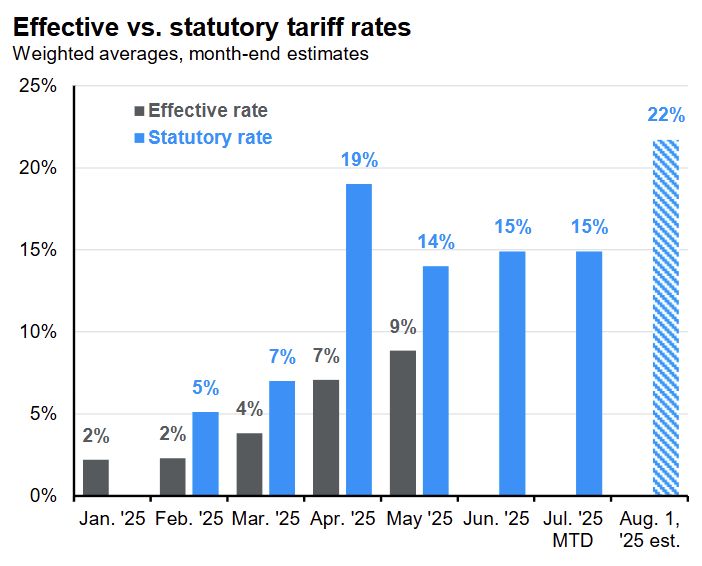

Tariff Update: Is TACO Still On The Menu? (SPX)

Markets may be mispricing tariff risks. Find out why record customs revenue, low volatility, and past patterns make a retreat less likely this time.

Markets are underestimating the risk of high tariffs taking effect on 8/1, relying too much on another TACO moment.

With the S&P 500 at all-time highs & volatility low, investors should be cautious, as downside risks currently outweigh upside potential.

seekingalpha.com/article/4801...

17.07.2025 13:38 — 👍 0 🔁 0 💬 0 📌 0

June U.S. CPI: Tariff Pressures Bubble Beneath Cooler Headline Rates (SPX)

June CPI data shows headline and core inflation in line with expectations. Check out my thoughts on financial markets' reaction to CPI data.

Jun CPI data shows headline & core inflation in line with expectations, but underlying goods & food prices are heating up due to tariffs.

The Fed is likely to stay patient, with Jul cuts off the table and Sep now a coin toss, tempering rate cut optimism.

seekingalpha.com/article/4801...

15.07.2025 17:12 — 👍 0 🔁 0 💬 0 📌 0

China Q2 GDP And June Data: Growth Holds Steady But Underlying Fragility Remains (SHCOMP)

China's Q2 GDP hits 5.2% YoY, driven by high-tech growth, but struggles in real estate and retail reveal challenges.

China’s Q2 GDP growth met government targets at 5.2% YoY, but the recovery remains uneven.

High-tech manufacturing and services are driving growth, while real estate and retail sectors continue to struggle, highlighting structural challenges.

seekingalpha.com/article/4801... #china #economy

15.07.2025 14:41 — 👍 0 🔁 0 💬 0 📌 0

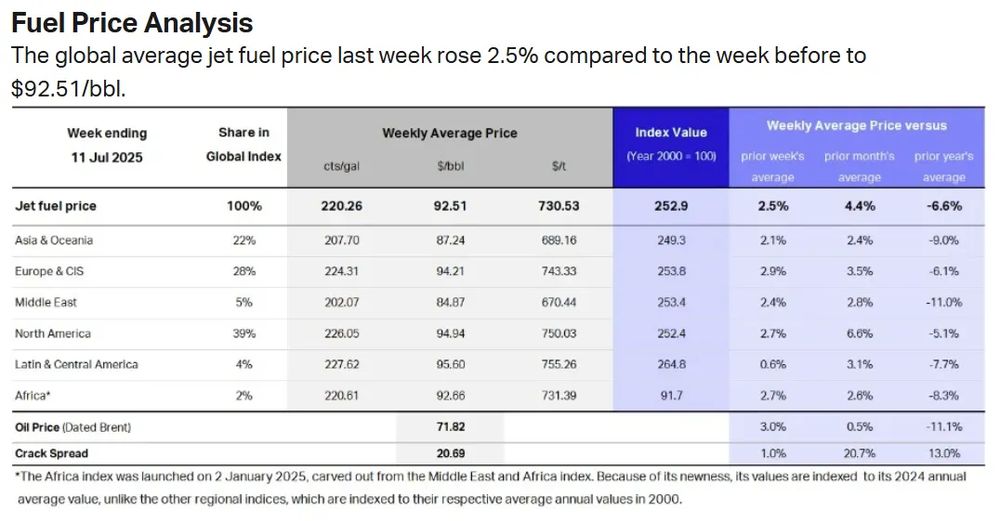

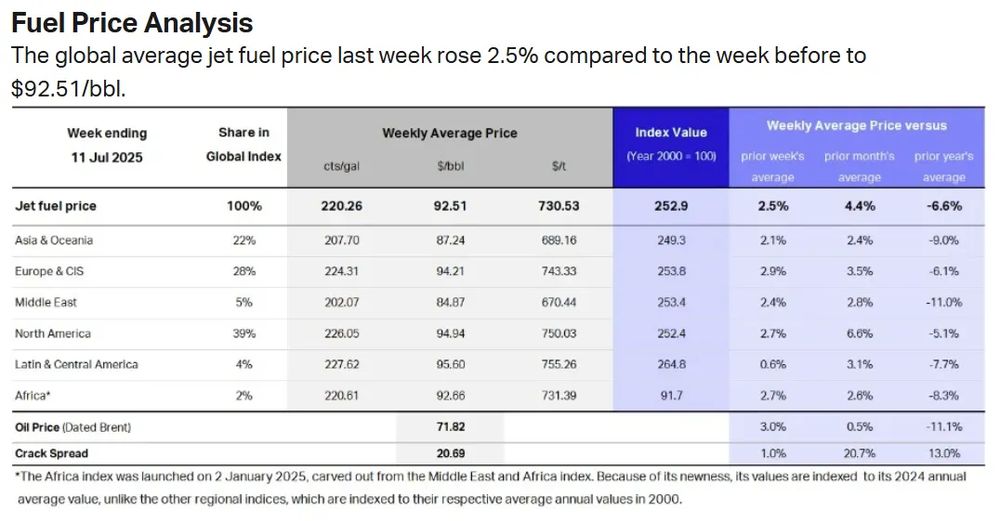

Jet fuel prices increased 2.5% WoW last week and are now up 4.4% from a month ago. On an annual basis, fuel prices are still lower, down -6.6% YoY.

14.07.2025 18:00 — 👍 0 🔁 0 💬 0 📌 0

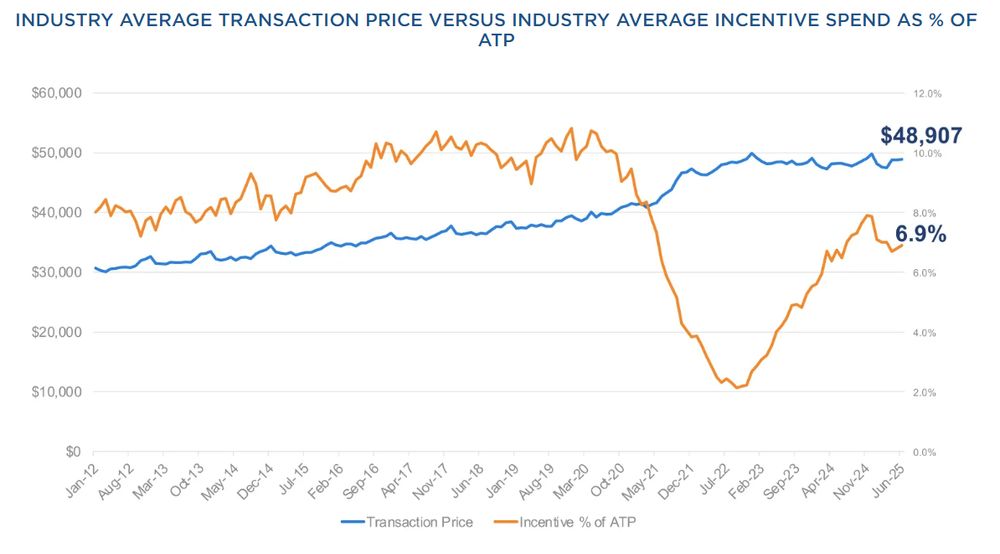

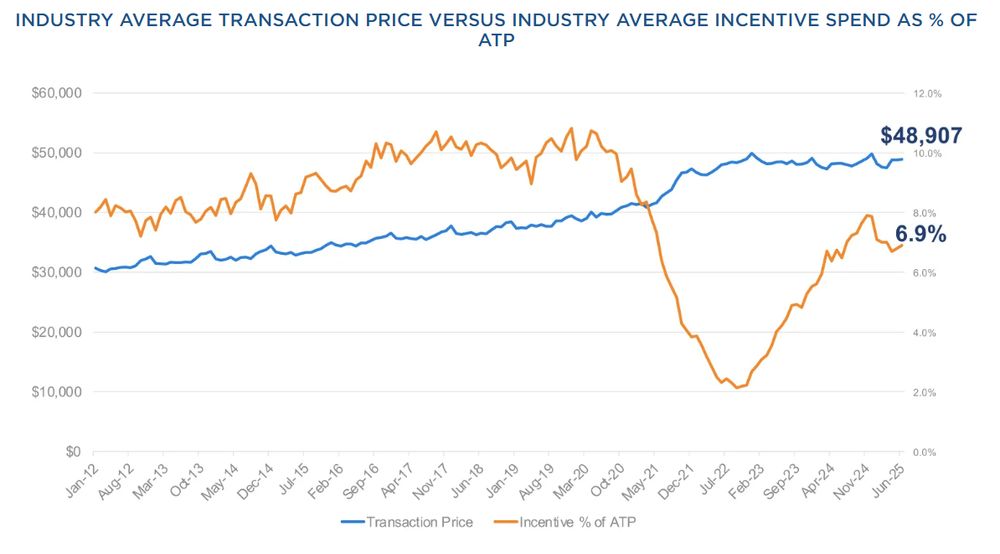

New-vehicle average transaction prices (ATP) rose 0.4% MoM and 1.2% YoY in June 2025 to $48,907, the highest YoY gain this year but still below the 10-year average of 3.9%.

14.07.2025 17:55 — 👍 0 🔁 0 💬 0 📌 0

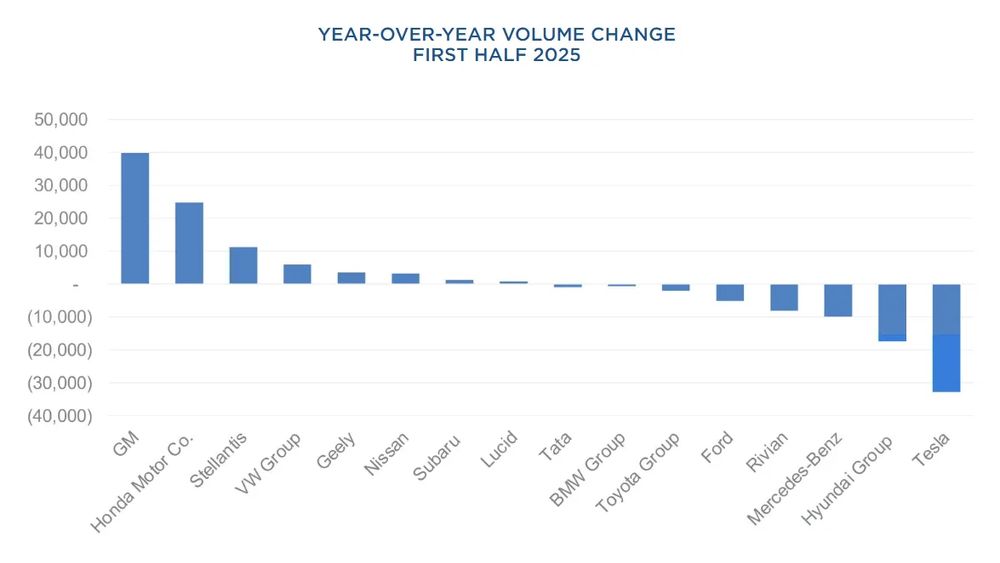

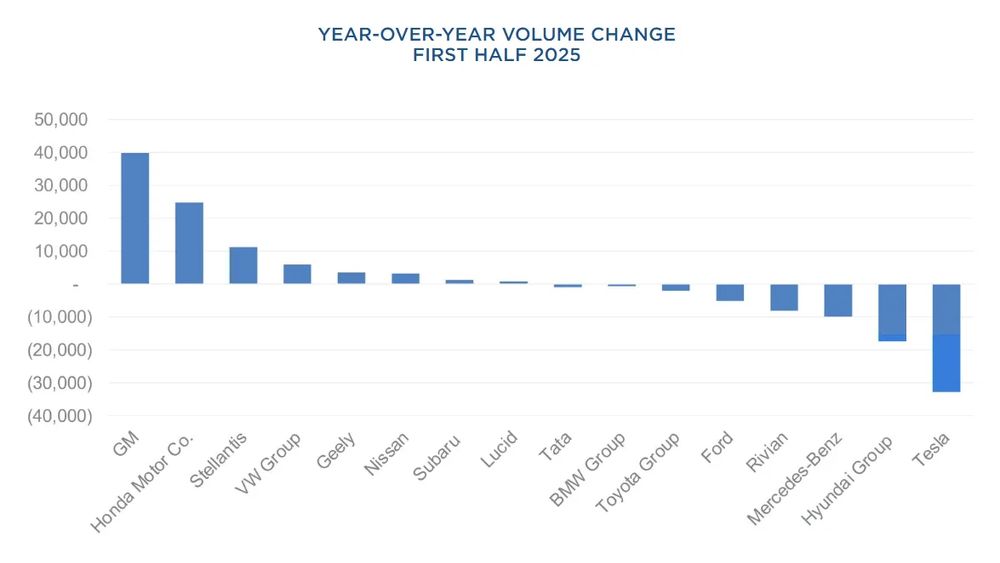

U.S. electric vehicle (EV) sales totaled 310,839 units in Q2 2025, down -6.3% YoY but up 4.9% QoQ, bringing H1 sales to a record 607,089, a modest 1.5% increase YoY.

14.07.2025 17:24 — 👍 0 🔁 0 💬 0 📌 0

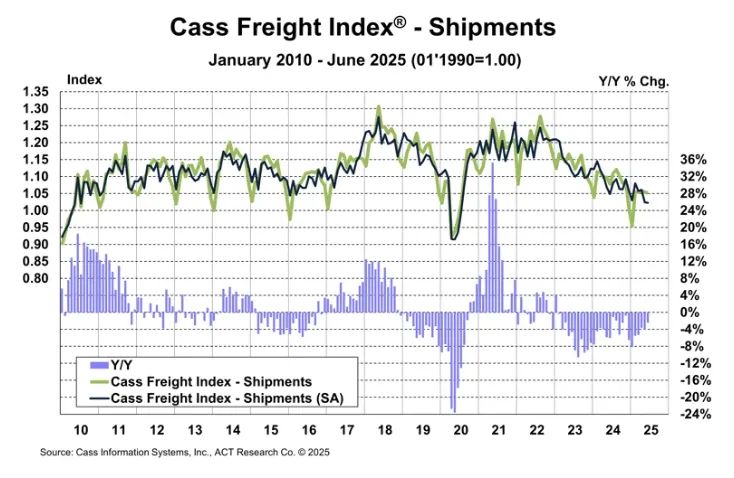

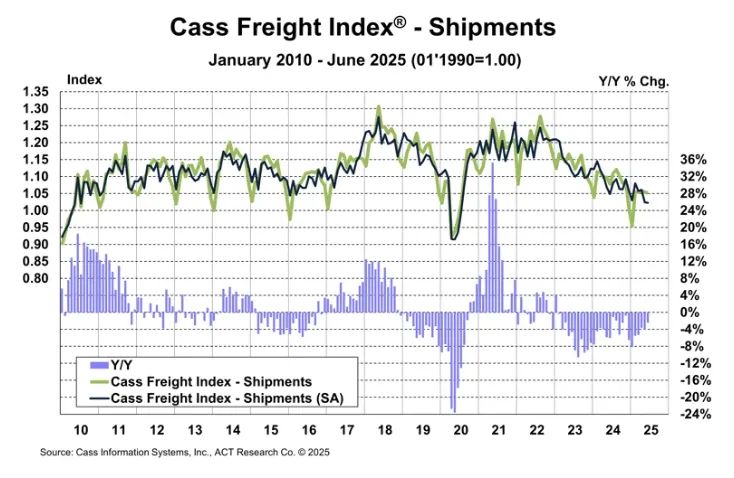

The Cass Freight Shipments Index fell -0.2% MoM (-0.2% SA) and -2.4% YoY in June, continuing its multi-year downtrend in volume despite some stability.

Freight volumes remain soft, and shipment levels are on track for a third straight annual decline, despite rate stabilization.

14.07.2025 17:19 — 👍 0 🔁 0 💬 0 📌 0

🌮 TACO has been accurate so far, but August 1st will be the most important TACO to date.

(chart via JPMorgan)

14.07.2025 12:47 — 👍 0 🔁 0 💬 0 📌 0

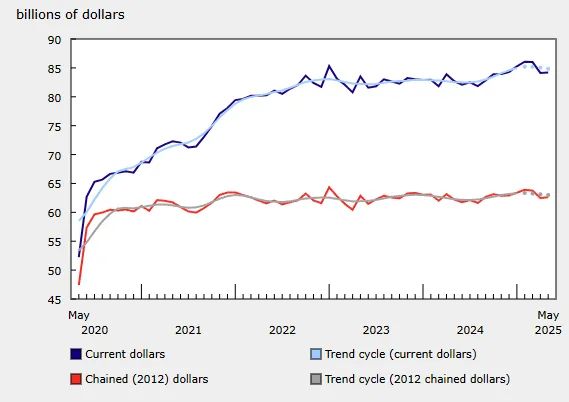

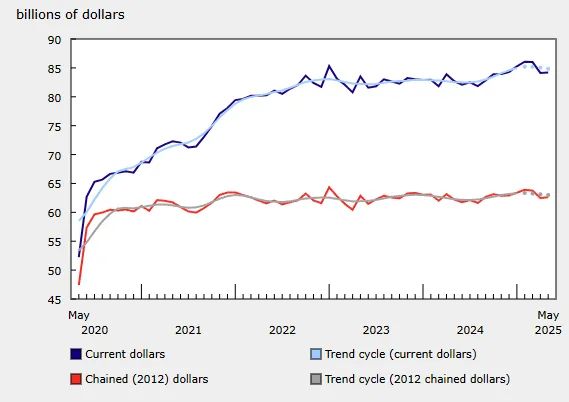

Canadian wholesale sales (excluding petroleum and oilseed/grain) rose 0.1% MoM in May 2025 to $84.2 billion and were up 1.8% YoY, with volume sales also increasing 0.2% MoM.

This was well ahead of the -0.4% MoM decline in the preliminary estimate.

14.07.2025 12:42 — 👍 0 🔁 0 💬 0 📌 0

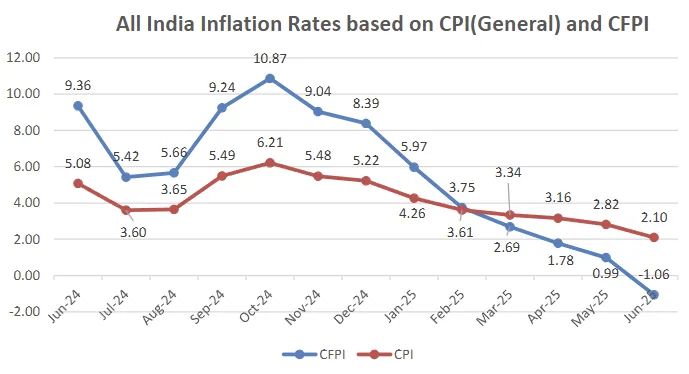

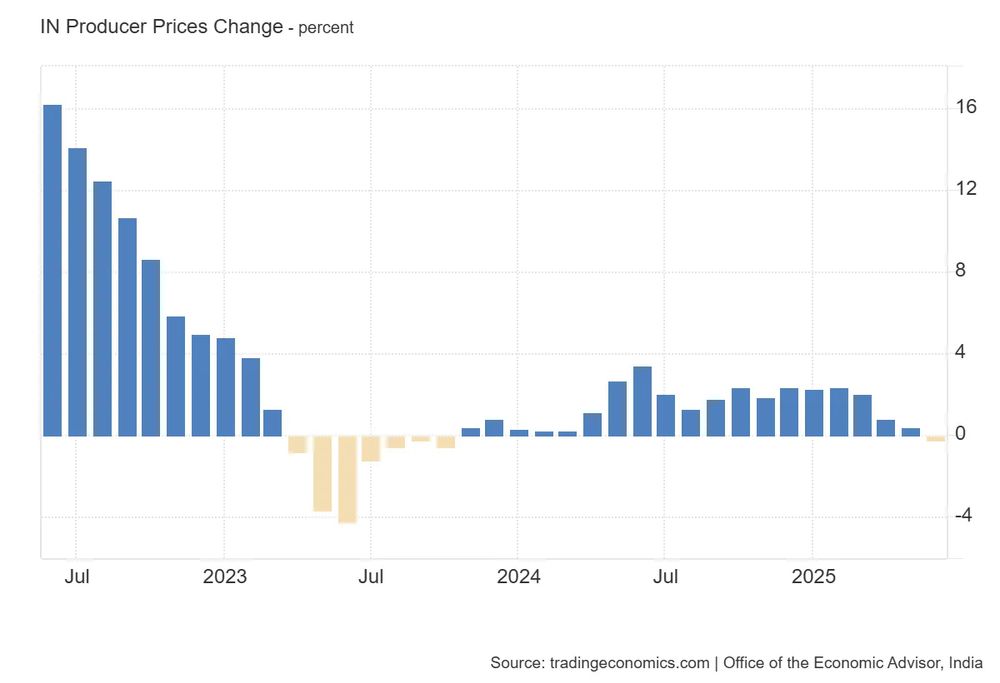

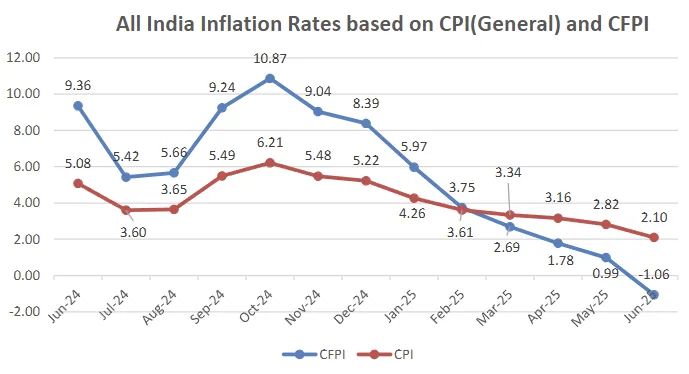

India’s CPI rose 0.06% MoM and 2.10% YoY (vs 2.5% YoY expected) in June 2025, down sharply from 2.82% YoY in May, marking the lowest annual inflation since January 2019.

14.07.2025 12:20 — 👍 0 🔁 0 💬 0 📌 0

No major #macro data comes out to start the week. That lets everyone focus on trade headlines instead.

14.07.2025 12:16 — 👍 0 🔁 0 💬 1 📌 0

Germany’s Manufacturing PMI Export Conditions Index edged down to 50.3 in June from 50.4 in May, remaining in modest expansion territory for the fifth straight month.

The New Export Orders Index rose to 52.0 in June from 51.0 in May, the fastest pace since February 2022.

14.07.2025 10:49 — 👍 0 🔁 0 💬 0 📌 0

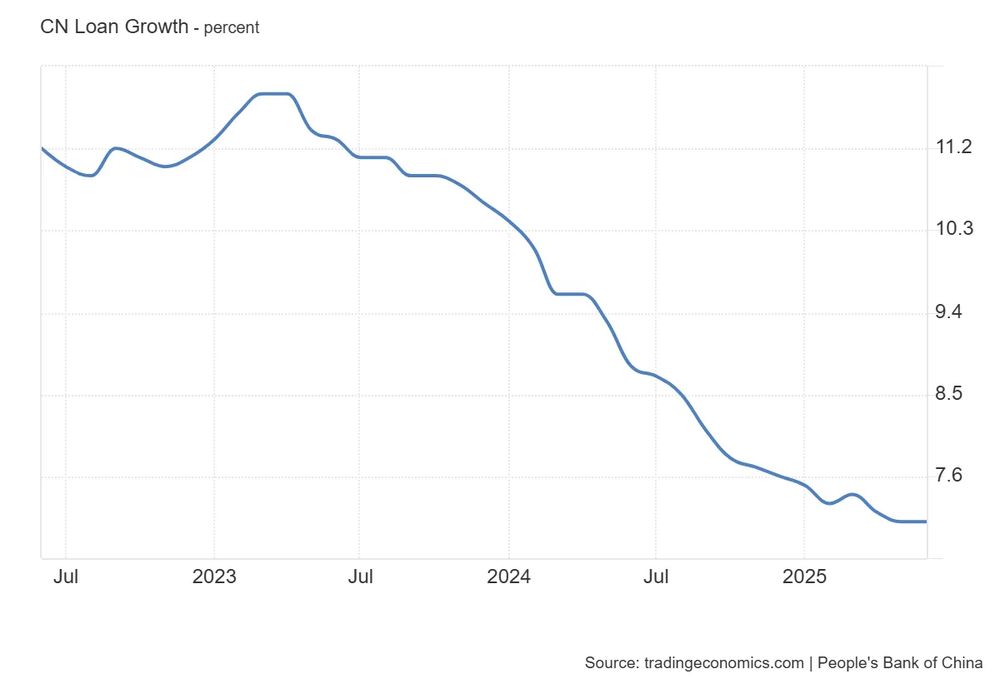

Interbank RMB lending rates in June fell to 1.46% (-9 bps MoM) and pledged repo rates declined to 1.50% (-6 bps MoM), indicating looser liquidity conditions.

14.07.2025 10:46 — 👍 0 🔁 0 💬 0 📌 0

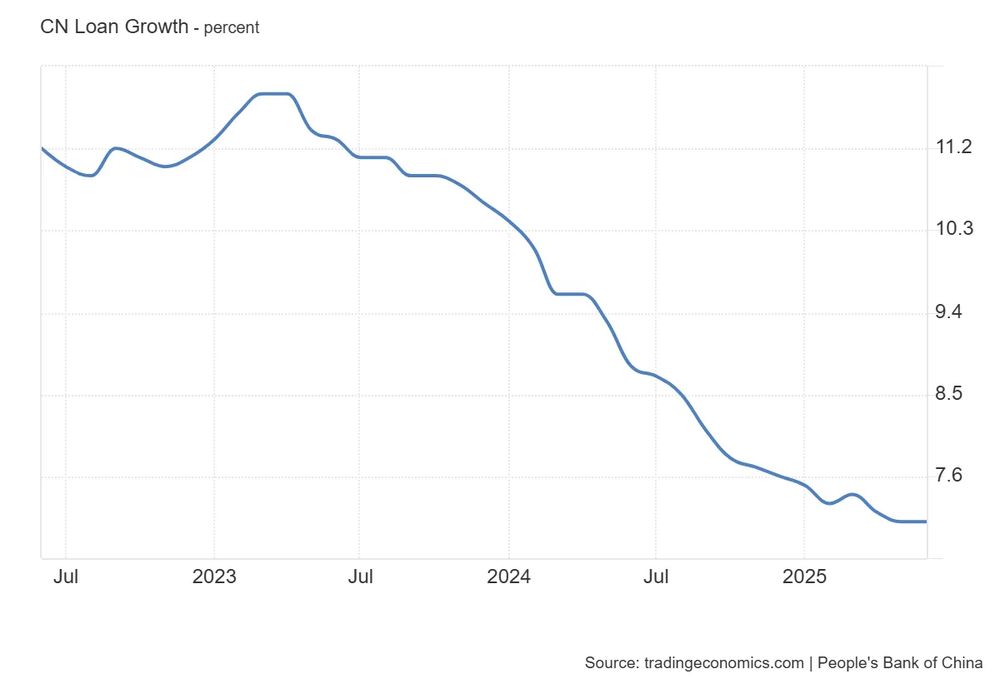

China’s M2 money supply was up 8.3% YoY in June, a significant acceleration from 7.9% YoY in May and above expectations of an 8.1% YoY increase.

- RMB loan growth was 7.1% YoY (vs 7.0% YoY expected) with the total balance of loans up to ¥268.56 trillion.

14.07.2025 10:46 — 👍 0 🔁 0 💬 1 📌 0

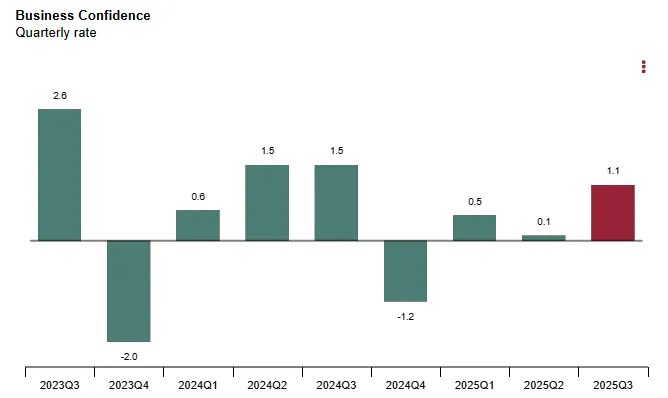

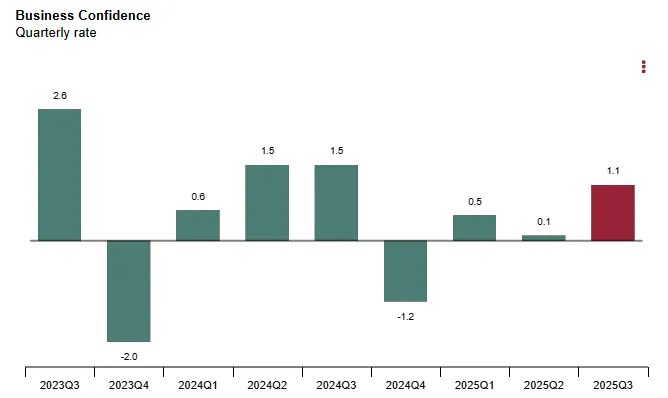

Spain’s Business Confidence Index rose 1.1% QoQ in Q3 2025, rebounding from a -2.0% drop in Q2 & supported by stronger sentiment across most sectors & firm sizes.

A net 9.6% of businesses had optimistic expectations for Q3, down from 11.2% in Q2 but still elevated vs to 2024.

14.07.2025 10:33 — 👍 0 🔁 0 💬 0 📌 0

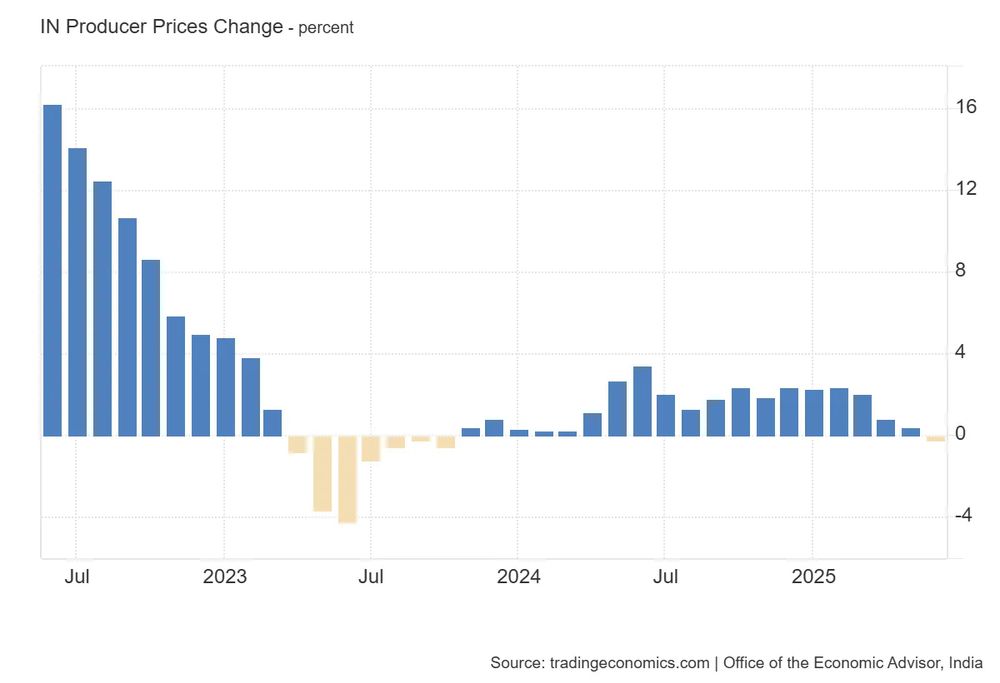

India’s Wholesale Price Index (WPI) declined -0.19% MoM and fell -0.13% YoY (vs 0.52% YoY expected) in June 2025, marking the first negative YoY print since October 2023, led by declines in fuel, food, and metals.

14.07.2025 10:26 — 👍 0 🔁 0 💬 0 📌 0

Japanese industrial production in May was revised down from 0.5% MoM in the initial estimate to a -0.1% MoM drop. On an annual basis, production is down -2.4% YoY vs the initial estimate of -1.8% YoY.

14.07.2025 10:12 — 👍 0 🔁 0 💬 0 📌 0

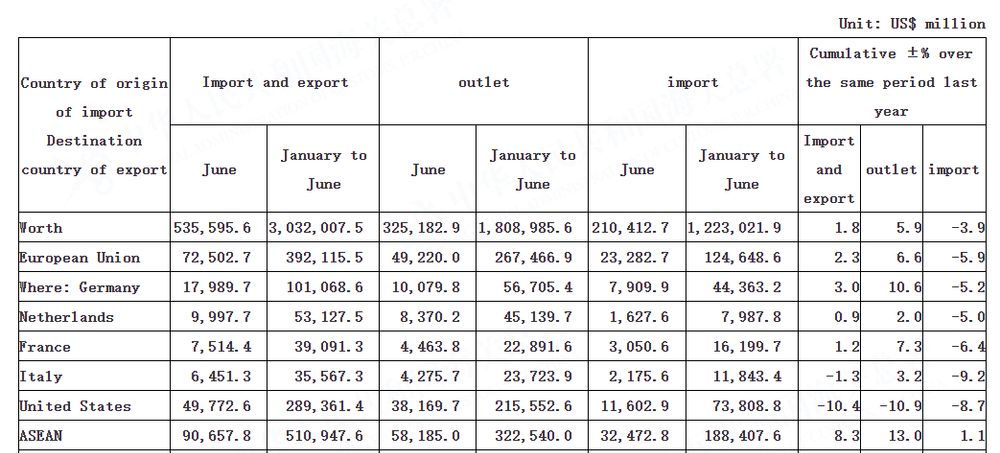

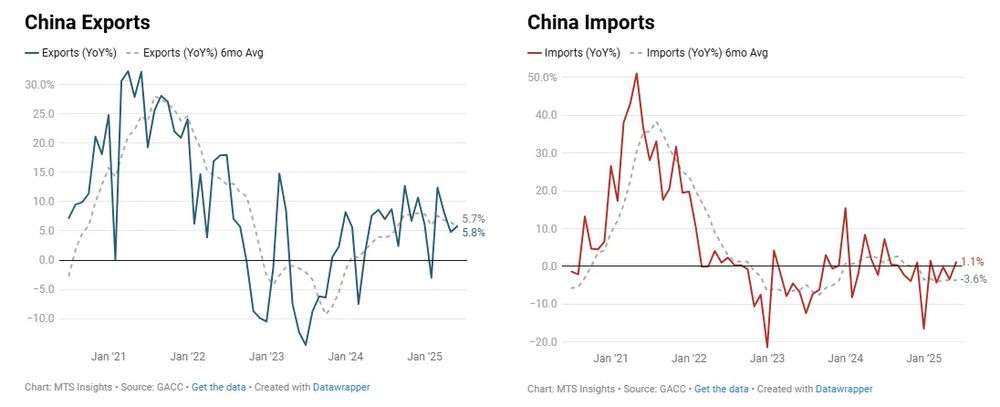

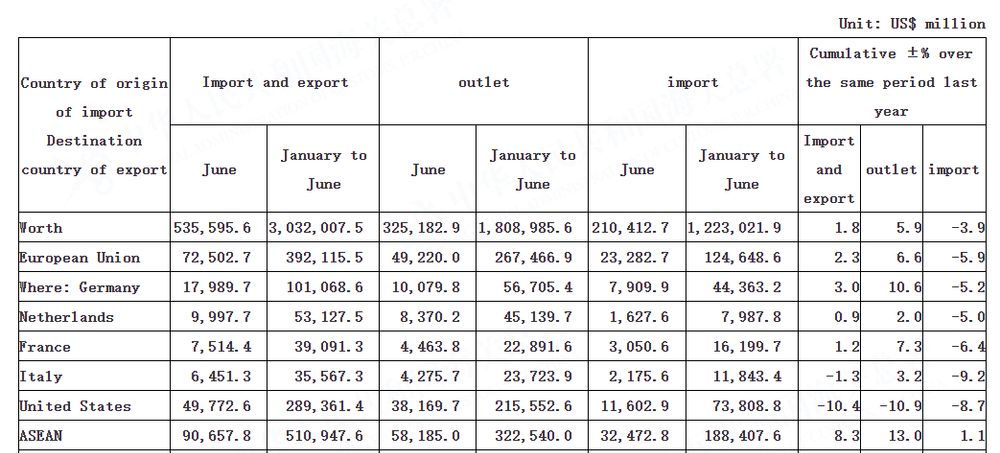

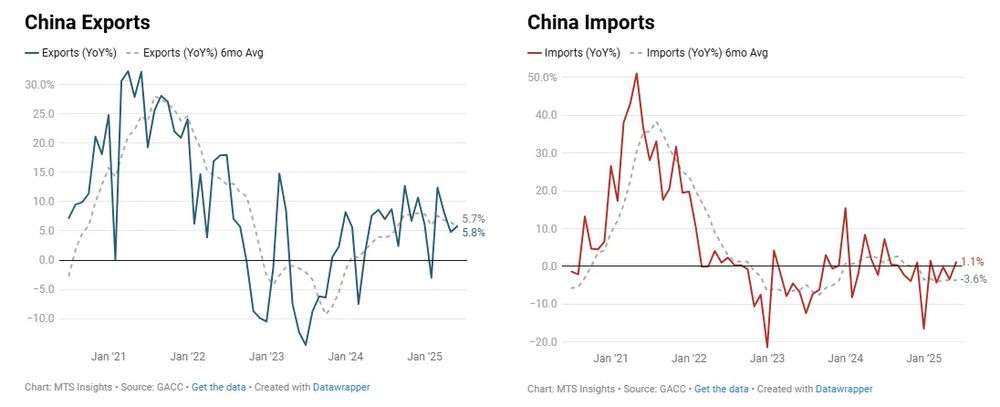

Chinese exports to the US surged 32.4% MoM as early trade deals encouraged trade to bounce back. Imports from the US were up 7.4% MoM.

On a YTD basis, trade between the US and China is down -10.4% YoY with exports down -10.9% YoY and imports down -8.7% YoY.

14.07.2025 09:53 — 👍 0 🔁 0 💬 0 📌 0

China’s trade balance improved again to $114.8 billion in June from $103.2 billion in May, beating expectations of a $109 billion trade surplus.

Exports increased 2.9% MoM and 5.8% YoY, up from 4.8% YoY in May and above expectations of 5.0% YoY.

14.07.2025 09:45 — 👍 0 🔁 0 💬 1 📌 0

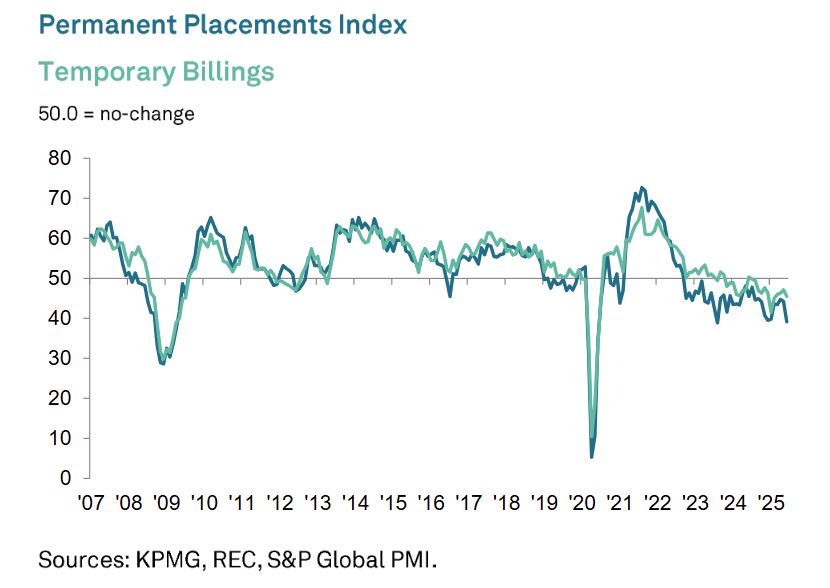

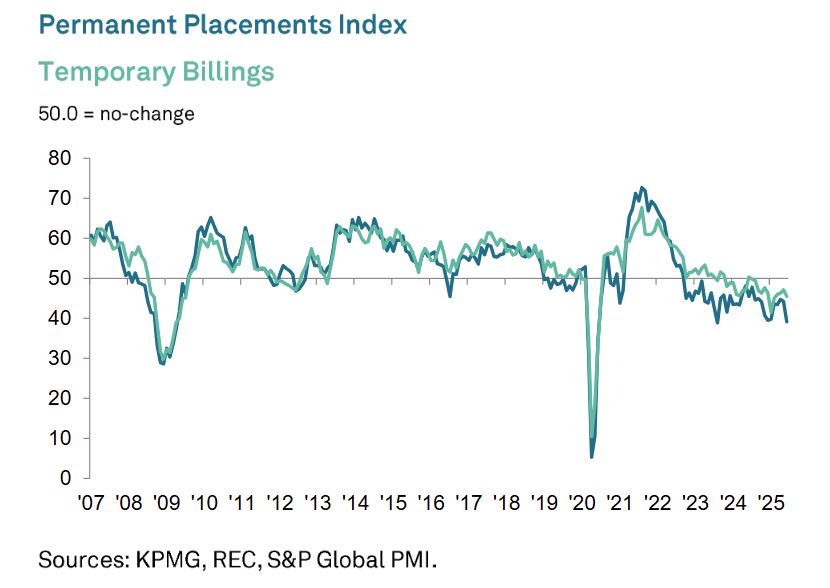

Hiring in the UK weakened further in June, with permanent placements falling at the fastest rate in 22 months.

Candidate supply rose at the steepest pace since November 2020, driven by redundancies and a reduced appetite for hiring.

14.07.2025 09:33 — 👍 0 🔁 0 💬 0 📌 0

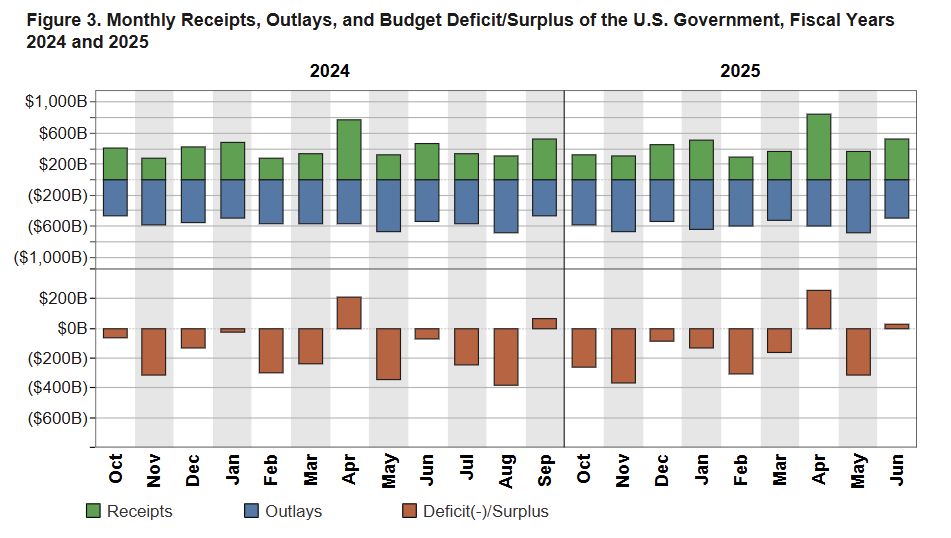

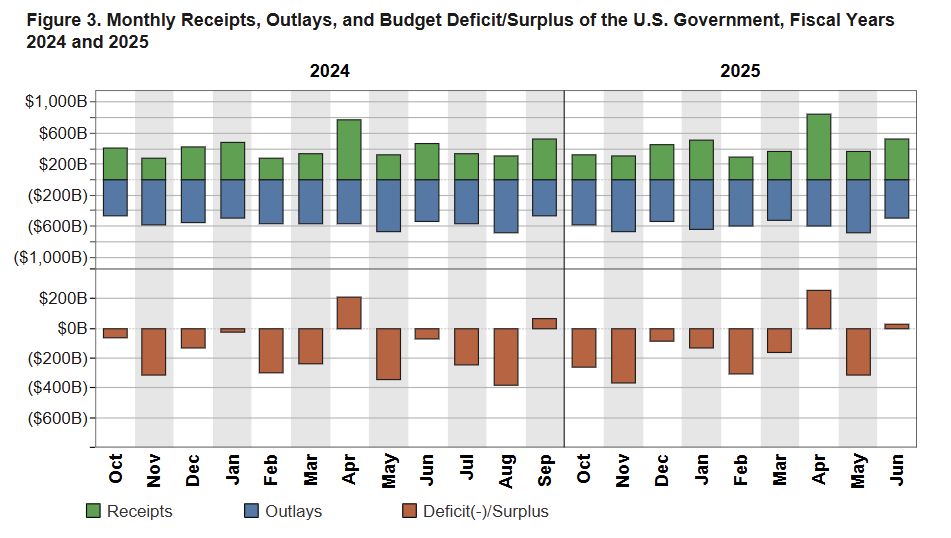

The Monthly Treasury Statement reports a surplus of $27.0 bil (vs -$41.5 bil expected) in June 2025, better than the -$71.0 bil deficit in June 2024.

The Oct-Jun FY25 deficit is now up to $1.34 trillion, a 5.0% YoY increase over the Oct-Jun FY24 deficit of $1.27 trillion.

11.07.2025 18:10 — 👍 0 🔁 0 💬 0 📌 0

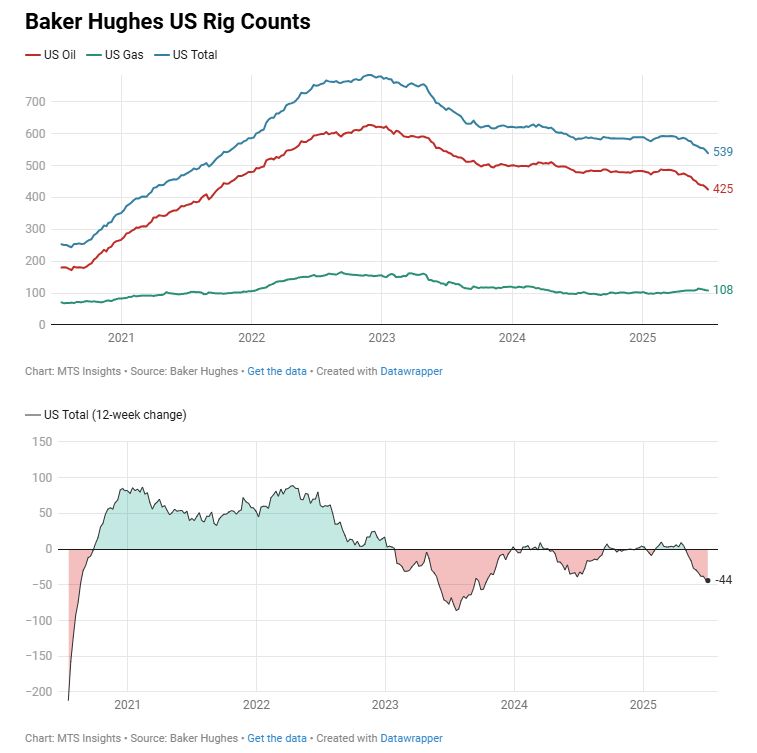

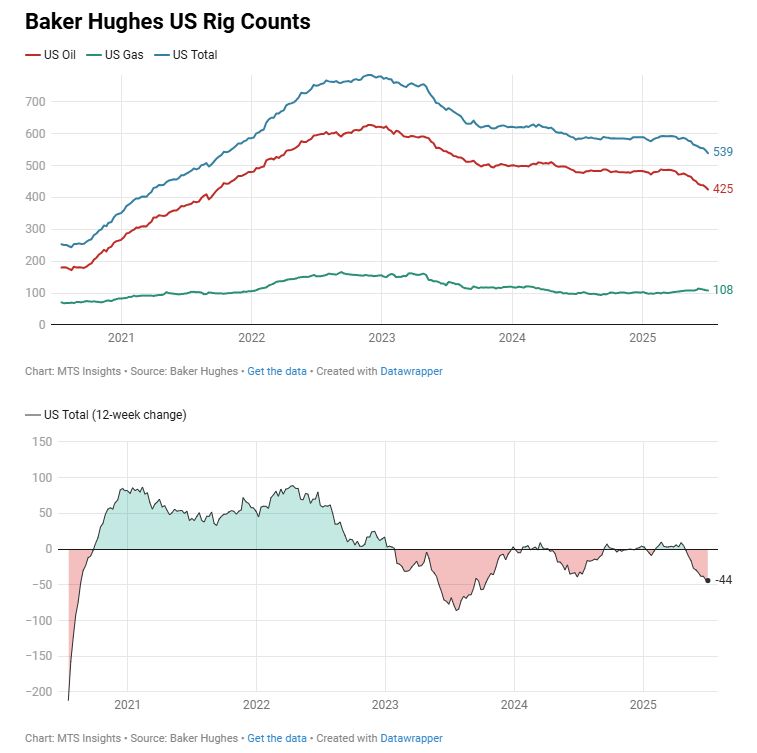

The number of active US oil and gas rigs fell by -2 to 539 last week. Over the last twelve weeks, the total rig count is down by -44 rigs, the largest decline since October 2023.

11.07.2025 17:48 — 👍 1 🔁 0 💬 0 📌 0

Cox Automotive: July opened with 2.83 million new vehicles available on dealer lots across the U.S., representing a 14.5% increase from 2.47 million units at the beginning of June, but still 1.4% lower than the same period last year.

11.07.2025 17:45 — 👍 0 🔁 0 💬 0 📌 0

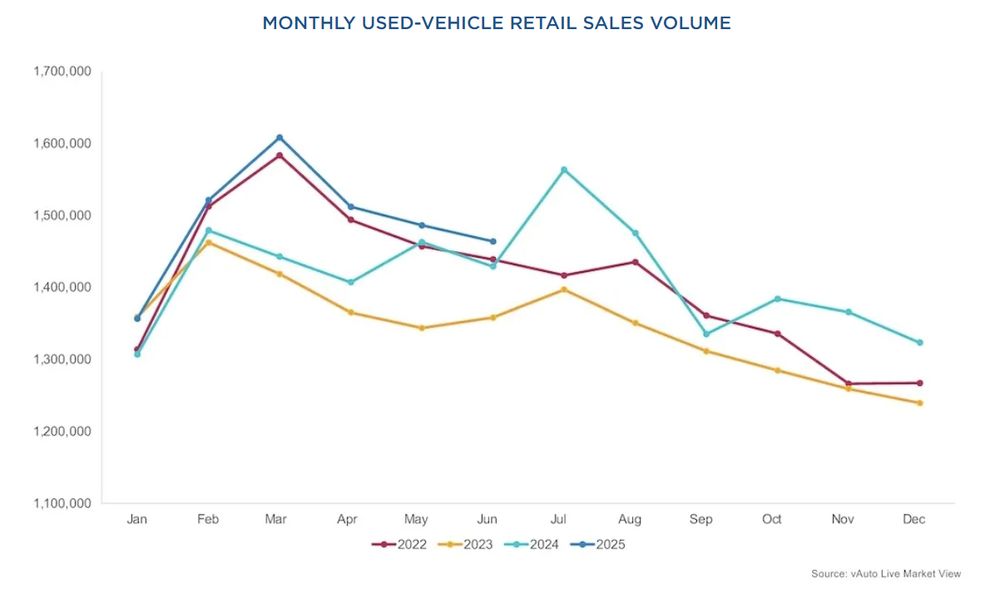

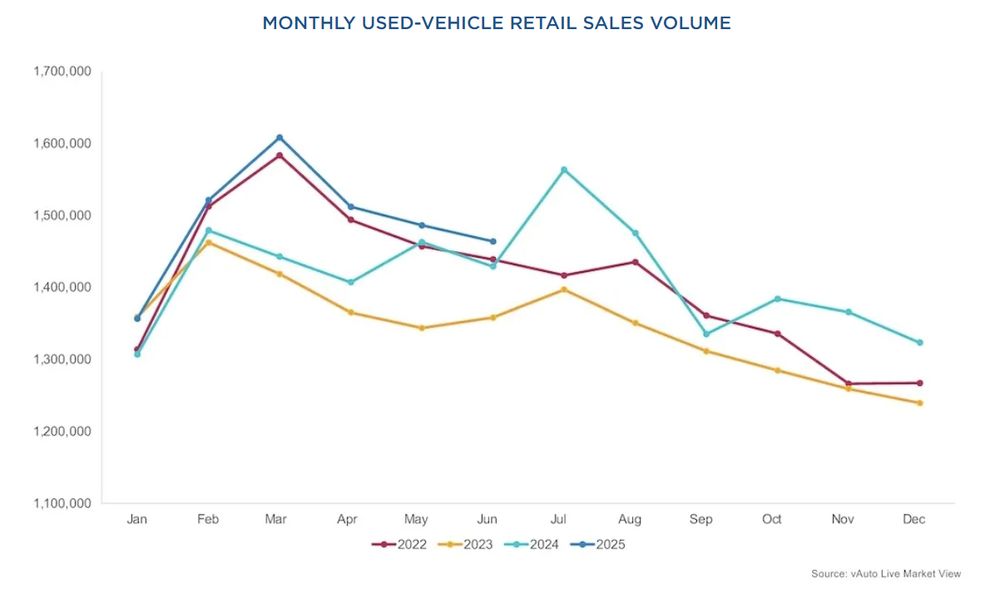

Used-vehicle retail sales totaled 1.46 million in June, down -1.5% MoM but up 2.4% YoY, according to Cox Automotive’s vAuto Live Market View.

Certified pre-owned (CPO) sales dropped -13.1% MoM to 200,950 and were down -3.7% YoY.

11.07.2025 17:42 — 👍 0 🔁 0 💬 0 📌 0

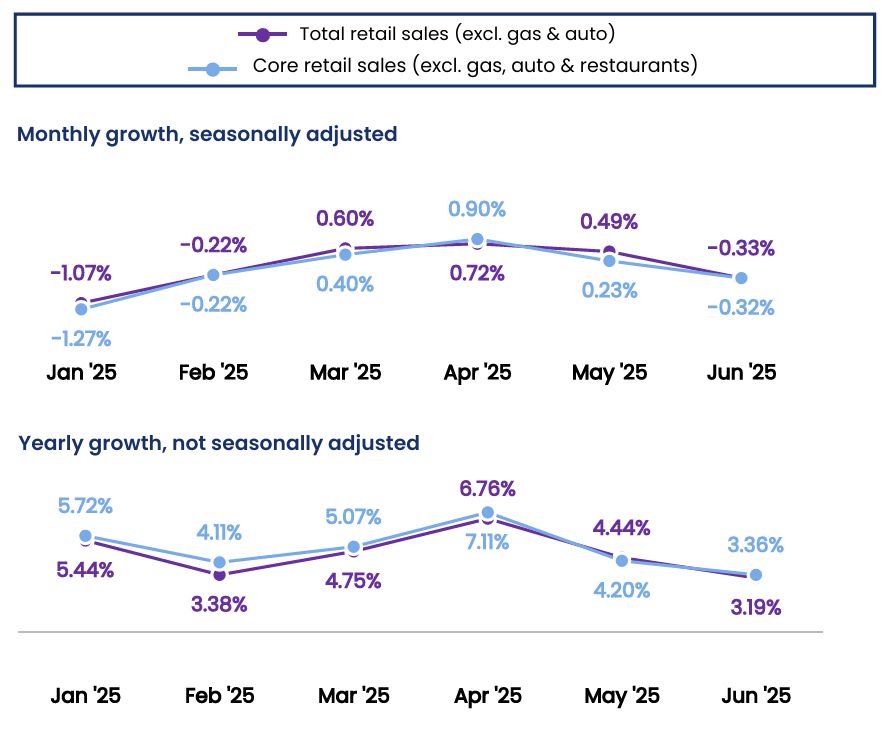

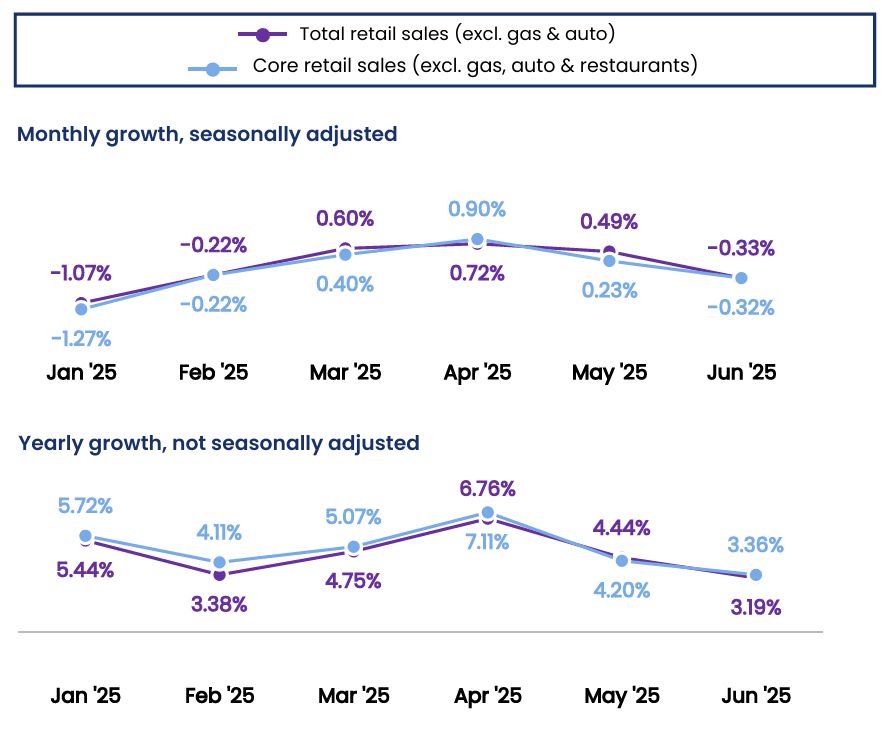

Retail sales (excluding gas and autos) fell -0.33% MoM and rose 3.36% YoY in June 2025, according to the CNBC/NRF Retail Monitor.

Core retail sales (excluding gas, autos, and restaurants) declined -0.32% MoM and were up 3.19% YoY.

11.07.2025 14:45 — 👍 0 🔁 0 💬 0 📌 0

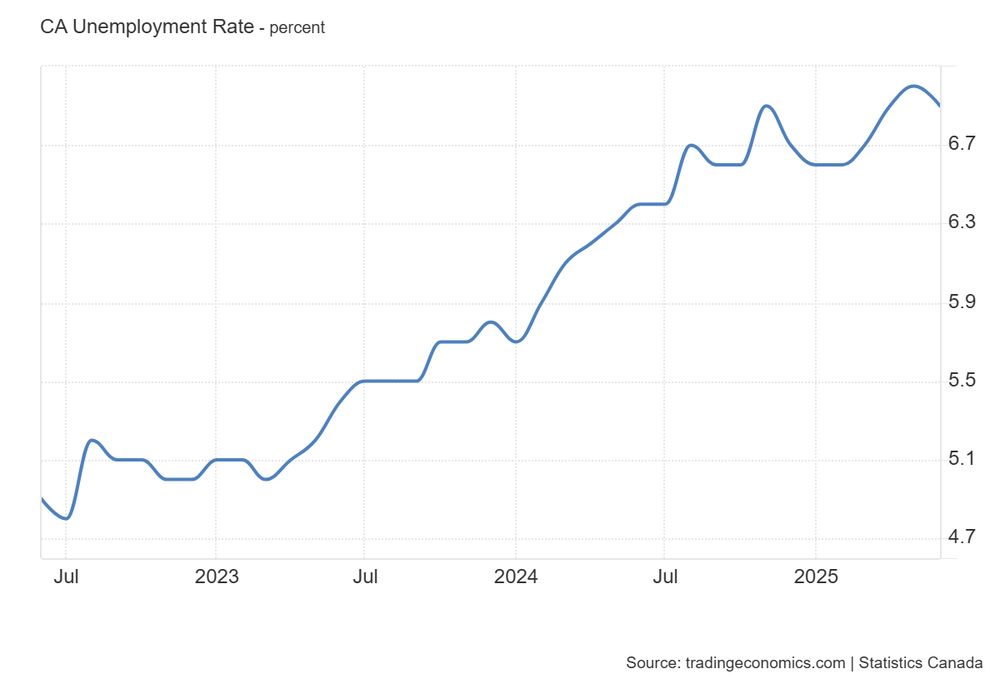

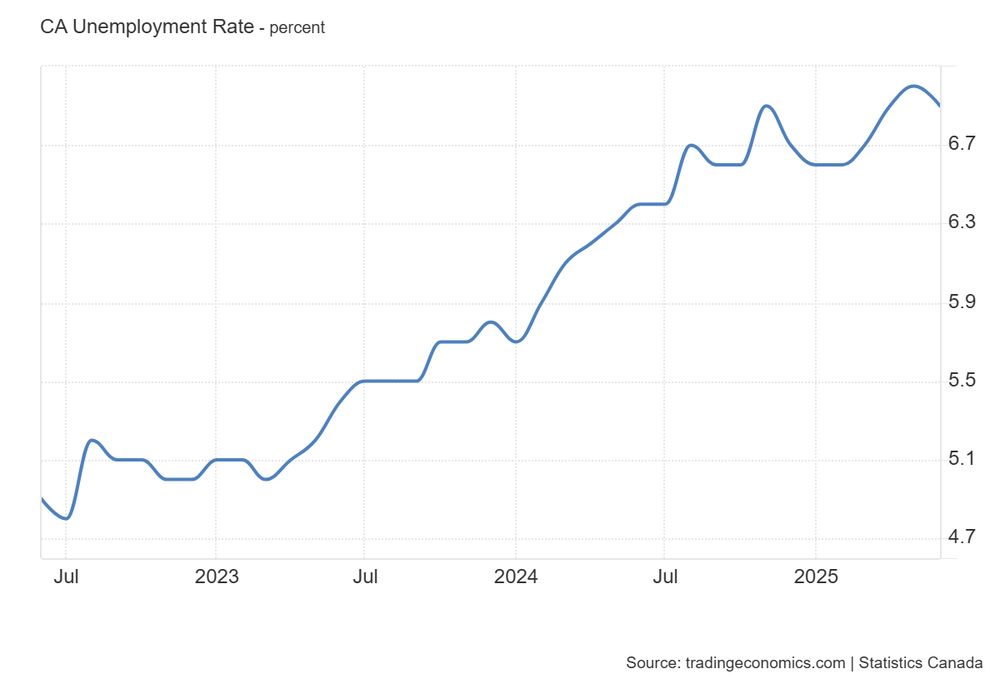

🇨🇦 Canadian employment increased 83k (or 0.4% MoM) in June, pushing the employment rate up 0.1 ppts to 60.9%.

The unemployment rate dropped -0.1 ppts to 6.9%, a downside surprise compared to expectations that it would increase to 7.1%

11.07.2025 12:32 — 👍 0 🔁 0 💬 0 📌 0

As an outplacement and executive coaching powerhouse, we help people and organizations bounce back after significant change. We offer trusted data and expert insights on the labor market, economy, and workplace.

FT, E17, Unhedged podcast, gardening, making bread, climbing, cycling, 6 Music Mum. I don't deserve my bad Uber rating and I never give investment advice - if it looks like I am, it's a scam.

writer/blogger, formerly journalist at WSJ, Dow Jones, Reuters, others. #economics #markets, #music, #philosophy, #books, #technology, #photos, etc. (ie hopelessly eclectic) Toronto. May not respond to DMs. Blog at: https://doncurren.blogspot.com

Posts from the economics directorate of the CBI. Follow us for updates and analysis on the UK economy, tax & fiscal policy, our business surveys, and consulting projects.

We find companies trading below their intrinsic value and share them via an email newsletter.

Subscribe here: marshequityresearch.substack.com

Since 1889 🗞️

Sign up for our newsletters and alerts: http://wsj.com/newsletters

Got a tip? http://wsj.com/tips

Follow our staff: https://go.bsky.app/2ppWqxF

Talking Points Memo (TPM) is an independent news organization that publishes reporting and analysis about American politics, public policy and political culture. https://talkingpointsmemo.com/

Dartmouth political scientist and Bright Line Watch co-director. Previously Upshot NYT / CJR contributor, Spinsanity co-founder, All the President's Spin co-author.

https://sites.dartmouth.edu/nyhan/

http://brightlinewatch.org

International Editor at The Economist

Previously covered Africa, banking, European business & finance

Staff writer for the Atlantic. Host of the David Frum Show webcast. Formerly ... quite a lot of things.

Washington DC and Wellington, Ontario.

Reach me via Producer@TheDavidFrumShow.com

DMs open to followers

stay hydrated

https://ruoshui.substack.com/

Create and share social media content anywhere, consistently.

Built with 💙 by a global, remote team.

⬇️ Learn more about Buffer & Bluesky

https://buffer.com/bluesky

Business, Economics, Financial Markets, Social Justice, Mental Health, Yoga, and Golf. Also, Screw Elon.

Rockfordian / dad / was an army guy during OIF & OEF / work in credit now / aTm ain’t never been elite, you guys

📍ORD

Executive Director of Employ America

Macro / Labor / Finance / Energy / Chart posting

Personal Account. Director of Economics, The Budget Lab at Yale University. Former Chief Economist, White House Council of Economic Advisers.

Macrodata Refinement

Views are my own | Private account

https://dodgersdigest.com/ | @dodgersdigest.bsky.social @ibwaa.bsky.social | Twitter: https://twitter.com/ChadMoriyama | "A highly rational Internet troll." - Los Angeles Times