Inflation Helped Trump Get Elected. Now It’s His Problem.

The president’s team blames his predecessor for stubborn inflation, but Trump’s own agenda could make it harder to defeat.

Trump isn't responsible for the ~3% inflation he inherited. But it's a problem for him b/c tariffs, maybe tax cuts could keep it above Fed's 2% target. In 1st term, w/ core inflation <2%, tariffs & tax cuts helped Fed meet rather than miss 2% target. My column: www.wsj.com/economy/infl...

14.02.2025 13:45 — 👍 3 🔁 0 💬 2 📌 0

Trump’s Tariffs Usher In New Trade Wars. The Ultimate Goal Remains Unclear.

The president’s trade assault, which makes no distinction between ally and adversary, is an assertion of U.S. dominance with significant risks.

Trump's tariffs spell end of postwar consensus of economic cooperation. Next: continuous trade war driven not by alliances and ideology, but the priorities of the day. The winner is the one who can inflict, and withstand, the most economic pain. My latest. www.wsj.com/economy/trad...

03.02.2025 03:00 — 👍 5 🔁 3 💬 0 📌 0

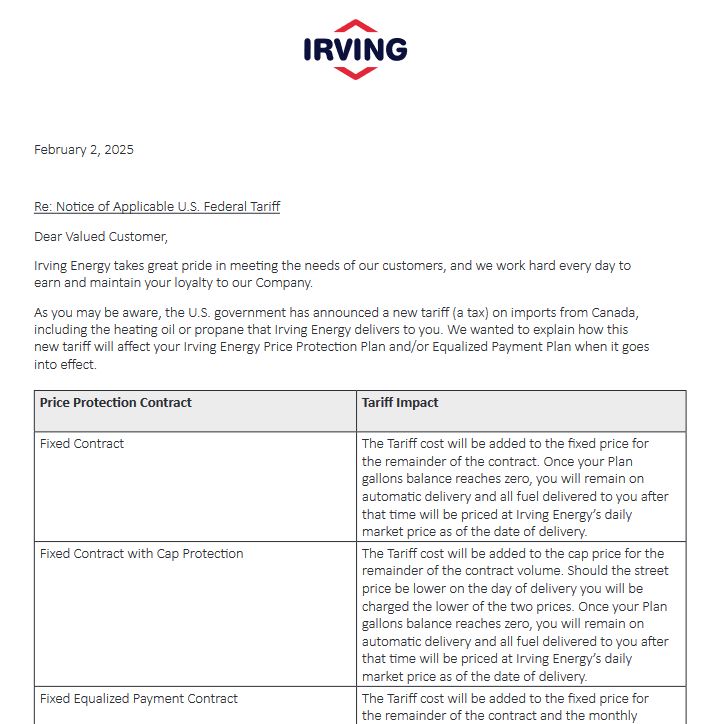

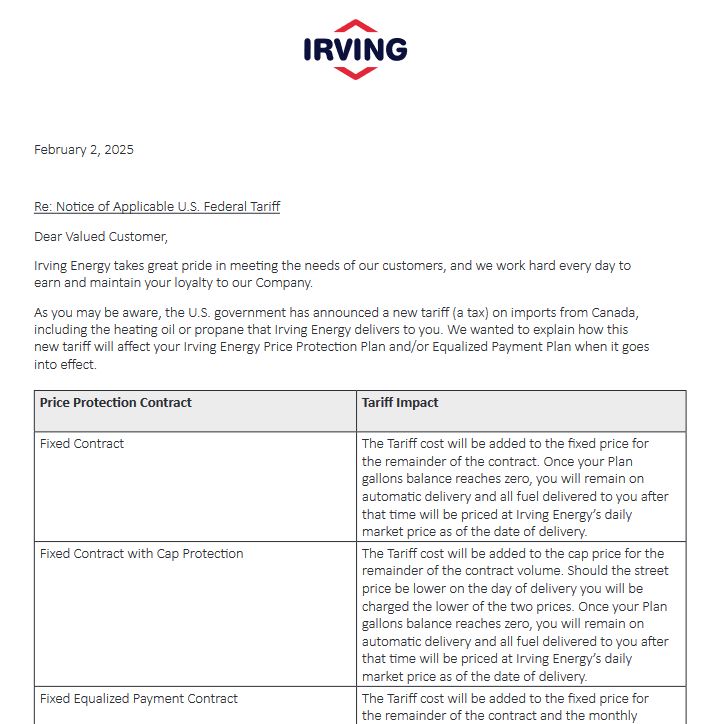

If there is any doubt that tariffs are passed through to consumers, the cost of propane to heat my house just went up by the amount of the tariff

02.02.2025 17:20 — 👍 4796 🔁 1770 💬 196 📌 145

... inward, to be satisfied by idle domestic resources. (By contrast, had the US still been at full employment, there would be no idle resources to satsify this tariff-induced demand; you'd get inflation, or a reduction in output elsewhere in the economy).

14.12.2024 19:35 — 👍 3 🔁 1 💬 1 📌 0

So another way of saying this (in more conventional terms) is: the U.S. could reduce its indebtedness through fiscal austerity; this would normally lead to underemployment. But it can neutralizes that by raising tariffs, effectively directing some of the demand now satisifed by imports ...

14.12.2024 19:35 — 👍 2 🔁 0 💬 1 📌 0

but if you're at full employment (an assumption underlying a lot of trade models), tariffs direct productive resources from one sector to another, so you're less likely to get higher absolute consumption.

13.12.2024 15:29 — 👍 3 🔁 0 💬 1 📌 0

I infer that for tariffs to raise overall consumption through the mechanism you describe, i.e. boosting production, the host country would have to be below full employment, i.e. there would have to be idle resources that can be put to use in the new production...

13.12.2024 15:29 — 👍 2 🔁 0 💬 1 📌 0

on first read it feels like a frank and logical assessment of China's need to boost demand by shifting income to the household sector. but his policy conclusions - more spending on industrial policy and infrastructure - are really boosting the supply side further

07.12.2024 03:15 — 👍 0 🔁 0 💬 1 📌 0

How Robert Lighthizer Got Shut Out of Trump’s Cabinet

Donald Trump’s former trade chief was hoping to run Treasury or the Commerce Department, but his prospects faded as other candidates emerged.

Robert Lighthizer won't join Trump's administration after declining to join the internal battle for a top cabinet level position, WSJ's Brian Schwartz reports. His absence could set back Trump’s ambitions. www.wsj.com/politics/pol...

04.12.2024 02:32 — 👍 3 🔁 1 💬 1 📌 0

I agree. My take: If lower inflows are caused by higher U.S. saving/lower investment, rates should fall. But if caused by exogenous decline in demand for dollar as a reserve asset, then marginal buyer of UST becomes more price sensitive and yields (esp term premium) should rise.

01.12.2024 18:13 — 👍 2 🔁 0 💬 0 📌 0

Trump's defense of the dollar's reserve currency status is disconsonant because it's a key reason for the demand for US dollar assets that causes our structural trade deficit. (Triffin dilemma, anyone?) Losing that status would mean a lower dollar, higher interest rates, and smaller trade deficit.

01.12.2024 04:22 — 👍 15 🔁 5 💬 2 📌 0

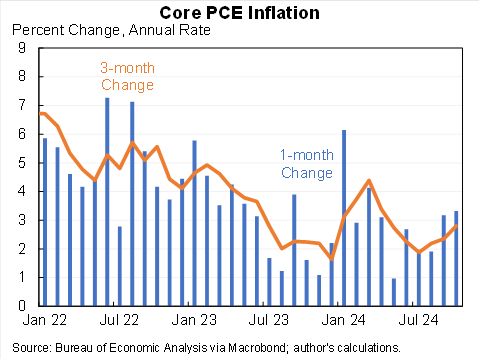

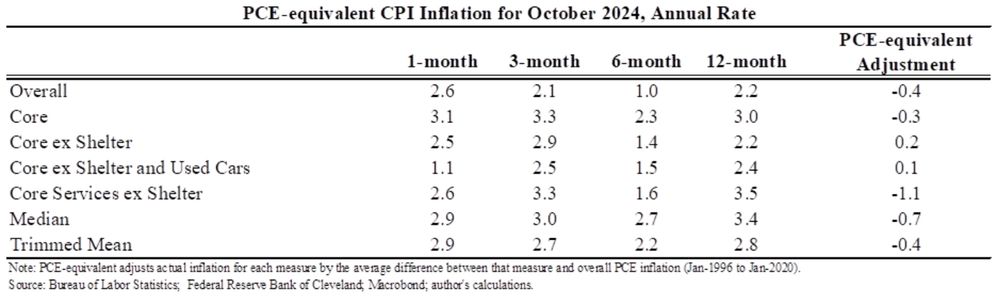

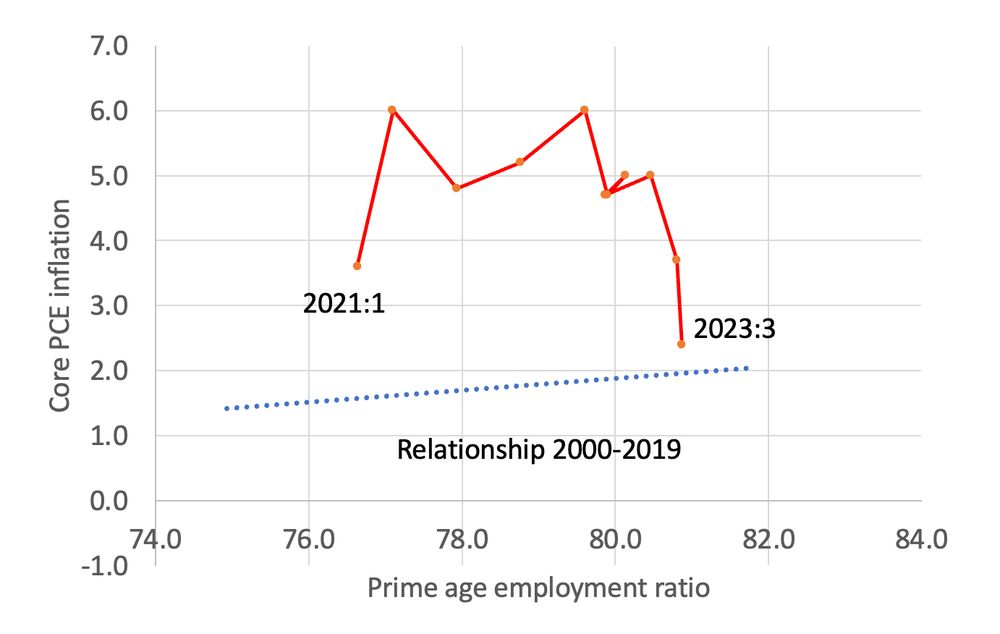

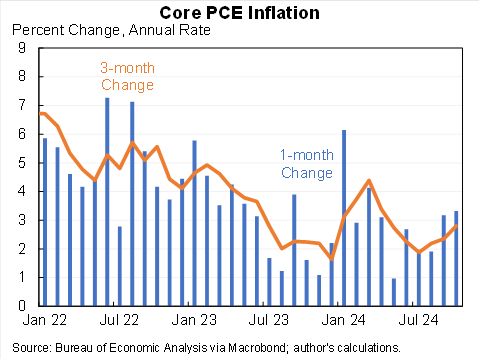

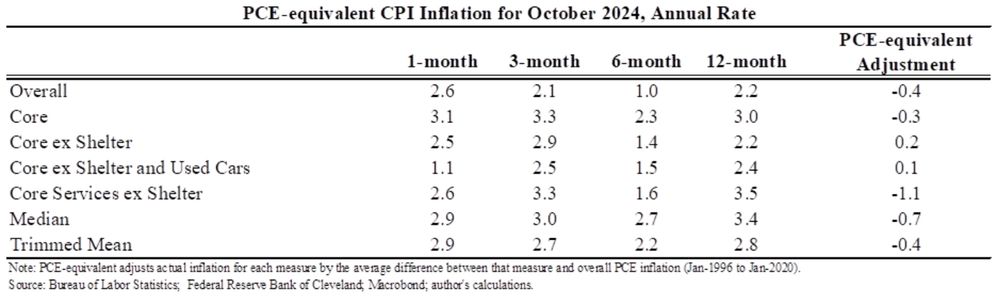

Core PCE came in high (as expected). The last mile thesis has gained strength over the last several months as 12-month core PCE is now up 2.8%. You might say that includes outdated, lagged data. But 3-month is also a 2.8% annual rate.

27.11.2024 15:29 — 👍 74 🔁 17 💬 6 📌 4

Trump’s Growth and Trade Agendas Are at Odds. His Economic Team Will Point to the Winner.

Tax cuts, deregulation and budget deficits would push up the dollar and worsen the trade deficit, while steep tariffs would undermine growth.

Trump's 2 key economic planks, tax cuts/dereg to bolster growth; and tariffs to reduce trade deficit & bring back factory jobs, are in conflict. Trump can prioritize stronger growth or a smaller trade deficit , but not both. What Treasury pick means for the clash. www.wsj.com/economy/trum...

21.11.2024 18:48 — 👍 5 🔁 1 💬 1 📌 0

Jeanna Smialek and Jim Tankersley Join International | The New York Times Company

I'm happy for @jeannasmialek.bsky.social and @jimtankersley.bsky.social but the DC economic policy press corps is taking a real hit here.

www.nytco.com/press/jeanna...

19.11.2024 14:54 — 👍 29 🔁 4 💬 1 📌 0

The horizontal bars represent the percentage saying "gotten better" minus the percentage saying "gotten worse." The first bar (for US) is the net answer across all battleground states on the US economy. For the states, it represents the net answer for each state.

19.11.2024 12:47 — 👍 1 🔁 0 💬 0 📌 0

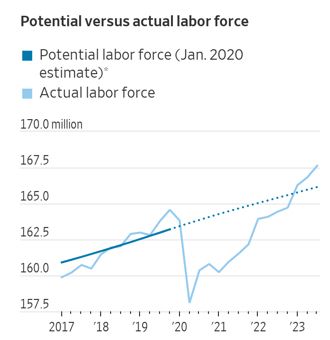

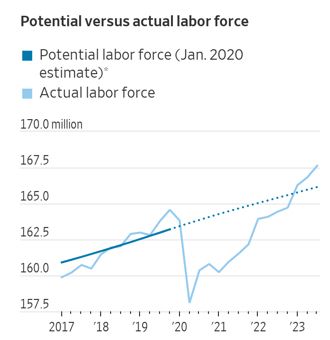

Trump inherits a remarkable economy. JP Morgan: "US real GDP currently stands nearly 4%-pts above its pre-pandemic potential path, while the RoW (rest of the world) maintains a greater than 1%-pt negative gap."

19.11.2024 03:24 — 👍 5 🔁 1 💬 1 📌 0

There's a new tariff in town

Podcast Episode · Today, Explained · 11/14/2024 · 28m

I talk with Noel King at Vox about tariffs: what Trump is trying to achieve, what we learned from his first term, how they might be implemented this time, and what the reaction might be. podcasts.apple.com/us/podcast/t...

15.11.2024 19:08 — 👍 4 🔁 1 💬 0 📌 0

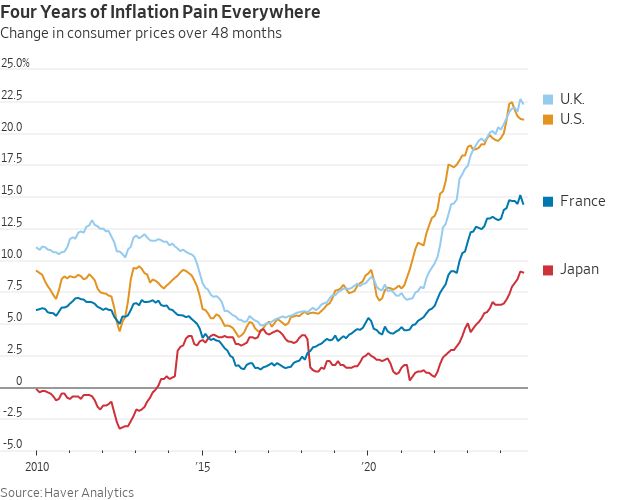

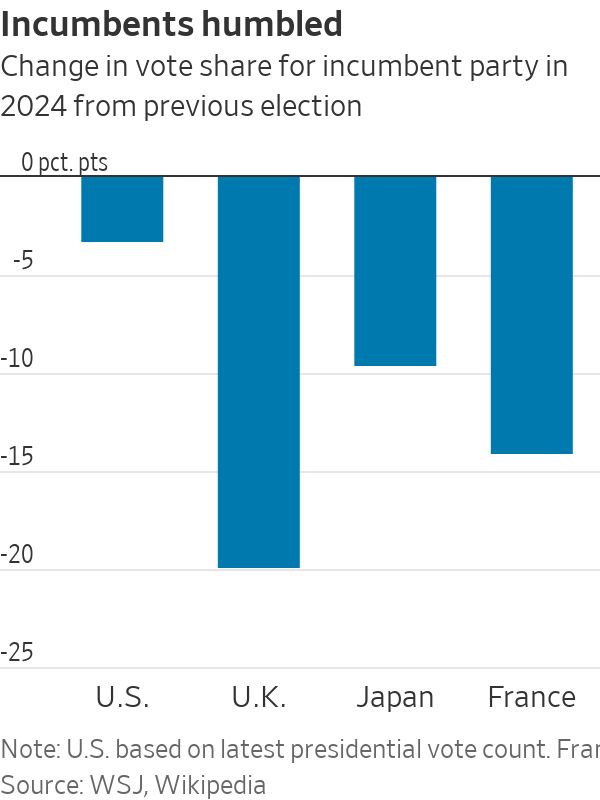

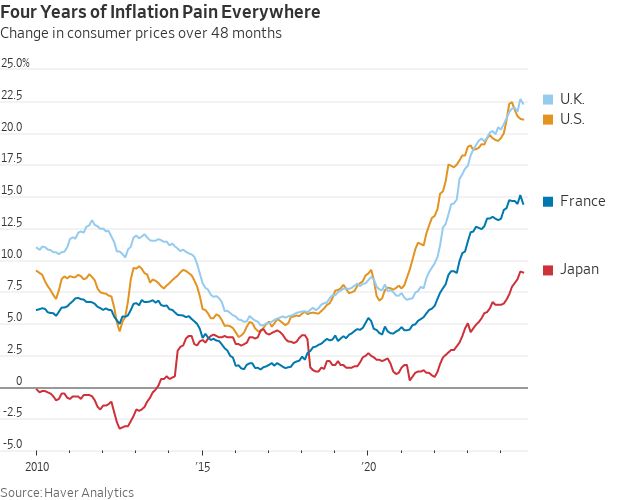

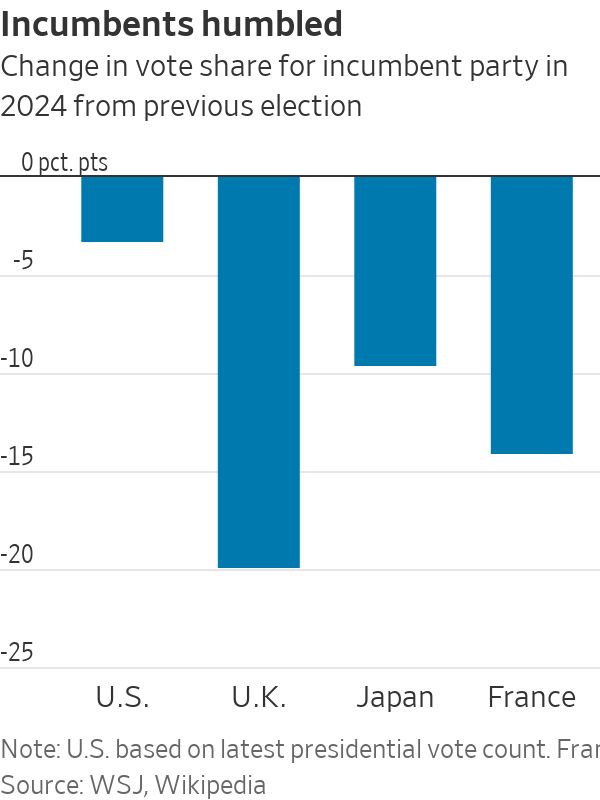

Did Harris lose because of economics or culture? I argue here economics. In UK, France, Japan, ihflation was #1 issue, like in U.S., and ruling parties in all lost despite changing leaders. My colleague Aaron Zitner makes the competing argument for culture. Read & vote

www.wsj.com/politics/ele...

15.11.2024 01:33 — 👍 3 🔁 1 💬 0 📌 0

A few media friends I’ve seen show up recently:

@michaelsantoli.bsky.social

@gregip.bsky.social

@boes.bsky.social

@maxblau.bsky.social

14.11.2024 14:02 — 👍 18 🔁 2 💬 7 📌 0

Seems like AI is at the phase right now where we’re getting a huge capex boost as companies figure out how to use it but we largely haven’t seen cost/job cuts due to AI yet, but we’ll get to a point where both the capex growth stops and we’ll get cost/job cuts from AI too.

13.11.2024 18:27 — 👍 39 🔁 4 💬 10 📌 0

The CPI-based Ecumenical Underlying Inflation measure was 2.5% in October, up from 2.2% in August and 2.4% in September. This is median of 21 measures. And FWIW, roughly matches my own sense of underlying inflation (in previous months my judgment was higher than this measure).

13.11.2024 19:28 — 👍 23 🔁 1 💬 1 📌 0

More of an example than an explanation. I wrote about the divergence here; I think the economic pessimism is referred pain from pessimism about the world in general. www.wsj.com/economy/the-...

06.11.2023 20:47 — 👍 2 🔁 0 💬 0 📌 0

Is Globalization in Decline? A New Number Contradicts the Consensus

Instead of looking at the dollar value of trade, focus on how many tons of stuff get shipped how far

Is Globalization in Decline? A New Number Contradicts the Consensus. Instead of looking at the dollar value of trade, focus on how many tons of stuff get shipped how far, by Josh Zumbrun www.wsj.com/economy/glob...

03.11.2023 18:35 — 👍 0 🔁 1 💬 0 📌 0

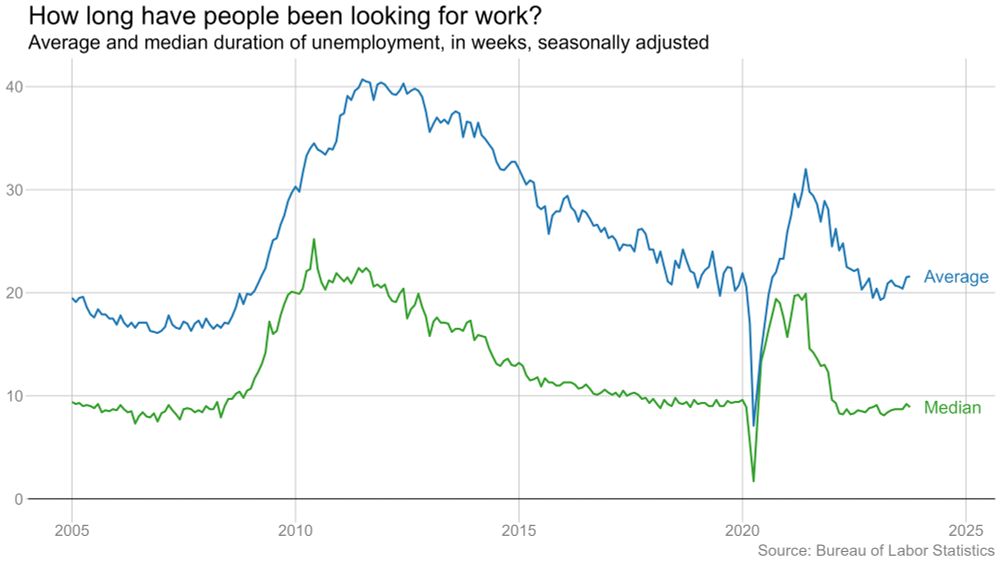

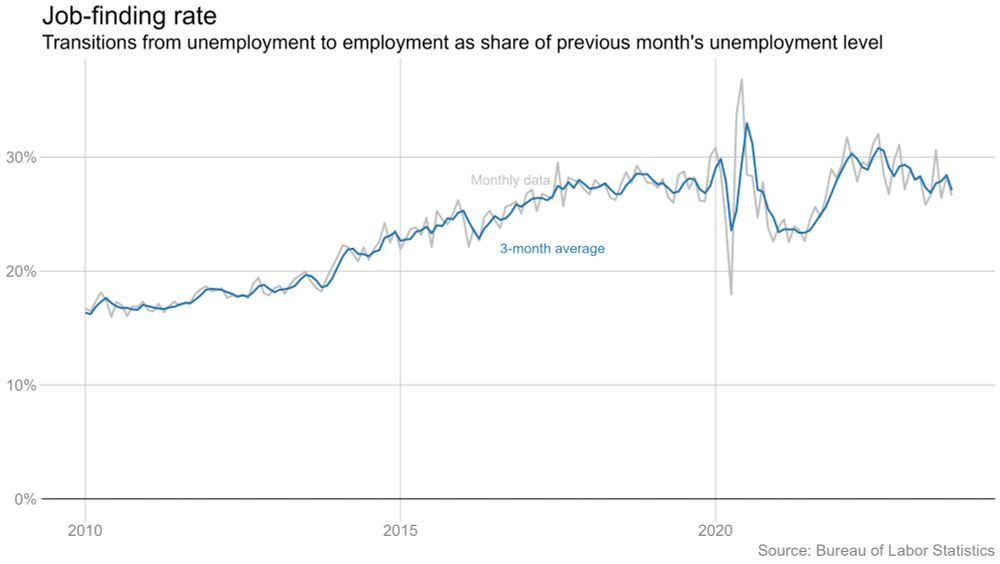

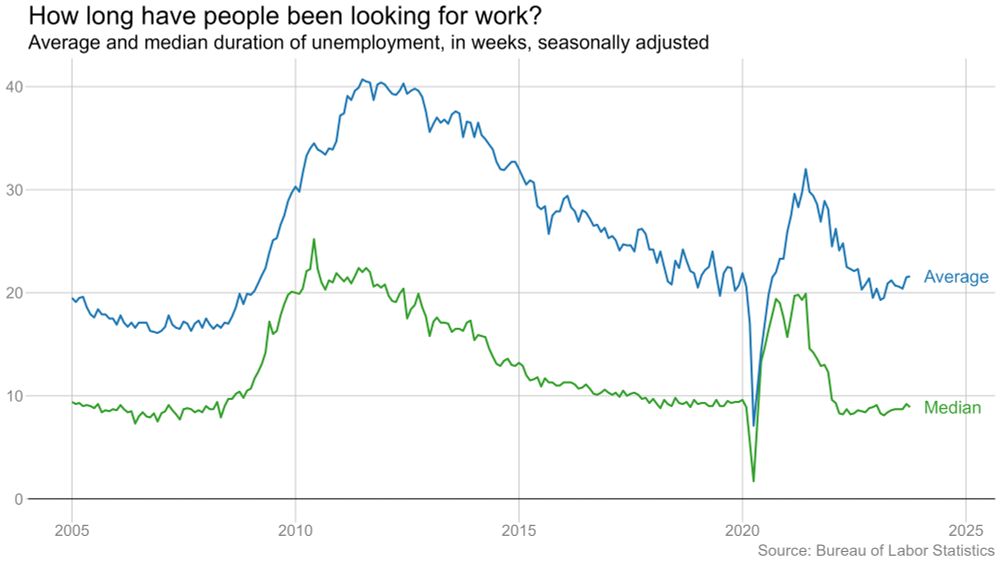

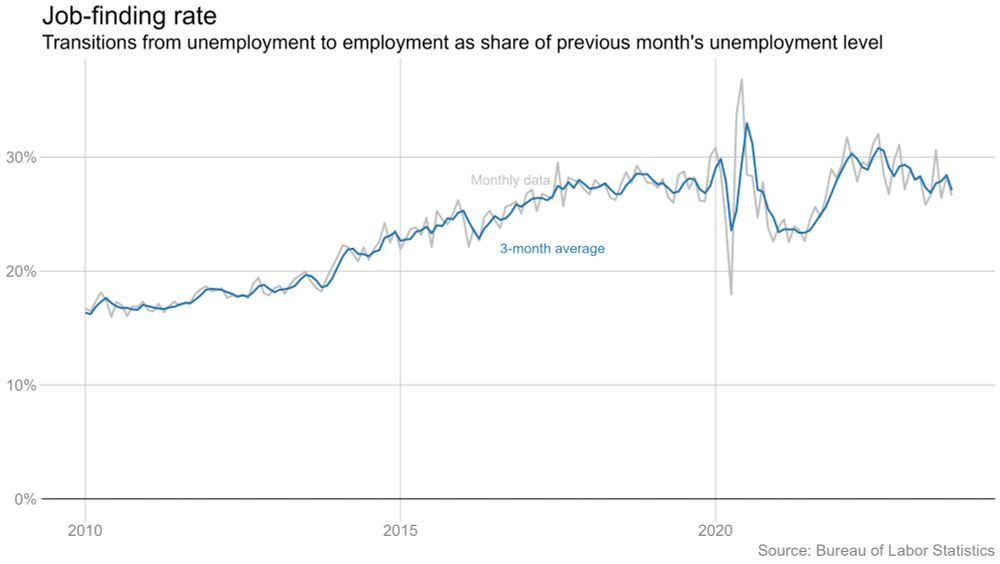

Layoffs remain very low. But for people who are out of work, it's getting harder to find a job. The job-finding rate is roughly back to where it was before the pandemic (which was still a very strong job market). And the average duration of unemployment has drifted up a bit.

03.11.2023 13:48 — 👍 1 🔁 1 💬 1 📌 0

This is the streaming equivalent of the potato chip company shrinking the size of the bag but keeping the price the same.

02.11.2023 18:48 — 👍 1 🔁 0 💬 0 📌 0

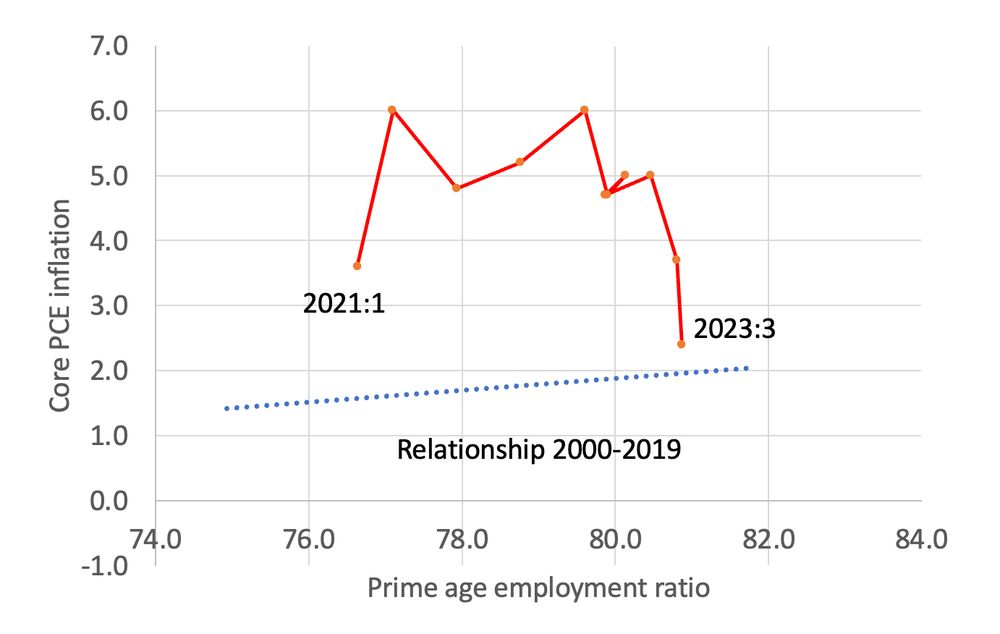

Why Fed chair Powell isn't bothered by what looks like above potential growth: potential has moved up. At least temporarily. "Fed Takes Heart in a Supply-Side Boom" wsj.com/economy/cent...

02.11.2023 00:53 — 👍 0 🔁 0 💬 0 📌 0

The Economy Is Great. Why Are Americans in Such a Rotten Mood?

Lingering inflation can’t explain all of the unhappiness; maybe it is referred pain from the wider world

GDP and jobs are above their prepandemic trend. Inflation is falling, real wages have recovered, real wealth is up. Why so much economic pessimism? Could it be "referred pain"? My latest. www.wsj.com/economy/the-...

01.11.2023 15:50 — 👍 0 🔁 0 💬 0 📌 0

Inflation is also higher than before Covid so there's at least a prima facie case that today's level of GDP is above potential, although CBO's own estimates don't show that.

27.10.2023 02:17 — 👍 0 🔁 0 💬 0 📌 0

What we talk about when we talk about Long Transitory

26.10.2023 14:47 — 👍 49 🔁 7 💬 0 📌 1

Fed chairmen used to lecture Congress and presidents on the deficit. Those days are over. Even as deficits drive up bond yields and roil markets, Powell refuses to offer advice, in contrast to 2020 when he advocated for more stimulus. My column. www.wsj.com/economy/cent...

25.10.2023 15:33 — 👍 1 🔁 0 💬 0 📌 0

Fellow @Brookings.edu. Past: Manhattan Institute (2017-25) Sen. Portman chief economist (2011-17), budget policy for 4 prez campaigns. Fiercely independent and tribeless. Views mine.🏳️🌈

Reginald Jones Senior Fellow @PIIE.com

@Trade--Talks.bsky.social Podcast host

Former State Department, White House, WTO, World Bank, Professor

I think about trade and policy. Probably too much

Me: www.chadpbown.com

Pod: www.tradetalkspodcast.com

Senior Fellow and Director, Retirement Security Project @Brookings. Previously: Research Associate @NBER, Senior Fellow @SIEPR, Biden-Harris Council of Economic Advisers. Passionate about connecting research to policy.

https://www.gopishahgoda.org

Professor of Economics and Public Policy, King's College London; Senior Fellow, UK in a Changing Europe. Immigration, economics, public policy. Personal views only; usual disclaimers apply.

Books: Immigration (Sage), Capitalism (Quercus)

Author of Calculated Risk Real Estate Newsletter at http://calculatedrisk.substack.com and Economic Weekly at https://economicweekly.substack.com/

SSRN’s mission is to rapidly share early-stage research and empower global scholarship to help shape a better future. You can submit your research to SSRN online at www.ssrn.com.

Econ nerd, Fed obsessive, Dodgers fan, recovering journalist (Ex-Econ Editor WaPo, WSJ), McKinsey alum, now Peterson Institute for International Economics VP Publishing, among other things. Opinions my own etc.

Senior Writer for Economics, Bloomberg News. Ex FT. Aussie. Red Sox nation. Opinions mine alone. Reposts not endorsements. sdonnan@bloomberg.net

Global economics correspondent for The Washington Post

Senior Fellow at Carnegie China. For speaking engagements, please write to chinfinpettis@yahoo.com

staff writer @theatlantic.com and senior fellow @snfagora.bsky.social. author of GULAG, IRON CURTAIN, RED FAMINE, TWILIGHT OF DEMOCRACY and AUTOCRACY INC

https://linktr.ee/anneapplebaum

Writing about the California economy for The Wall Street Journal. Currently based in Los Angeles. Previously CDMX, São Paulo, Rio, and DC.

Tips to paul.kiernan@wsj.com or Signal/WhatsApp +1-202-808-4258

https://www.wsj.com/news/author/paul-kiernan

American Enterprise Institute, CNBC

My book: 🚀THE CONSERVATIVE FUTURIST (2023) 🚀 https://www.hachettebookgroup.com/titles/james-pethokoukis/the-conservative-futurist/9781546005544/?lens=center-street

My Substack: Faster, Please! https://fasterplease.subs

President of the @ec.europa.eu

Mother of seven. Brussels-born. European by heart. 🇪🇺

Director, @stanforddel.bsky.social

Professor Stanford Institute for Human-centered AI, SIEPR, Stanford department of Economics and GSB

Author https://amazon.com/Second-Machine-Age-Prosperity-Technologies/dp/0393350649

Wall Street editor at The Economist, co-host of our Money Talks podcast.

undisciplined scholar and recovering academic @AEI @DNVA1 @CUBoulder @UCL | Subscribe to The Honest Broker ➡️ http://rogerpielkejr.substack.com

Director of Economic Policy Studies and Senior Fellow at the American Enterprise Institute. Professor of Practice at Georgetown University.