When the fog clears: the effect of reduced inflation uncertainty on households' financial behaviour

Staff working papers set out research in progress by our staff, with the aim of encouraging comments and debate.

Staff Working Paper 1133 by Johannes Fischer (Bundesbank), Christoph Herler (BoE) and Philip Schnattinger (BoE) examines the effects of inflation uncertainty on households’ consumption and saving decisions. 🔗 Read the paper here: www.bankofengland.co.uk/working-pape...

04.07.2025 09:39 — 👍 4 🔁 2 💬 0 📌 0

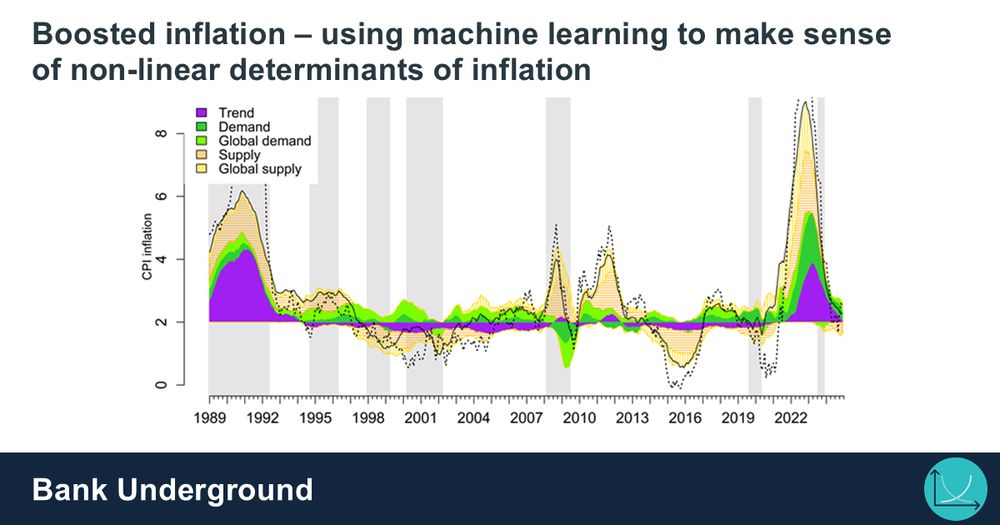

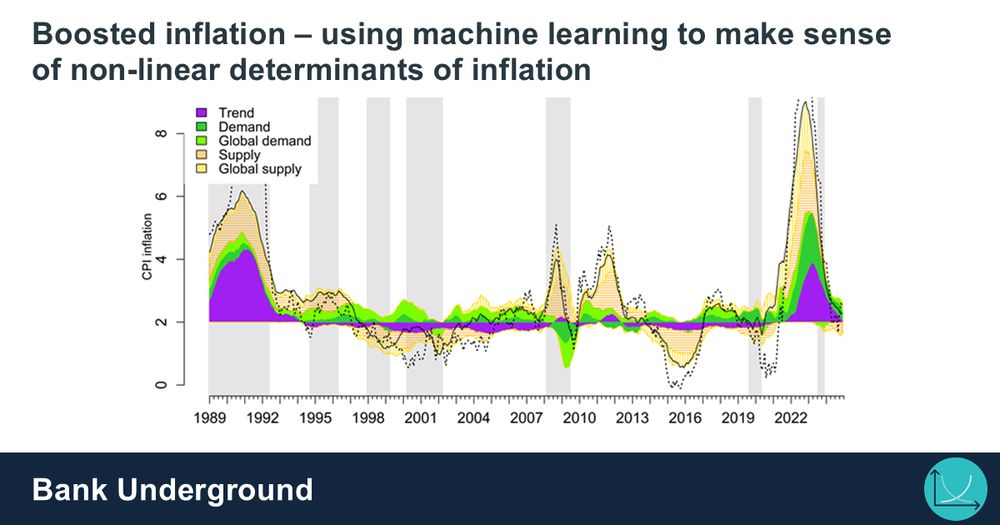

In our latest Bank Underground post, Marcus Buckmann (BoE), Galina Potjagailo (BoE) and Philip Schnattinger (BoE) propose a new machine learning approach that disentangles non-linear demand and supply-like determinants of inflation. 🔗 Read the post here: bankunderground.co.uk/2025/05/15/b...

16.05.2025 13:11 — 👍 3 🔁 1 💬 0 📌 0

In today’s Bank Underground post, Isabelle Roland (BoE), Yukiko Saito (Waseda University) and Philip Schnattinger (BoE) provide new evidence on forbearance by quantifying the aggregate impact of Japan’s 2009 SME Financing Facilitation Act. 🔗 Read more here: bankunderground.co.uk/2025/04/03/f...

03.04.2025 10:19 — 👍 2 🔁 1 💬 0 📌 0

Bank of England Research | Linktree

Research papers, Bank Underground posts, publications and news BoE Research

Welcome to the Bank of England Research Bluesky Account! 🌟

Stay updated with our latest Staff Working papers, Bank Underground blog posts, research conferences & researcher career opportunities. Follow us for research updates and news from our staff. We are also on LinkedIn linktr.ee/boeresearch

25.02.2025 10:49 — 👍 10 🔁 4 💬 0 📌 0

🧵 In today’s Bank Underground post, Michal Stelmach (BoE), James Kensett (BoE) and Philip Schnattinger (BoE) investigate how best to measure labour market tightness… bankunderground.co.uk/2025/03/06/w...

06.03.2025 10:15 — 👍 4 🔁 2 💬 1 📌 0

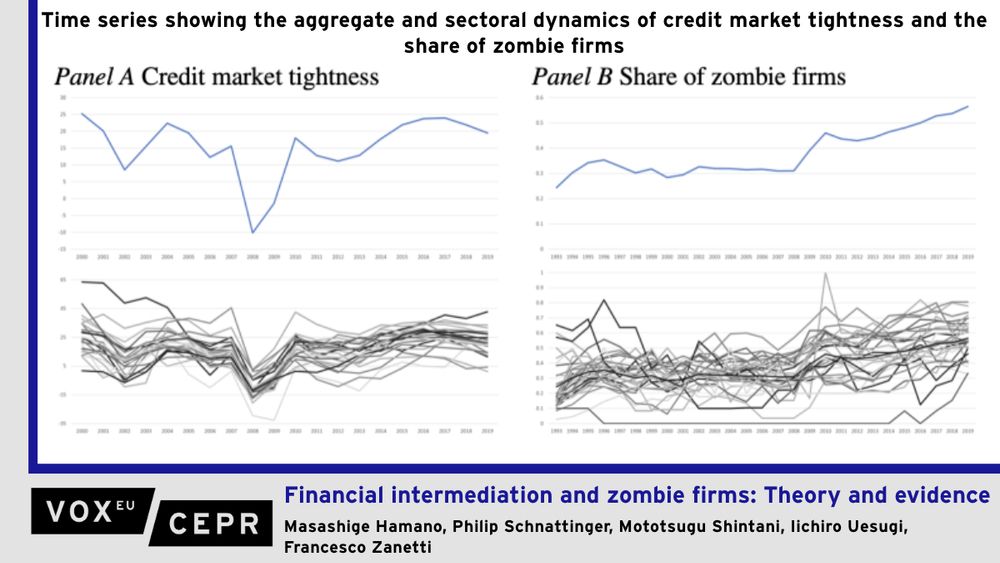

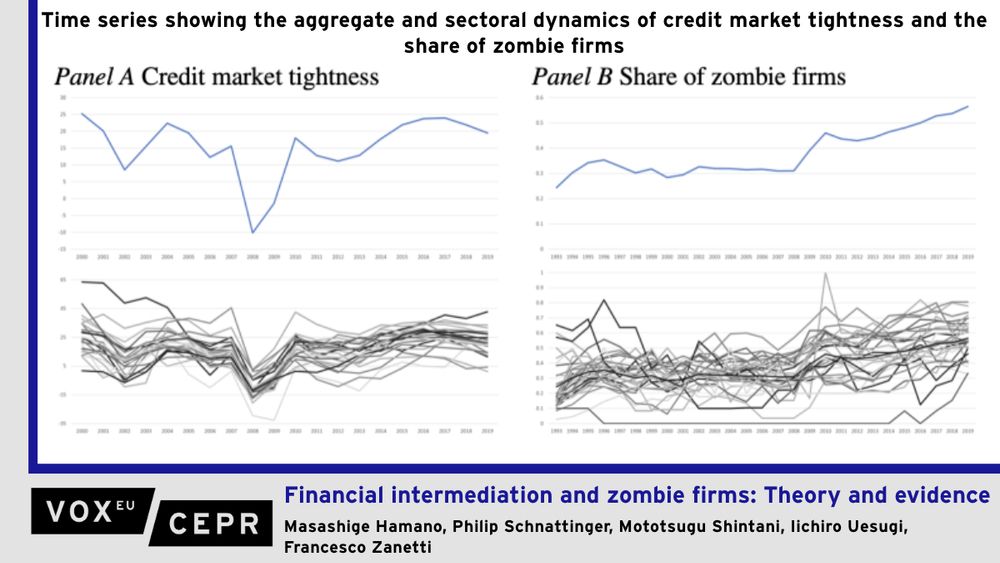

Credit market conditions have been identified as a key driver of the prevalence of zombie firms. This column studies the relationship between credit conditions and zombie firms using a new theoretical framework. It highlights that credit market tightness creates opposing incentives for banks and firms. Increases in credit market tightness first lead to a higher share of zombie firms, but the share begins to decline at higher levels of tightness. The theoretical predictions are supported by industry-level data from Japan, which furthermore shows that the ability of capital injections to reduce zombie lending increases with credit market tightness.

Credit market tightness creates opposing incentives for banks & firms. 📈 credit market tightness lead to a higher share of zombie firms, but the share declines at higher levels of tightness. #EconSky

M Hamano, @pschnattinger.bsky.social, M Shintani, Iichiro Uesugi, F Zanetti

cepr.org/voxeu/column...

28.02.2025 08:56 — 👍 5 🔁 2 💬 0 📌 0

American Economic Association

AEA ASSA 2025 starting off with fantastic presentations. Do check out our session on Zombie Lending later this Weekend (Sunday 10:15 am , Hilton Union Square, Yosemite C)

www.aeaweb.org/conference/2...

#ASSA2025

03.01.2025 18:45 — 👍 0 🔁 0 💬 0 📌 0