A jobs day to remember! Check out my latest video for the full story on what happened on Friday and what this means for our economy

06.08.2025 20:40 — 👍 6 🔁 8 💬 0 📌 0

the voting rights act is, in its entirety, obviously constitutional under the 15th amendment, which gives congress broad and proactive authority to stop racial discrimination in voting. and you know it is obviously constitutional because roberts has had to invent entire new doctrines to gut it.

02.08.2025 18:07 — 👍 10075 🔁 2743 💬 145 📌 77

Healthcare, the one industry still doing major hiring, is in for big federal cuts.

First, NIH and NSF cuts this year. Next, ACA subsidy cuts starting next year. Then, Medicaid cuts starting in the coming years.

How long do they keep hiring for?

01.08.2025 14:04 — 👍 3 🔁 2 💬 0 📌 0

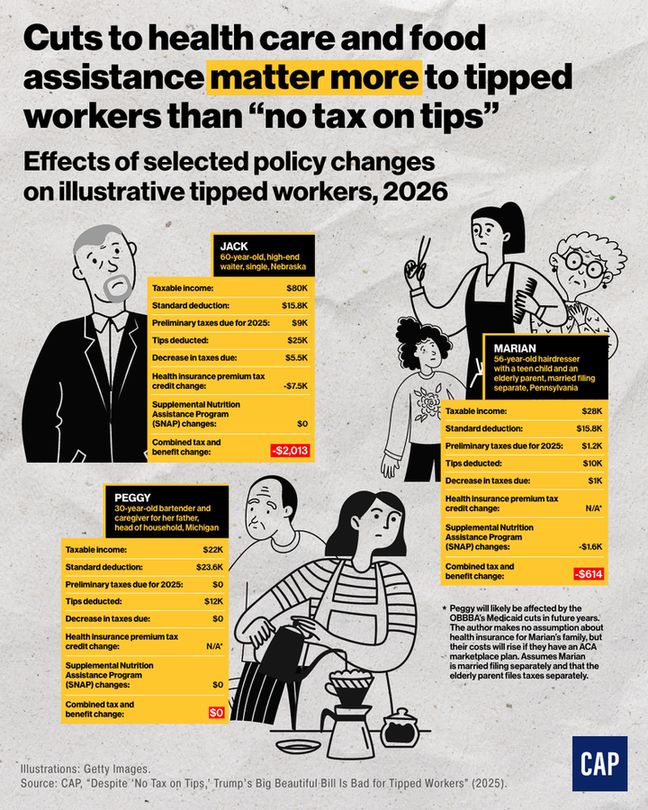

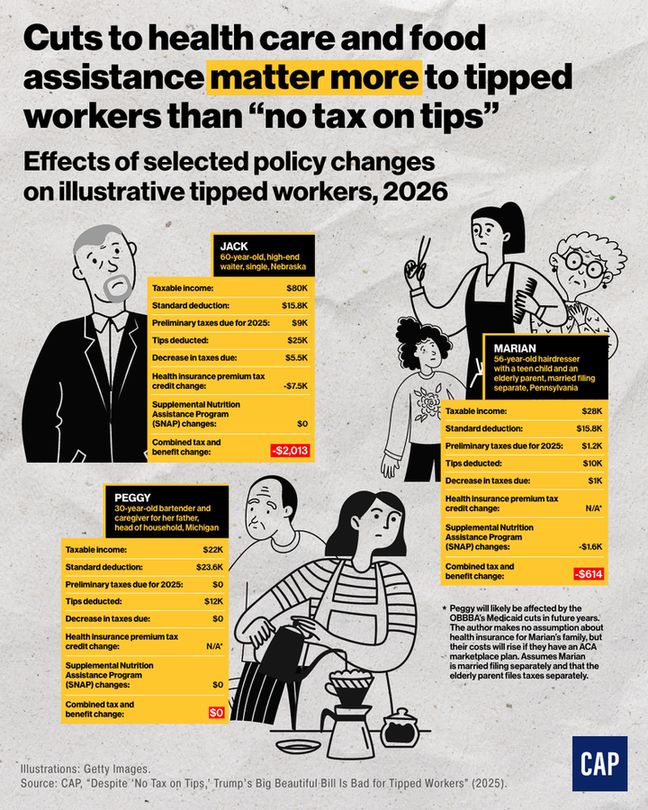

Illustrated infographic showing three profiles of illustrative tipped workers Jack, Marian, and Peggy. Title text says, 'Cuts to health care and food assistance matter more to tipped workers than "no tax on tips".' Subheader text shows, "Effects of selected policy changes on illustrative tipped workers, 2026."

Despite appearances, the OBBBA's "no tax on tips" provision will only benefit a small number of workers, and many of them will suffer more from the law's severe program cuts. Learn more: www.americanprogress.org/article/desp...

31.07.2025 19:05 — 👍 13 🔁 11 💬 2 📌 1

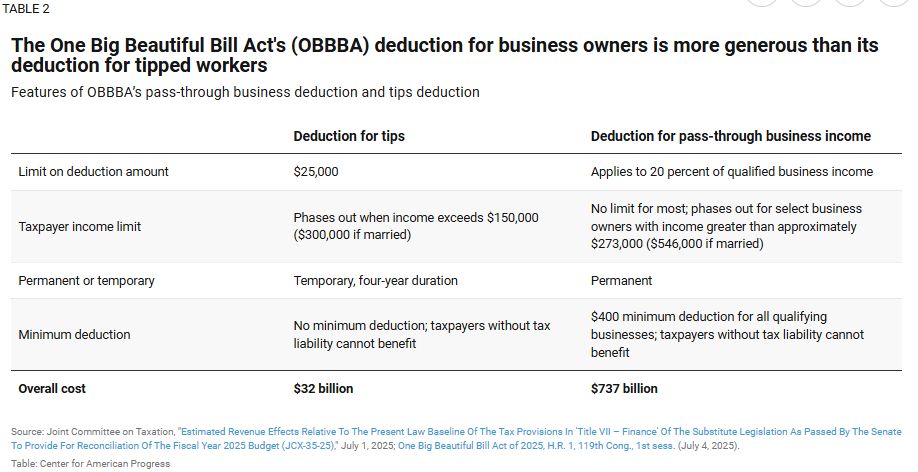

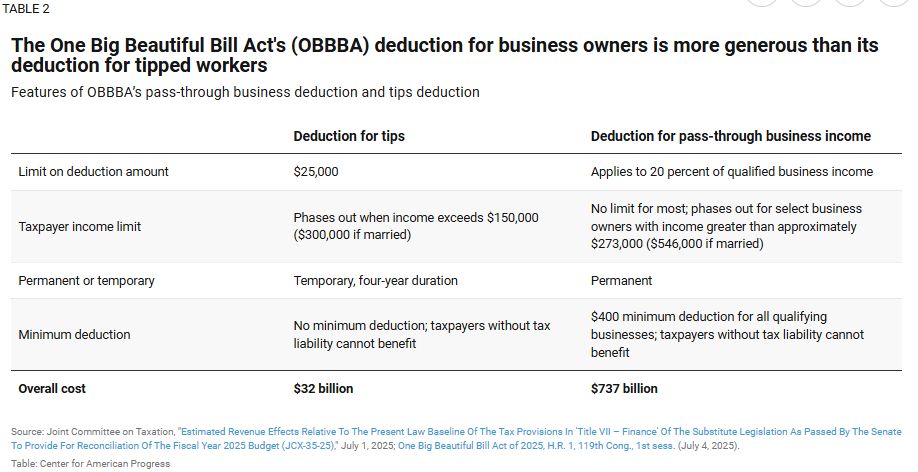

Finally, “No Tax on Tips” will be difficult to access.

Its a tax deduction (not a credit, not a min. wage) with many restrictions. i.e. 1/3 of all tipped workers don’t have a tax liability to deduct from.

Business tax breaks in the bill don’t have similar restrictions…

31.07.2025 17:51 — 👍 0 🔁 1 💬 1 📌 0

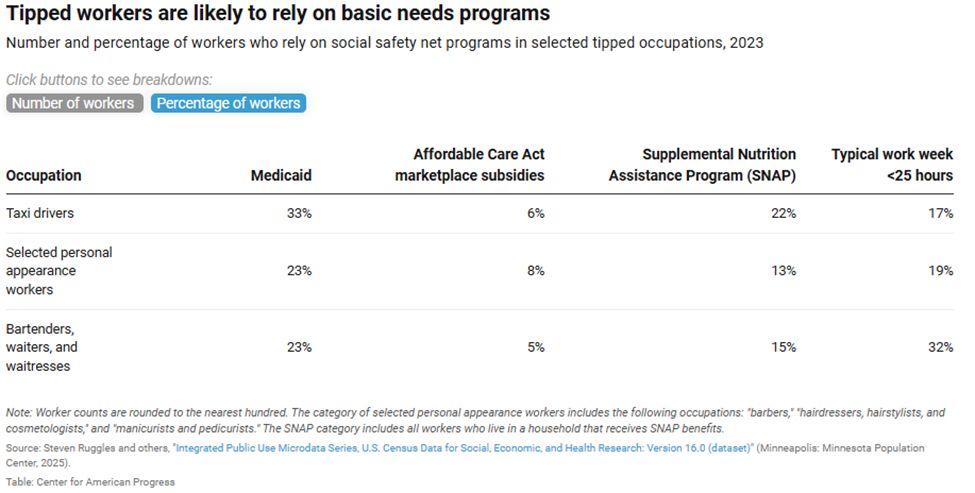

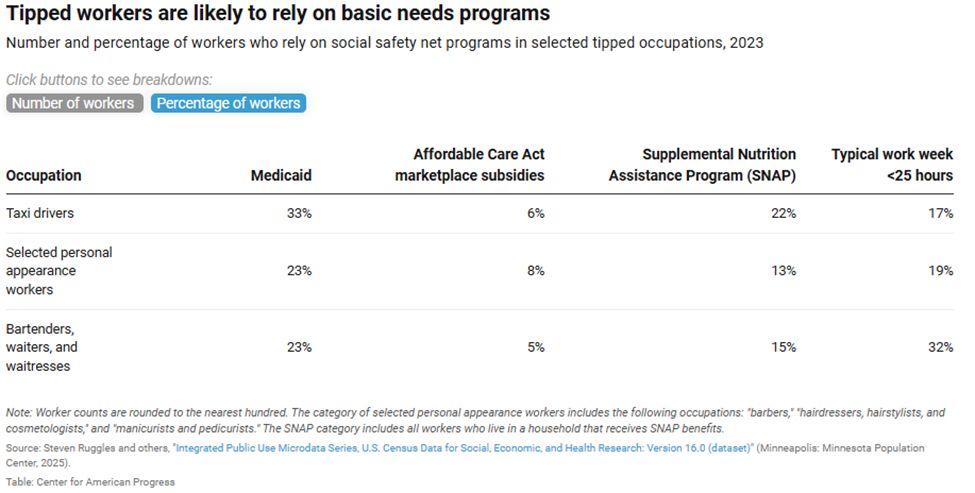

The work hours column is also important. Rs ramped up paperwork requirements for SNAP and Medicaid—Now to get lifesaving help you must consistently work >20 hrs/wk. Tipped workers often don’t control their schedule so will get kicked off. This affects waiters/bartenders in particular

31.07.2025 17:51 — 👍 0 🔁 0 💬 1 📌 0

Tipped workers are mostly low-income and only 1/3 get health insurance at work. We present the first estimates of how many tipped workers are vulnerable to the coming Medicaid, ACA and SNAP cuts. Its well over 1 million (over 30%)

31.07.2025 17:49 — 👍 0 🔁 1 💬 1 📌 0

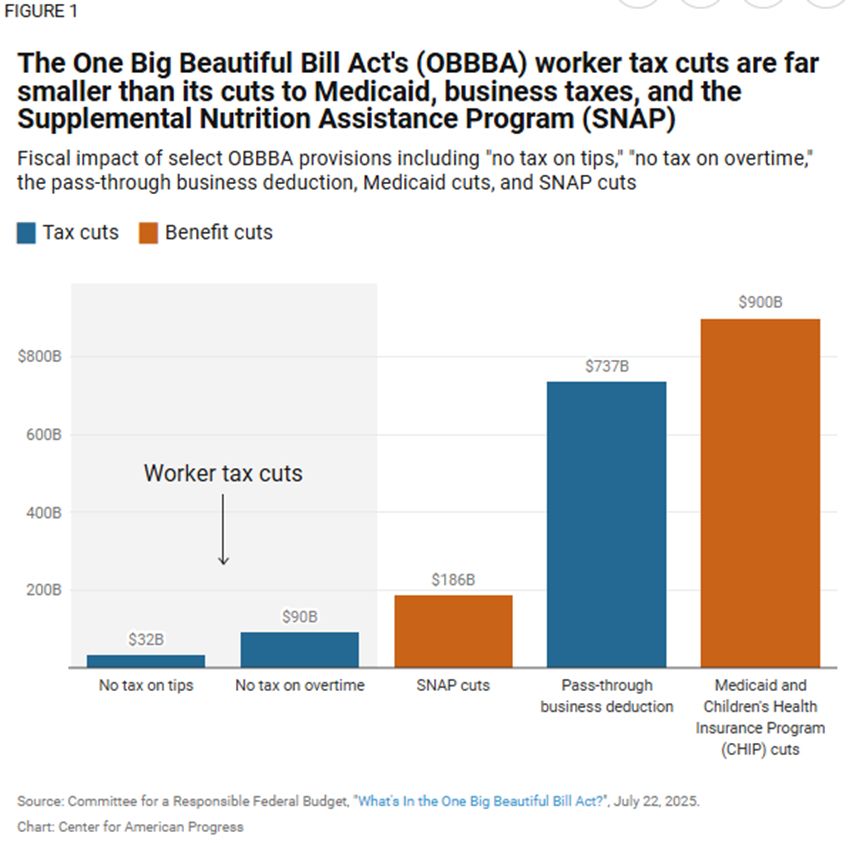

New research from me @americanprogress.bsky.social

today: How will Trump’s OBBBA affect tipped workers?

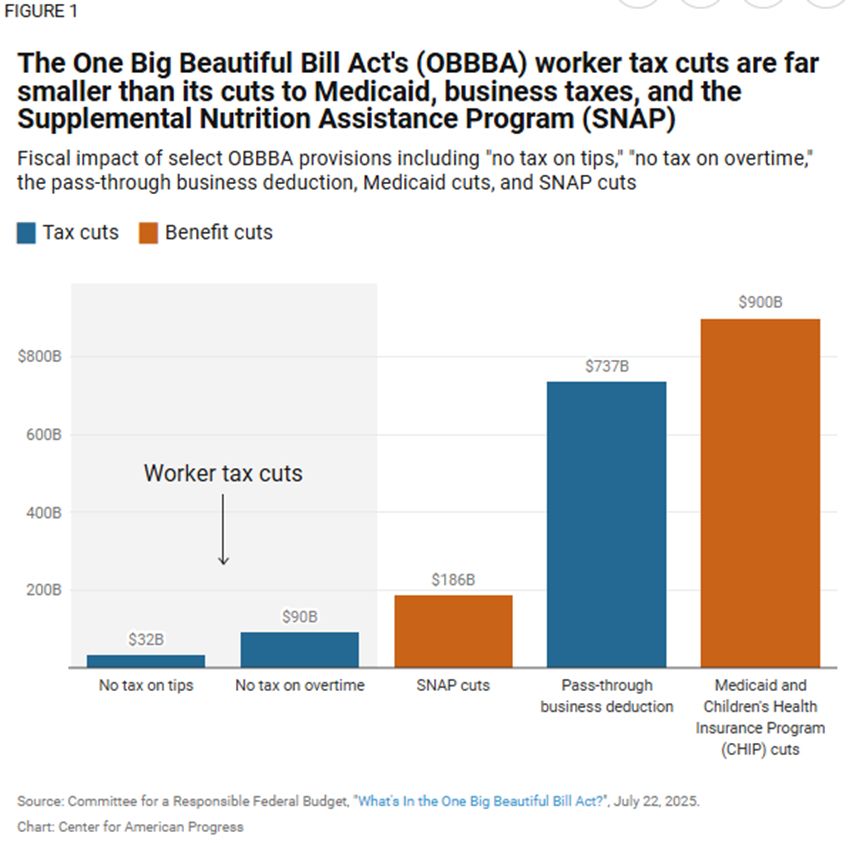

Most have focused on “no tax on tips”, but tipped workers are esp. vulnerable to the bill’s program cuts. Medicaid & SNAP cuts vastly outweigh the worker tax cuts

31.07.2025 17:49 — 👍 9 🔁 11 💬 1 📌 0

Let's put the $3.4 trillion cost of Republican reconciliation law in context.

Its tax cuts are so costly that Republicans could have extended all of the expiring tax cuts for families (including millionaires) without cutting SNAP/Medicaid...and it would have cost *less*.

21.07.2025 18:36 — 👍 45 🔁 33 💬 3 📌 0

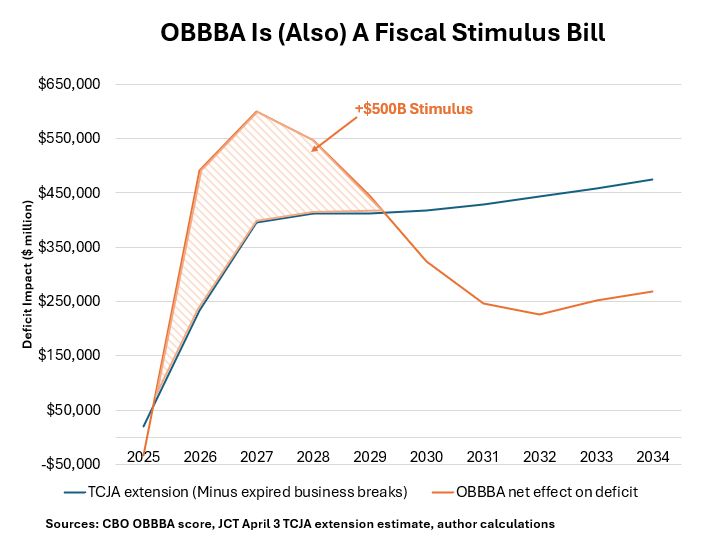

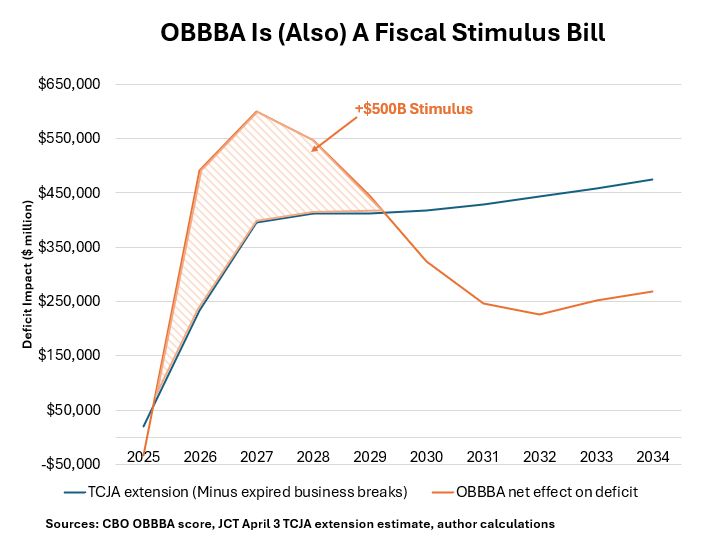

Not the most important aspect of this bill, but still an important aspect. Is it enough to kick up inflation? Perhaps only modestly, esp with tariffs.

Caveats: the $500b would be larger if not for how CBO counts student loan reforms. Baselines differ, etc

03.07.2025 16:53 — 👍 0 🔁 0 💬 0 📌 0

After years of debates about inflation and fiscal stimulus, its striking that Republicans are passing a new fiscal stimulus.

Even relative to current policy, this bill pours $500 billion into the economy, mostly over the next 3 years

03.07.2025 16:52 — 👍 0 🔁 0 💬 1 📌 0

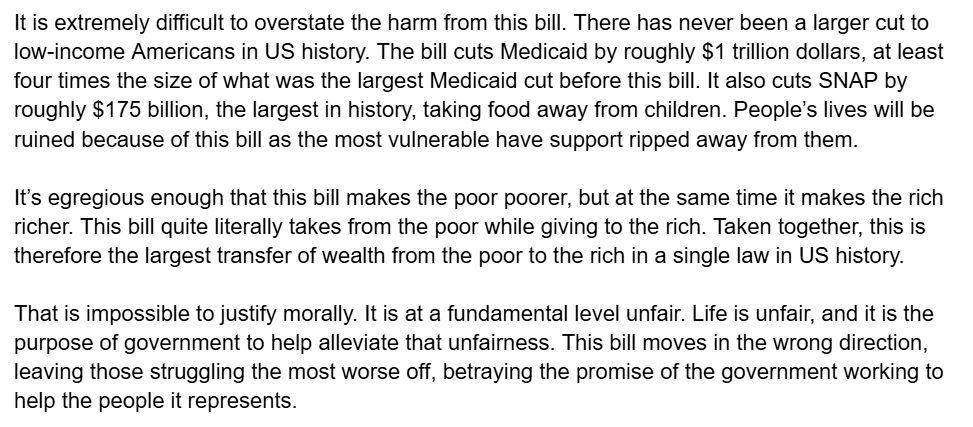

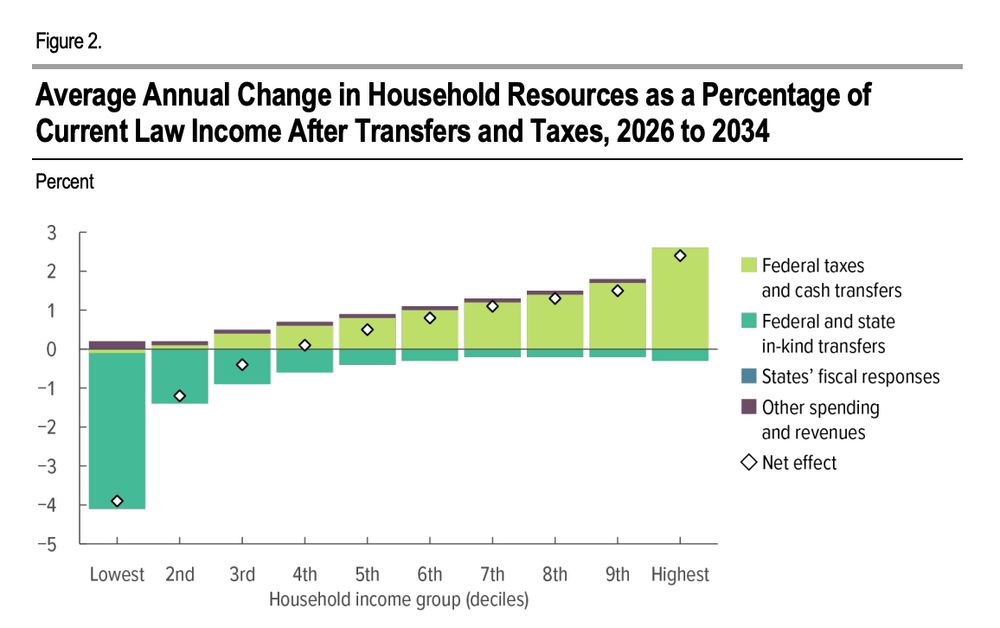

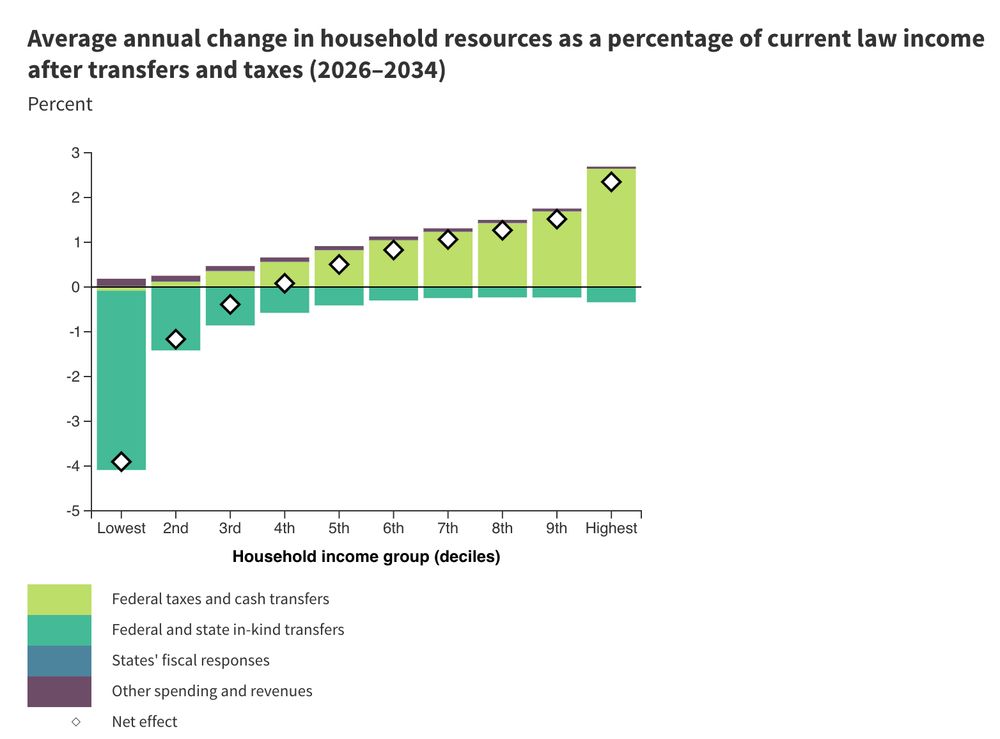

It is extremely difficult to overstate the harm from this bill. There has never been a larger cut to low-income Americans in US history. The bill cuts Medicaid by roughly $1 trillion dollars, at least four times the size of what was the largest Medicaid cut before this bill. It also cuts SNAP by roughly $175 billion, the largest in history, taking food away from children. People’s lives will be ruined because of this bill as the most vulnerable have support ripped away from them.

It’s egregious enough that this bill makes the poor poorer, but at the same time it makes the rich richer. This bill quite literally takes from the poor while giving to the rich. Taken together, this is therefore the largest transfer of wealth from the poor to the rich in a single law in US history.

That is impossible to justify morally. It is at a fundamental level unfair. Life is unfair, and it is the purpose of government to help alleviate that unfairness. This bill moves in the wrong direction, leaving those struggling the most worse off, betraying the promise of the government working to help the people it represents.

My statement

03.07.2025 14:52 — 👍 198 🔁 71 💬 3 📌 5

Today's number (+147K) shows steady job growth in an economy anxious about Trump’s tariffs and weakening consumer spending threatening to slow investment. An inopportune moment for Congress to pass a budget bill that kills jobs, guts basic needs programs, and adds $3.4 trillion in deficits. Why? 🧵

03.07.2025 13:43 — 👍 9 🔁 8 💬 1 📌 0

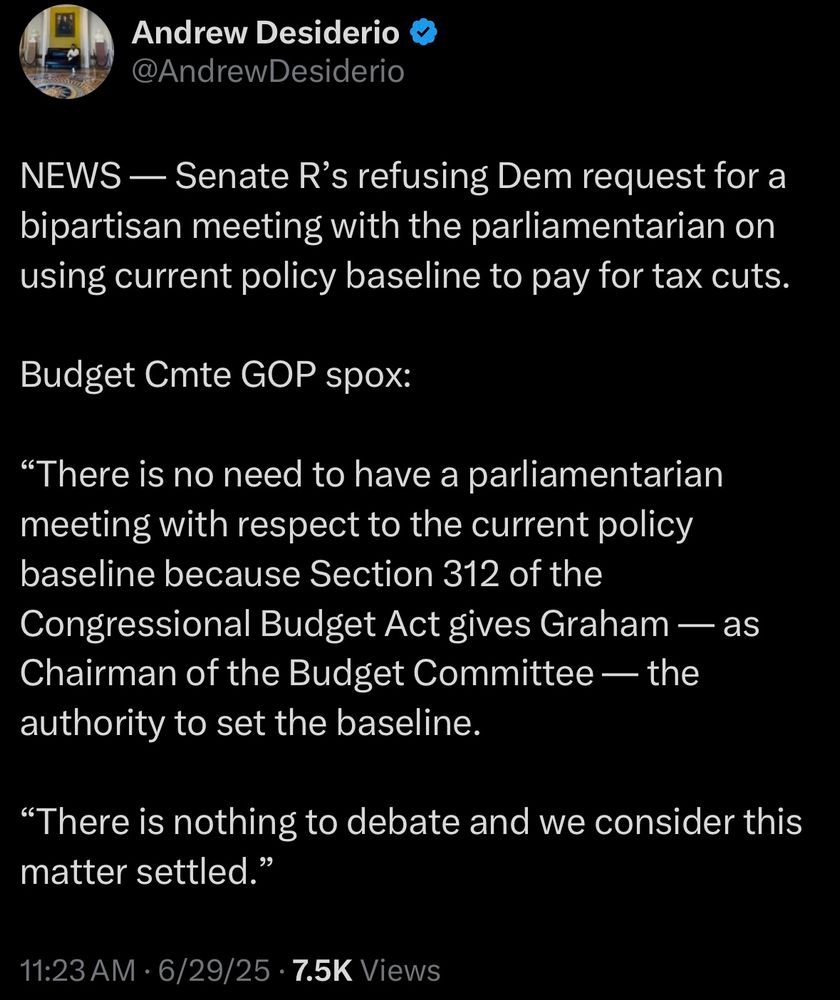

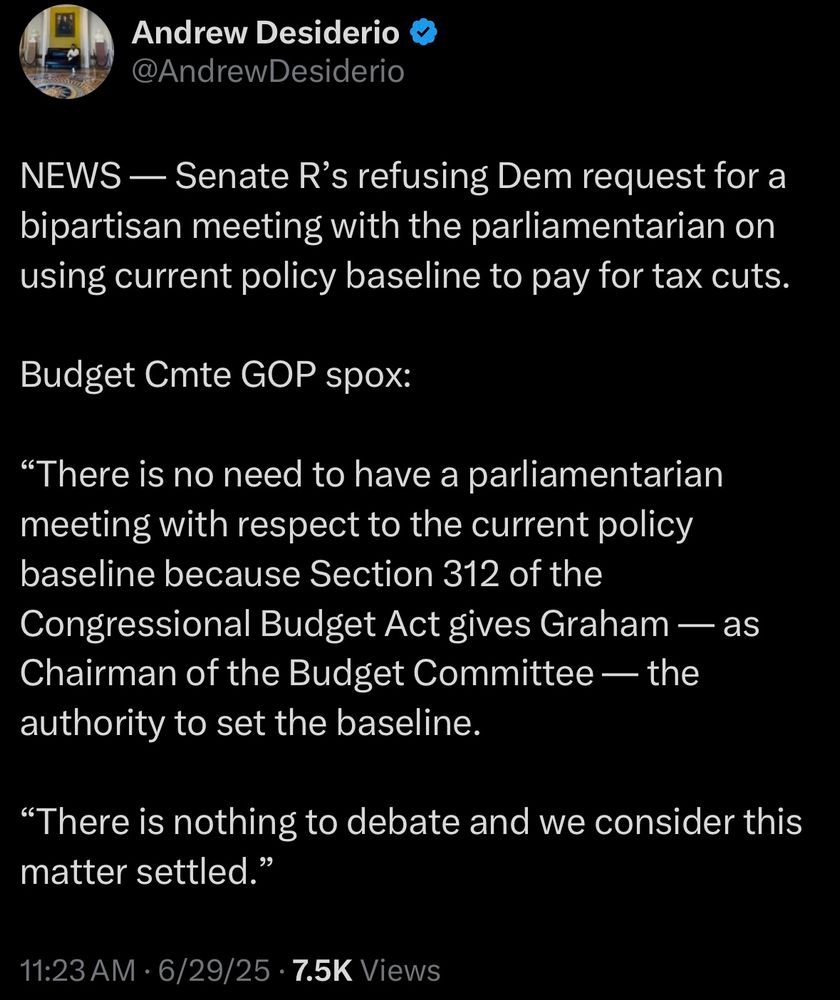

NEWS — Senate R's refusing Dem request for a bipartisan meeting with the parliamentarian on using current policy baseline to pay for tax cuts.

Budget Cmte GOP spox:

"There is no need to have a parliamentarian meeting with respect to the current policy baseline because Section 312 of the Congressional Budget Act gives Graham — as Chairman of the Budget Committee — the authority to set the baseline.

"There is nothing to debate and we consider this matter settled."

I want to be very clear about what’s happening: Senate Republicans know the parliamentarian will say they can’t use 312 to pretend tax cuts are free (because two have two Byrd rule problems).

So they are refusing to meet with her so they can pretend they never ignored her when they do it anyway.

29.06.2025 15:32 — 👍 2267 🔁 891 💬 60 📌 62

Senate Republicans are calling to cut Medicaid and CHIP by over $1 trillion, growing to an 18% cut by 2034.

This would be at least four times the size of the largest Medicaid cut in history.

29.06.2025 04:06 — 👍 1384 🔁 658 💬 52 📌 59

Republicans just lost 10% of the affirmative savings they wanted to get in reconciliation.

Truly in awe of the Bernie Sanders HELP staff and the Jeff Merkley Budget staff.

26.06.2025 04:49 — 👍 405 🔁 86 💬 10 📌 7

Some personal news

23.06.2025 18:47 — 👍 2 🔁 0 💬 0 📌 0

amtrak’s marketing team gets it

21.06.2025 12:21 — 👍 30816 🔁 10094 💬 460 📌 1223

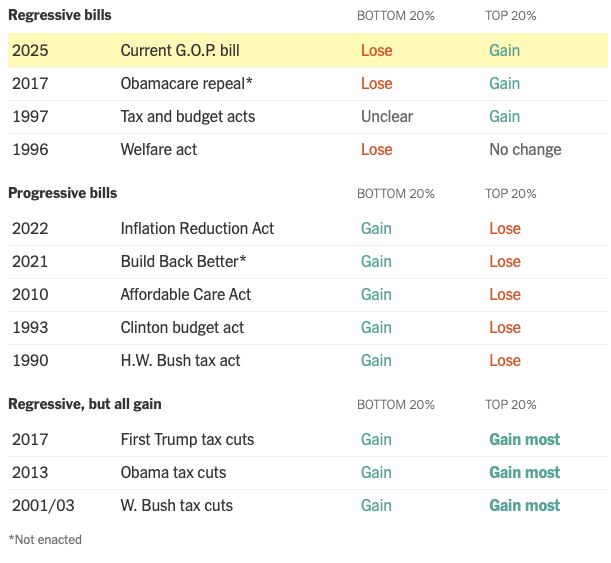

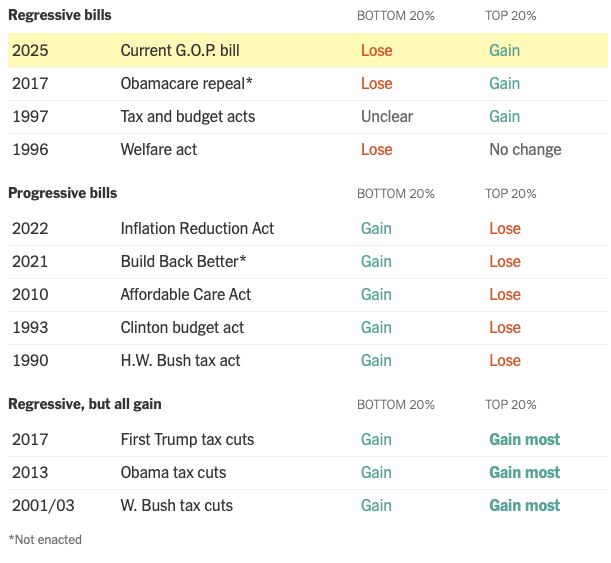

Regressive bills

BOTTOM 20%

TOP 20%

2025

Current G.O.P. bill

Lose

Gain

2017

Obamacare repeal*

Lose

Gain

1997

Tax and budget acts

Unclear

Gain

1996

Welfare act

Lose

No change

Progressive bills

BOTTOM 20%

TOP 20%

2022

Inflation Reduction Act

Gain

Lose

2021

Build Back Better*

Gain

Lose

2010

Affordable Care Act

Gain

Lose

1993

Clinton budget act

Gain

Lose

1990

H.W. Bush tax act

Gain

Lose

Regressive, but all gain

BOTTOM 20%

TOP 20%

2017

First Trump tax cuts

Gain

Gain most

2013

Obama tax cuts

Gain

Gain most

2001/03

W. Bush tax cuts

Gain

Gain most

*Not enacted

NYT found the “big beautiful bill” would be the largest transfer from the poor to the rich in a single law since at least 1990.

In fact, it would be the largest transfer *ever.*

Reagan’s low-income cuts were MUCH smaller - and his tax cuts were done separately. And before him, nothing comes close.

13.06.2025 16:15 — 👍 1704 🔁 889 💬 32 📌 47

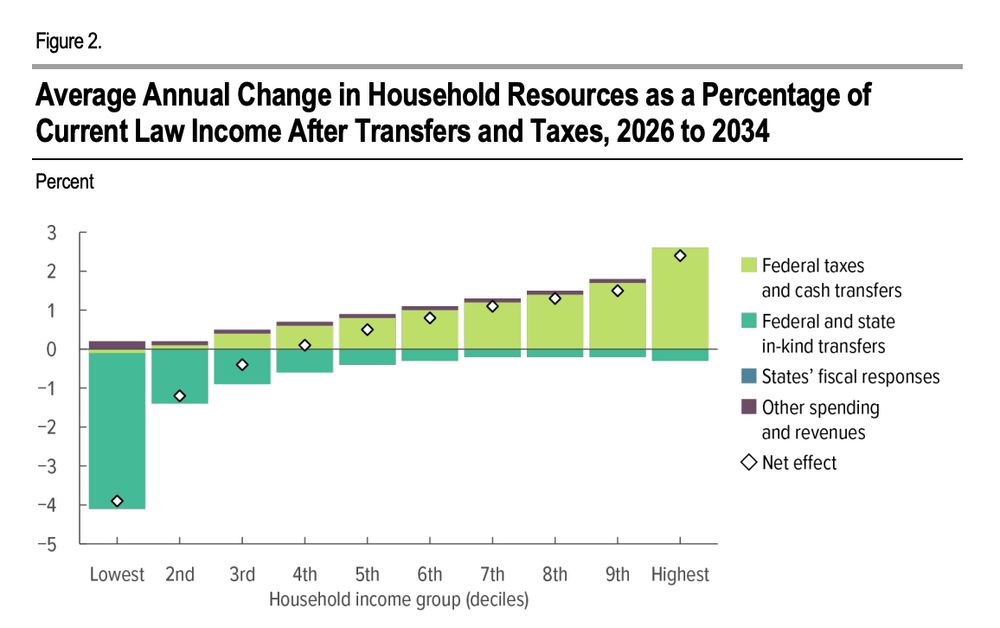

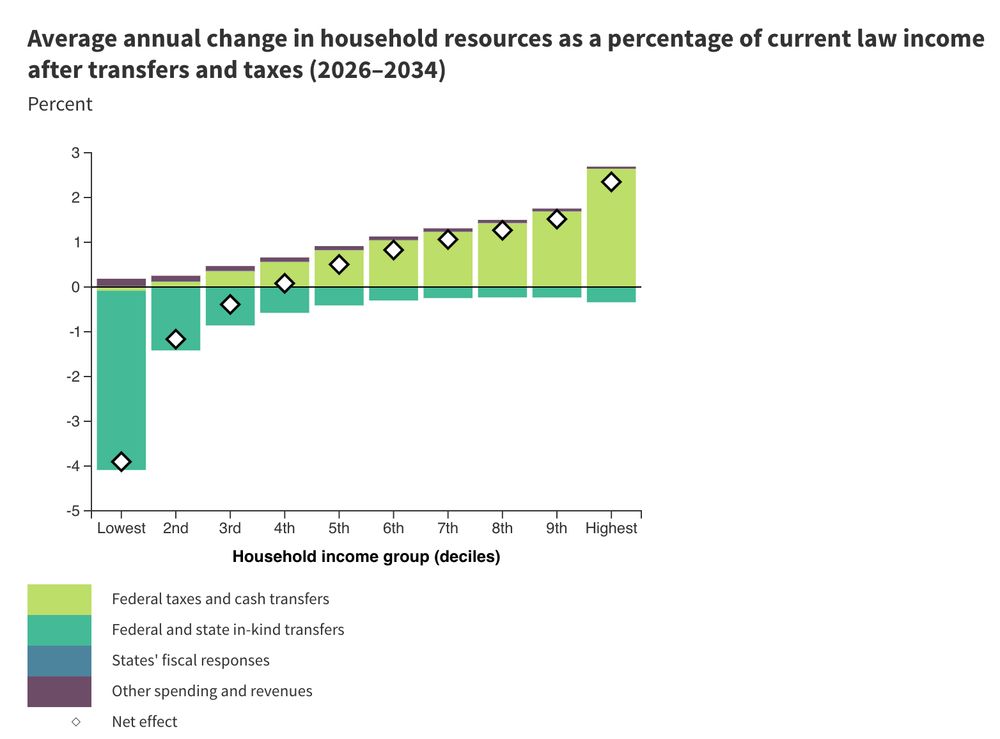

Folks, CBO estimate of the distributional effect of the One Big Beautiful Bill Act is out: www.cbo.gov/system/files...

It's grotesque

12.06.2025 15:16 — 👍 1169 🔁 544 💬 40 📌 48

New figures from CBO about how Americans at different income levels are affected by the GOP's Big Beautiful Bill.

Topline finding: Richest decile gets about 2% richer. Poorest decile gets about 4% poorer.

www.cbo.gov/publication/...

12.06.2025 15:17 — 👍 850 🔁 404 💬 39 📌 35

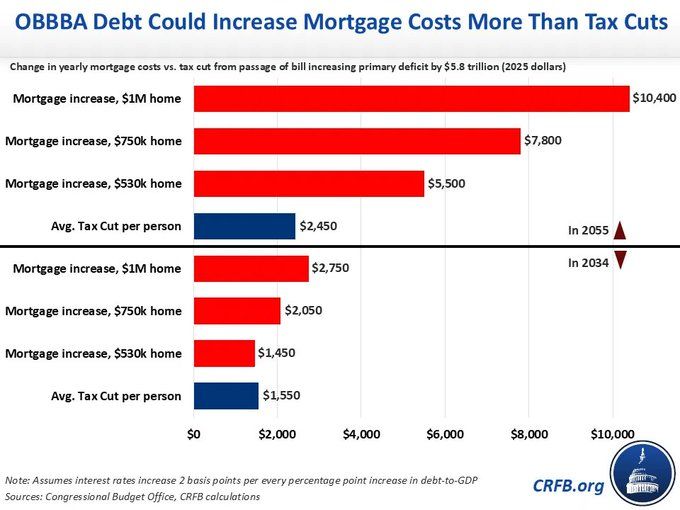

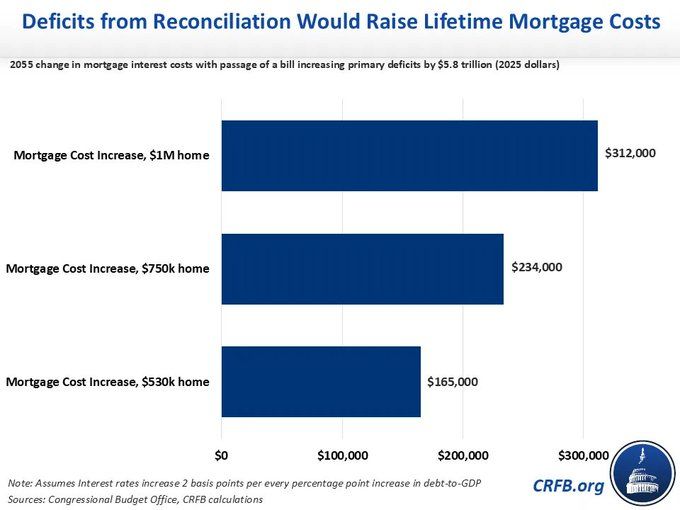

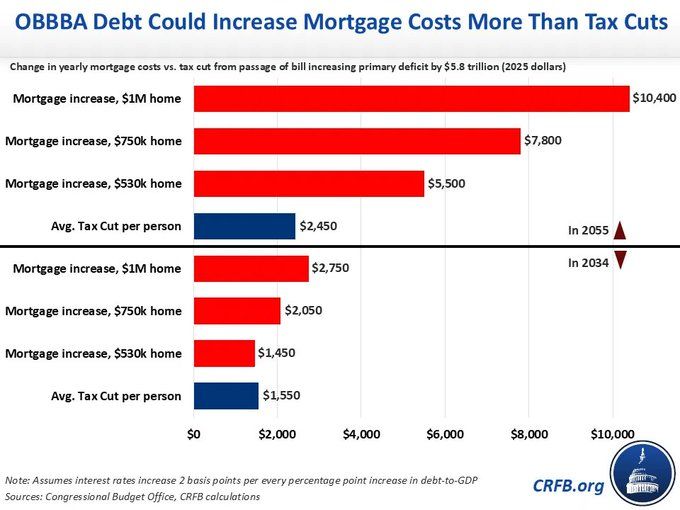

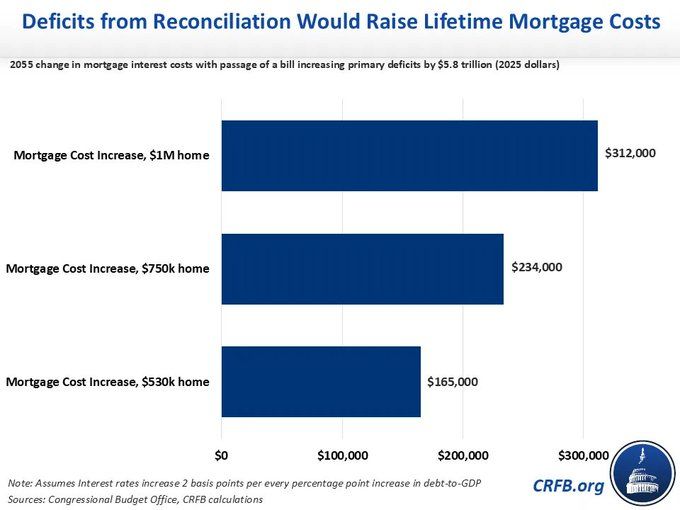

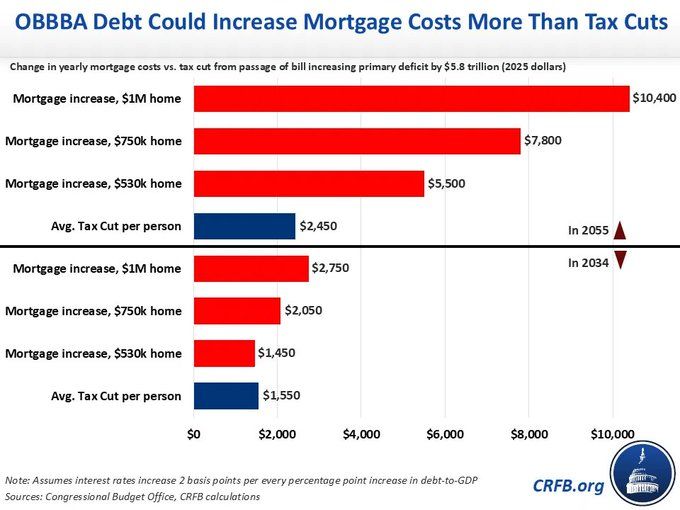

New from CRFB, we estimate how mortgage costs will increase in 2034 as a result of the OBBBA. The bill's deficits ⬆️ mortgage costs, meeting or exceed the tax cut for many families:

-Avg mortgage payment +$1,450

-vs pp tax cut of $1,550

By 2055, costs skyrocket

06.06.2025 15:27 — 👍 2 🔁 2 💬 1 📌 0

We use CBO's conservative estimate, but if the true number is closer to the Fed or AEI, then anyone who borrows money (mortgages, credit cards, business loans, etc) is in for high cost growth.

Even with CBO's number, mortgage interest costs grow a lot over the coming decades

06.06.2025 15:28 — 👍 0 🔁 0 💬 1 📌 0

The driver here is debt. As debt rises, countless papers tell us this raises interest rates for the government and the economy at large. For every increased %pt of Debt-to-GDP, interest rates rise:

-2 basis pts (CBO)

-3 bps (Dallas Fed)

-4.5 bps (AEI)

06.06.2025 15:28 — 👍 0 🔁 0 💬 1 📌 0

New from CRFB, we estimate how mortgage costs will increase in 2034 as a result of the OBBBA. The bill's deficits ⬆️ mortgage costs, meeting or exceed the tax cut for many families:

-Avg mortgage payment +$1,450

-vs pp tax cut of $1,550

By 2055, costs skyrocket

06.06.2025 15:27 — 👍 2 🔁 2 💬 1 📌 0

On top of everything else, Cuomo is yet another politician who doesn't live in New York City. On top of all of his flaws, why are these groups just glossing over the reality that the guy is squatting his daughter's apartment just so he can run for mayor? He doesn't know anything about city life.

03.06.2025 16:11 — 👍 80 🔁 20 💬 1 📌 3

Policy Analyst at the Center for American Progress just trying to make our economy a little more fair than when I found it.

Cat mom 🐈⬛, cyclist 🚴♀️, ceramics🏺

opinions are my own

Economist @ CAP; opinions my own

Analyzing economic policy, advancing racial equity, and making progress on my TBR pile

Comms for Center for American Progress/CAP Action.

Opinions are my own.

The Center for American Progress is dedicated to improving the lives of Americans through ideas and action. https://secure.actblue.com/donate/center-for-american-progress-1

Charles L. Denison Professor of Law, NYU School of Law; Faculty Co-Director of @taxlawcenter.org; Former Biden White House and Obama White House

Kopple Family Professor, NYU Law. Faculty Director @taxlawcenter.org. Former Assistant Secretary for Tax Policy at Treasury; Deputy Director, National Economic Council; Chief Tax Counsel, Senate Finance Committee.

Numbers wizard for the Senate Budget Committee Democrats; tax nerd, budget wonk. Formerly at @BudgetHawks

i have a very good brain, and i’ve said a lot of things. tax advisor. personal account. they/them

Senior Director of Federal Budget Policy for the Center for American Progress doing budget, tax, and econ.

Formerly: Biden OMB, Biden Transition Team, Senate Budget Committee (Murray and Sanders).

CBO and OMB’s biggest fan! Personal account.

Fiscal policy wonk at Center on Budget & Policy Priorities| Former Biden-Harris White House National Economic Council | Former Senate Aide | CAP/JEC Alum | Brock Purdy Fan Club Founder

Director of Federal Tax Policy @centeronbudget.bsky.social

Tax, budget, policy, racial and economic justice | Views are my own

she/her

Roll Tide/Wave, Who Dat. Donate money to your local food bank. Expect typos.

The Atlanta Fed serves the Sixth Federal Reserve District: AL, FL, GA and parts of LA, MS and TN. We foster a healthy economy and financial stability. We’re apolitical and decentralized to conduct monetary policy that’s in the best interest of the economy.

Investing in #CommercialRealEstate to Reduce Carbon Emissions; combining impact investment with fund strategies to grow and preserve capital. #CRE #CarbonReduction #ClimateFinance #GreenFinance #ImpactInvesting #ESG #CarbonAccounting #GreenBuilding #GRESB

Executive Director @taxlawcenter.org

Tax, law, policy, budget, economy. US & NZ.

Former Senior Director for Economic Policy @centeronbudget.bsky.social.

Host of Crooked Media’s “What A Day.” Contributing writer at the New York Times. Previously: host of The Argument. Go Blue means Go the University of Michigan.

An org with a mission to educate the public about the impact of parking policy on housing, climate, equity, and traffic.

https://parkingreform.org/