The Senate's budget reconciliation plan is just as bad if not worse than the House plan.

@nishinair.bsky.social shows how the plan would take food assistance away from parents and children... all to help fund massive tax breaks for the wealthy.

The Senate's budget reconciliation plan is just as bad if not worse than the House plan.

@nishinair.bsky.social shows how the plan would take food assistance away from parents and children... all to help fund massive tax breaks for the wealthy.

While we're still waiting on estimates on the cost and distribution of the Senate's tax plan, it generally has the same issues as the House plan: tax breaks that will overwhelmingly benefit the rich to pay for cruel cuts to health care and food assistance. Some of the worst tax provisions:

17.06.2025 19:40 — 👍 1 🔁 1 💬 1 📌 0

The Senate Finance Committee's tax changes closely resemble what the House passed last month.

They want massive tax cuts to the rich and health care stripped away from millions.

@amyhanauer.bsky.social on the bill: "It’s hard to imagine a more misplaced set of priorities." itep.org/itep-stateme...

Undocumented immigrants paid an effective federal income tax rate of 5.27% in 2022.

That means they paid a higher effective tax rate than 5 of the richest Americans…and a higher effective tax rate than 55 mega corporations.

So let me ask you: who are the real freeloaders?

The Legislature's health care premium proposal for undocumented adults is discriminatory, unjust, and undermines California’s commitment to #HealthEquity.

Learn more from @adri-ramyam.bsky.social

Thanks!

@unroll.skywriter.blue unroll

“Notably, the Legislature punts on advancing meaningful revenue solutions, delaying necessary action despite the clear need.

calbudgetcenter.org/news/stateme...

@clinkeyoung.bsky.social writes: "Ultimately, the 2017 ACA repeal effort failed over some Republican Senators’ unwillingness to inflict major cuts on the American health care system. The weeks ahead will determine whether that remains true in 2025." www.brookings.edu/articles/new...

04.06.2025 21:08 — 👍 2 🔁 2 💬 0 📌 0

The choice is clear: Cut health care, delay affordable housing, and slash food assistance for people barely getting by — or

Ask the ultra-wealthy and big corporations to pay their fair share in taxes.

#CALeg, which side are you on?

great, let's tax them!

04.06.2025 15:15 — 👍 3 🔁 3 💬 0 📌 0

Medi-Cal, In-Home Supportive Services, and other core programs allow Californians with disabilities to live safely and independently. Cutting these supports is unconscionable.

calbudgetcenter.org/resources/pe...

🥕The Republican House Bill makes the largest cuts to food and health care in history, to fund tax breaks to the wealthy. We stand with our children and families and say #HandsOff! @calbudgetcenter.org

02.06.2025 17:25 — 👍 4 🔁 3 💬 0 📌 0

“Most of these [ #CAbudget ] savings come, not from the $100 premiums that people are paying, but from the fact that they know people won’t be able to pay $100 premiums and will just lose coverage,” our executive director, @thewallner.bsky.social said.

@sacbee.com amp.sacbee.com/news/politic...

The House tax plan would create the first 100% refundable tax credit for donations to private school vouchers.

It would create a profitable tax shelter for wealthy people who agree to help funnel public funds into private schools. itep.org/house-tax-bi...

New @centeronbudget.bsky.social state fact sheets on the House budget reconciliation bill - here's a quick look at how Californians would be impacted. www.cbpp.org/research/sta...

30.05.2025 19:14 — 👍 3 🔁 2 💬 0 📌 0

"Assistance to the poor should be seen less as spending on people and more as investment in people." - @kedseconomist.com

www.bloomberg.com/opinion/arti...

"It's about three times as generous as what you're gonna get from donating to a children's hospital or a veteran's group or any other cause. It really preferences voucher groups over every other kind of charity." www.npr.org/2025/05/23/n...

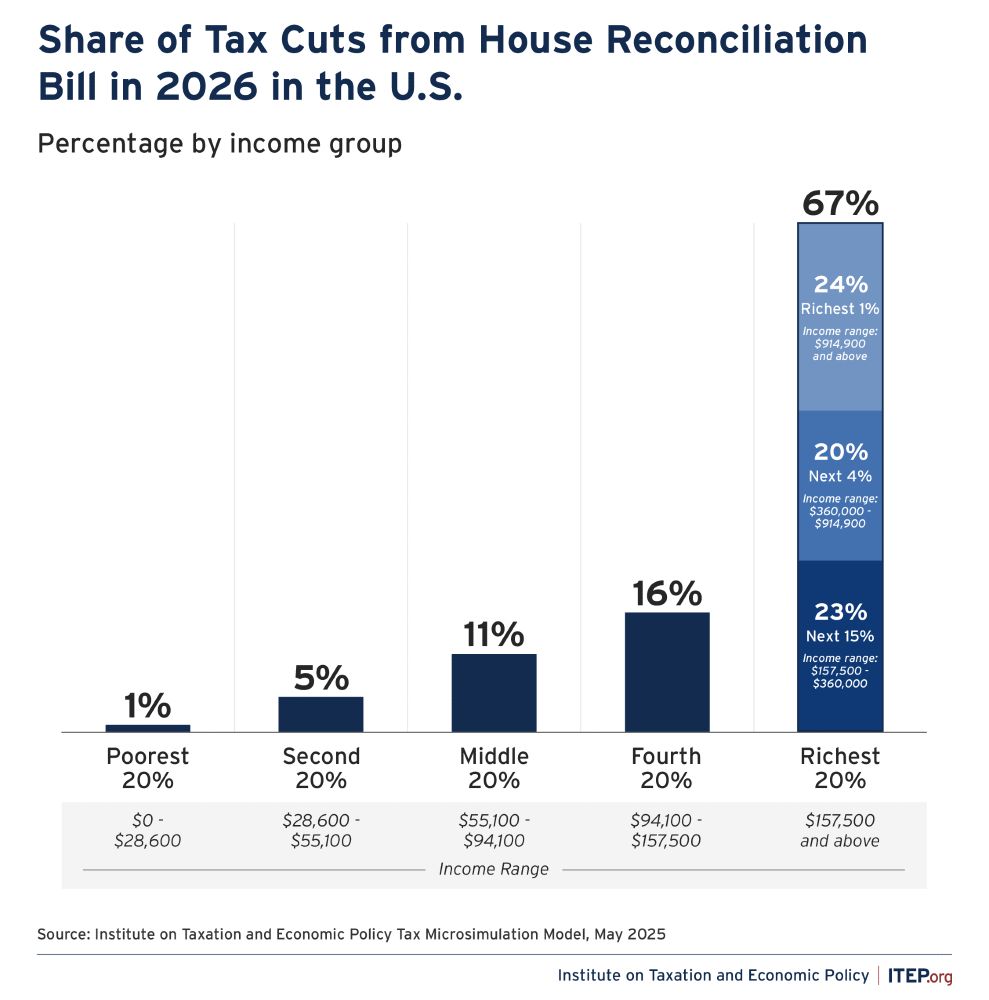

23.05.2025 19:28 — 👍 3 🔁 1 💬 0 📌 0New @itep.org estimates show that the House-passed bill would give the richest 1% of Californians (a group of less than 200K ppl who have incomes above ~$1M) an avg tax cut of $36K. Meanwhile, up to 3.4 MILLION Californians could lose Medi-Cal and 880K+ Californians could lose some CalFresh benefits

23.05.2025 01:15 — 👍 5 🔁 1 💬 1 📌 0

This morning, every Republican representative from California voted Yes on the House’s budget reconciliation package.

Let’s be clear: they voted to take health care and food assistance away from millions of vulnerable Californians.

calbudgetcenter.org/resources/ho...

My @familiesusa.bsky.social statement on the horrible House vote to make massive cuts to Medicaid, Medicare, and the ACA, forcing millions off coverage and raising costs for millions more in both public and private plans.

22.05.2025 13:50 — 👍 3 🔁 2 💬 0 📌 0"Determined to make the biggest cut to Medicaid in history, Congress is rushing a bill through in just days, through meetings in the middle of the night... trying to jam the bill forward before more Americans recognize what is happening to their health care," says @awright2care.bsky.social

22.05.2025 03:14 — 👍 0 🔁 1 💬 0 📌 0Thread: Latest House GOP reconciliation bill language again makes the draconian #Medicaid cuts harsher. For example, mandatory work requirements now will take effect 12/31/26 instead of 1/1/29 and states have option to implement them earlier (1/x)

22.05.2025 01:49 — 👍 569 🔁 299 💬 17 📌 36

Rs dropped the manager’s amendment at 9pm.

They’re planning to pass it through Rules shortly & through the full House TOMORROW MORNING w/out anyone understanding how the changes work & w/out any analysis of how it would affect people.

Deliberately because they don’t want to wait for the analysis.

House Republicans’ latest changes to the already harmful health provisions of their budget reconciliation bill layer on last minute cuts, swifter coverage losses, more cost increases, and restrictions on care.🧵

www.cbpp.org/research/hea...

New version of reconciliation bill is out. This "manager's amendment" moves up the date for when Medicaid work requirements start - says strike ‘‘January 1, 2029’’ and insert ‘‘not later than December 31, 2026, or, at the option of the State, such earlier date as the State may specify’’

22.05.2025 00:59 — 👍 248 🔁 103 💬 20 📌 7

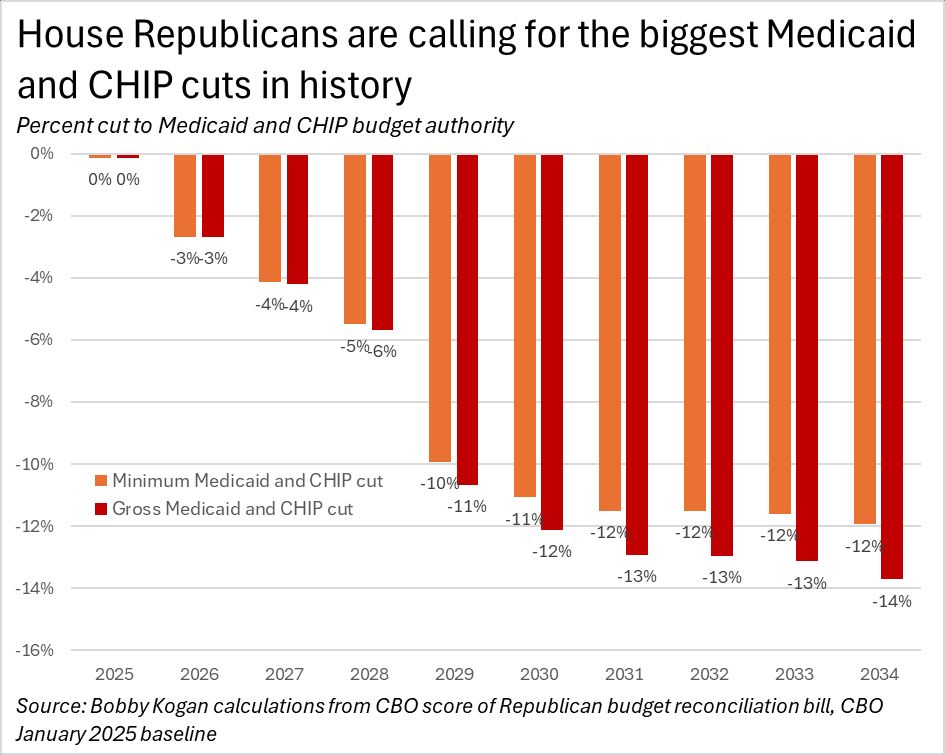

New from me: the House GOP bill would cut Medicaid & CHIP by 12-14%, growing higher over time - the largest in history.

There's $792 bn of gross Medicaid & CHIP cuts (mostly Medicaid). There are $76 bn of total health offsetting interactive effects (mostly Medicaid), so the true cut is $716-792 bn.

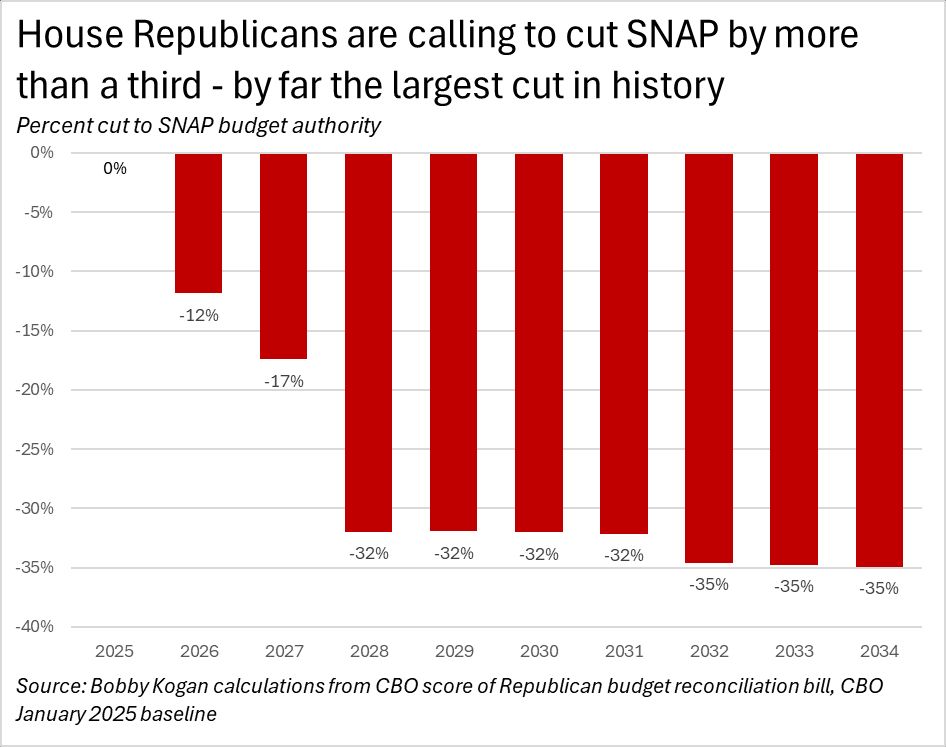

In the budget reconciliation bill, House Republicans are trying to cut SNAP by $295 billion. This would cut it in third in what would be by far the largest SNAP cut in history.

This would rip food assistance away from millions of people, including households with children as young as 7 years old.

14 million people could lose their Medicaid coverage.

22 million people could see their health insurance skyrocket.

And they're doing all of it so they can give millionaires and billionaires and their mega-corporations more tax breaks.

Everyone is seeing this, right?

New analysis of the tax provisions in the House reconciliation package: The richest 1% of Americans would receive a total of $138 billion in net tax cuts in 2026, significantly more than the $92 billion that would go the bottom 60% of Americans.

21.05.2025 12:36 — 👍 2 🔁 1 💬 1 📌 0