What actionable objectives do #macropru authorities follow? Find out who targets resilience and who aims to dampen credit cycles or lean against house price exuberance #housing www.bis.org/publ/cgfs69....

11.12.2023 12:55 — 👍 1 🔁 0 💬 0 📌 0

Mitigating boom-bust cycles needs consistency across all housing-related policies. #Macropru alone can’t fix structural problems in housing markets - housing supply matters #housing www.bis.org/publ/cgfs69....

11.12.2023 12:54 — 👍 0 🔁 0 💬 0 📌 0

Longer terms and higher incomes have also helped but not as much as higher repayments

07.12.2023 13:36 — 👍 1 🔁 2 💬 1 📌 0

Here's my chart on how all the variables that go into deciding how much borrowers can afford have changed since the market peak in August 2022.

The rise in rates would've hit borrowing capacity hard but they've been largely offset by borrowers having higher repayments as a % of their income.

07.12.2023 13:35 — 👍 3 🔁 1 💬 2 📌 0

Nice! I did something like that (but not so detailed) a while back to see how much low rates contributed to lower debt service ratios

07.12.2023 21:15 — 👍 1 🔁 0 💬 0 📌 0

Nice thread. I am not at all an expert on this topic but this tread is refreshing. Brings facts to the topic. Not just some half backed opinion

03.12.2023 22:09 — 👍 0 🔁 1 💬 0 📌 0

In response to Mike Bird’s question here I posted this thread on the other place. Just copying here as well

03.12.2023 14:47 — 👍 22 🔁 17 💬 4 📌 4

Feeling happy. My paper on direct lenders: dampening the financial accelerator www.bis.org/publ/work979... has just been accepted at the JMCB.

29.11.2023 19:50 — 👍 0 🔁 0 💬 0 📌 0

#EconSky 📉📈

Great virtual issue of the EJ that collects best recent papers published in the EJ on income and wealth distribution. Foreword by F. Lippi and F. Portier.

All articles in this virtual issue will be Free-to View for a limited time only, until May 2024. Don’t miss it!

👉 bit.ly/3Rk5cQj

28.11.2023 16:52 — 👍 7 🔁 6 💬 0 📌 0

My recent paper in Economic Journal:

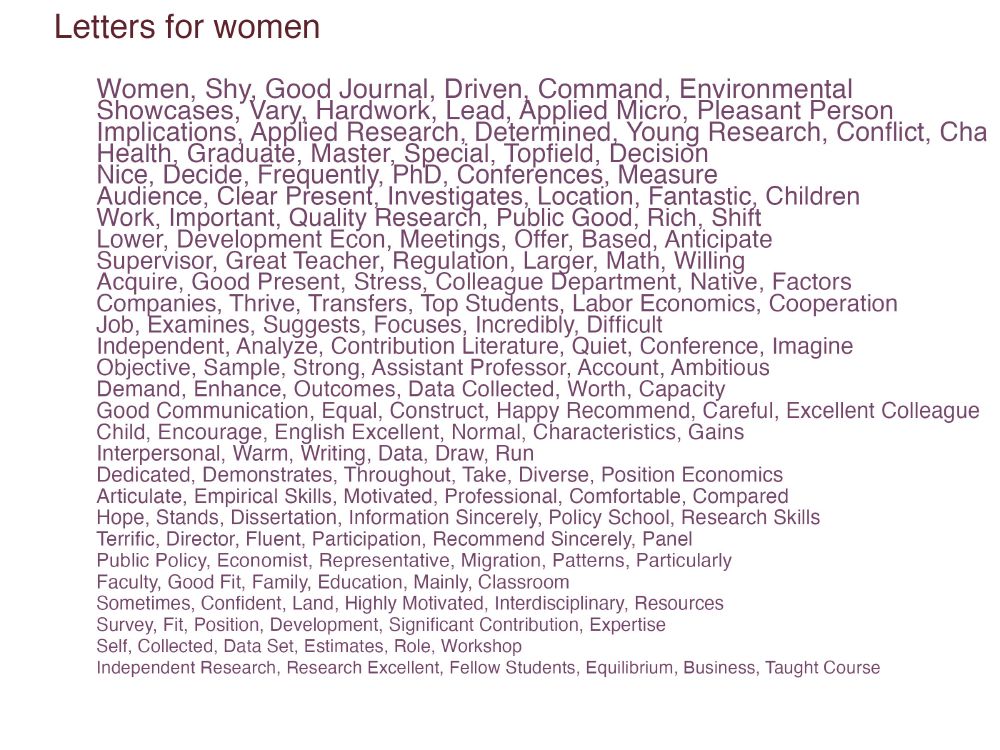

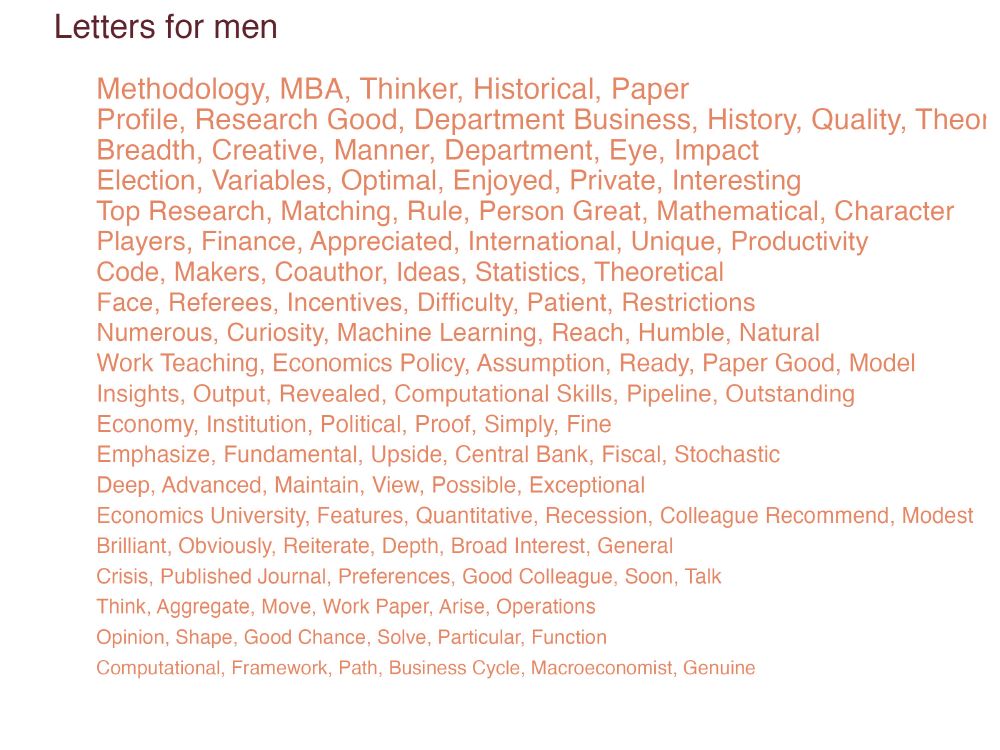

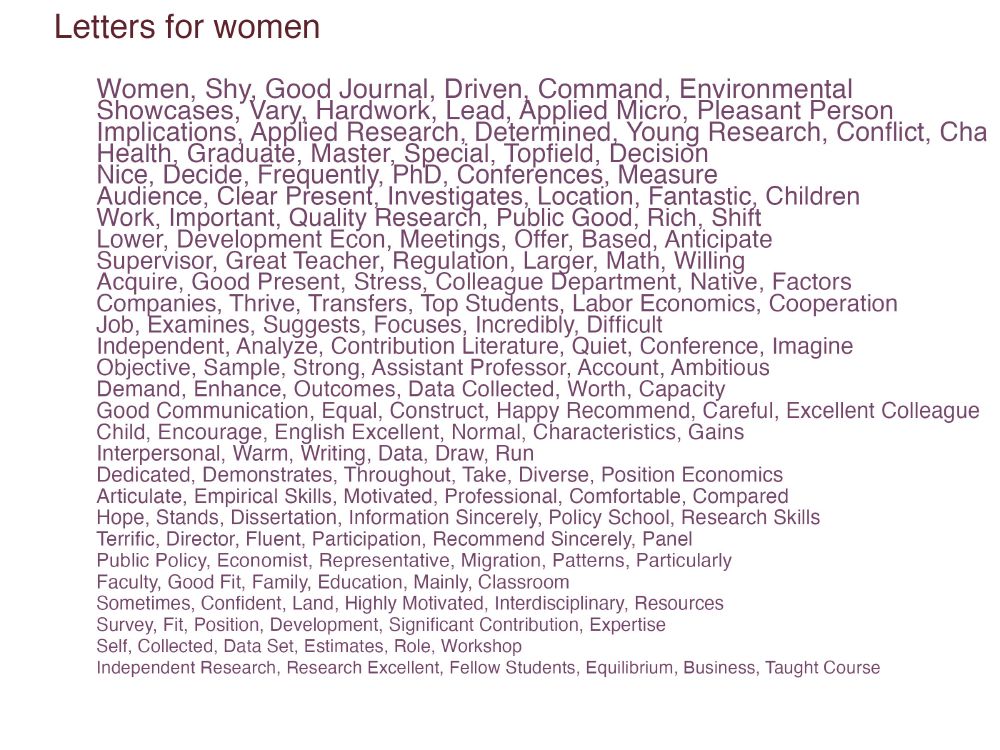

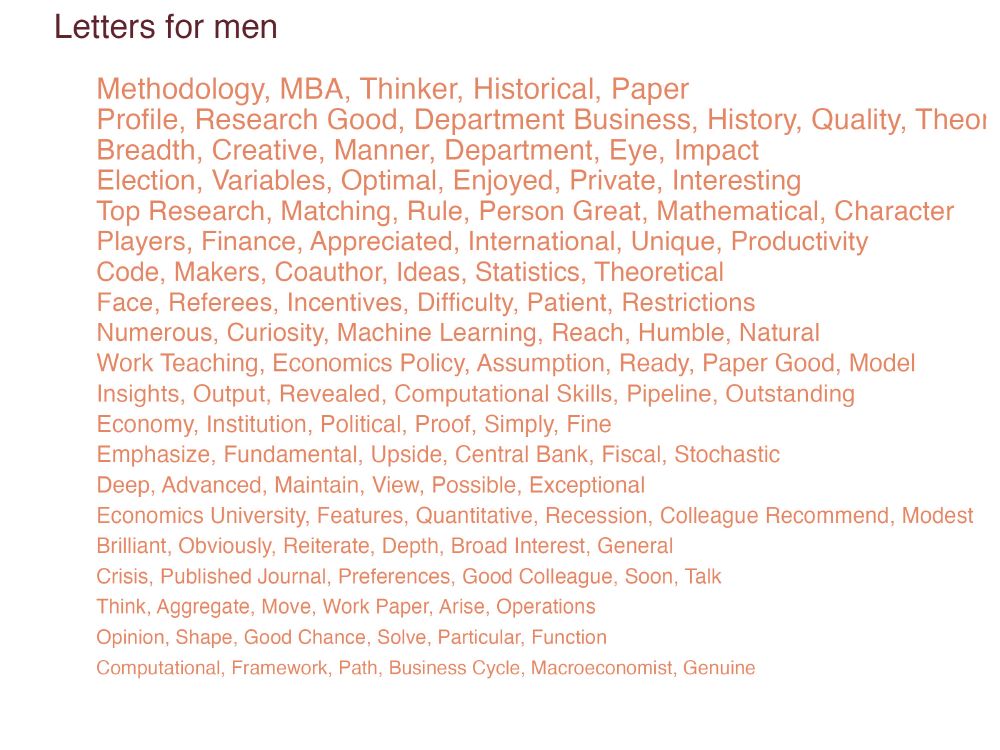

In the Econ job market men and women are recommended differently: letters for women stress hard work, those for men more likely highlight brilliance. This affects job placement.

Link to Paper: t.co/HUieaMuERd

With Giovanni Facchini and Markus Eberhardt

27.10.2023 09:07 — 👍 106 🔁 48 💬 2 📌 5

@t0nyyates.bsky.social is providing a real public service. Many thanks from me too!

27.10.2023 20:54 — 👍 7 🔁 1 💬 2 📌 0

Conference on Challenges for Financial Intermediaries and their Supervisors in the New (or Old?) Mon...

09.–10.11.2023 | Conference on Challenges for Financial Intermediaries and their Supervisors in the New (or Old?) Monetary Policy Normal | Frankfurt/Main

Looking forward to discussing nonbank lending and monetary policy papers.ssrn.com/sol3/papers....

@bundesbank conference. Similar conclusions to my paper on US direct lenders (www.bis.org/publ/work979...), but for households and firms in Denmark

26.10.2023 20:19 — 👍 2 🔁 0 💬 0 📌 0

Solopreneur @ IndieVisual

Data geek who loves problem solving

Rambles about fitness & random stuff too

https://indievisual.tech

causal inference, econometrics, ML, arsenal, loud music, unix, FOSS for scientific computing.

apoorvalal.github.io

(passively) maintains @paperposterbot.bsky.social

expert provider of lay opinions

Yale SOM professor & Bulls fan. I study consumer finance, and econometrics is a big part of my research identity. He/him/his

Economics Professor at Brown, studying discrimination, education, healthcare, and applied econometrics. I like IV

https://sites.google.com/site/aboutpeterhull/home

Trade wonk, Brexit bore, globalisation defender, music lover, cricketer, gardener, supporter of mediocre football teams, who knows where the time goes?

Senior Research Fellow at the Mercatus Center || Podcast Host at http://macromusings.libsyn.com || Former U.S. Treasury Economist || Micah 6:8

Chief economist at Absolute Strategy Research in London. But all of the nonsense I spout on here is mine and mine alone. RTs are not endorsements unless they are.

UK-cit ES-res European, "dangerously continental". Federalist. en fr de ca es. #FBPE. M: @littlegravitas@c.im. lgrav24[a]privateum.net. ✔️ e2e 🚫 'crypto'! Signal details by email. Kagi search engine advocate. NO DMs unless I know you. I mostly follow back.

Creator of 📰 News feeds, @xblock.aendra.dev, @moji.blue, founder of @shoots.green, co-organiser @atproto.london.

Opinions my own; not a journalist. I do datavis stuff sometimes.

she/her/ze/hir 🏳️⚧️

🌐 aendra.com

💻 github.com/aendra-rininsland

🗞️ ft.com/æ

Quant, Economist. I write about the US monetary policy at eightateeight.substack.com and about trade at https://eighttradeeight.substack.com/ 🇨🇭

Provost Prof. of Economics (UMass Amherst).

Inequality, labor market policies and competition.

Affiliations: NBER, IZA, MIT Shaping the Future of Work Initiative

Preorder my book, The Wage Standard: https://www.thewagestandard.com

Professor of Economics at Ghent University. Posts in English & Dutch

Political economist. Associate Fellow, Centre for European Reform. Past lives elsewhere. Likes long runs, good coffee and the Paris Review.

President, PIIE. Globalist. Former central banker. Political economy with a policy purpose. Writes on macroeconomic policy, G7/China relations, globalization, and economies of US, UK, Germany, Japan, and PRC.

Economist. Macro, inequality, public finance, international finance, asset pricing, labor.

https://www.jonathanheathcote.com