James D. Paron

James Paron's personal website. I am a Ph.D. candidate in Finance at the Wharton School of the University of Pennsylvania. My research interests include asset pricing, household finance, and macro-fin...

7️⃣The paper has many more interesting results, including implications for other secular trends & welfare

Check out the paper (jamesparon.com) for these results + details about the empirical evidence, growth model, and estimation!

And other great papers!

02.12.2024 13:44 — 👍 2 🔁 0 💬 0 📌 0

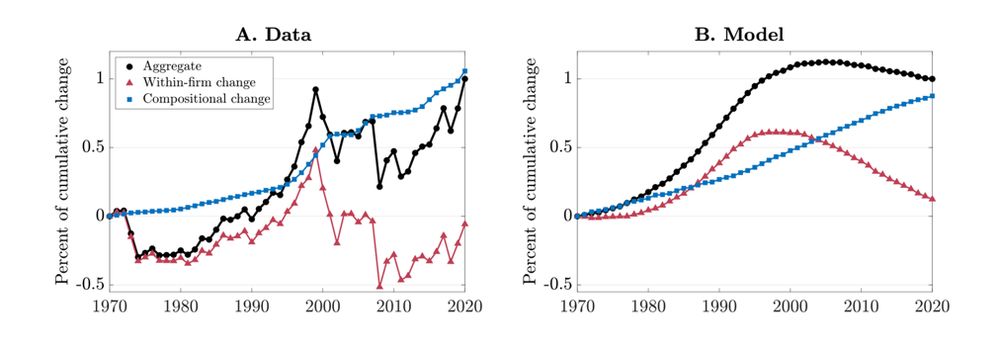

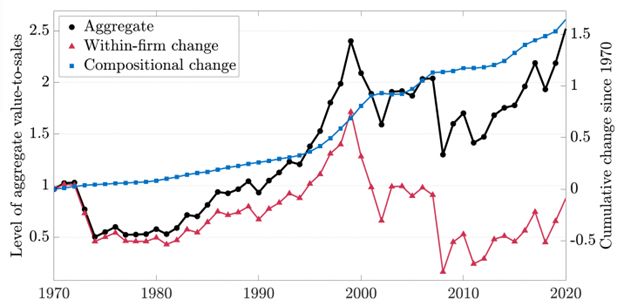

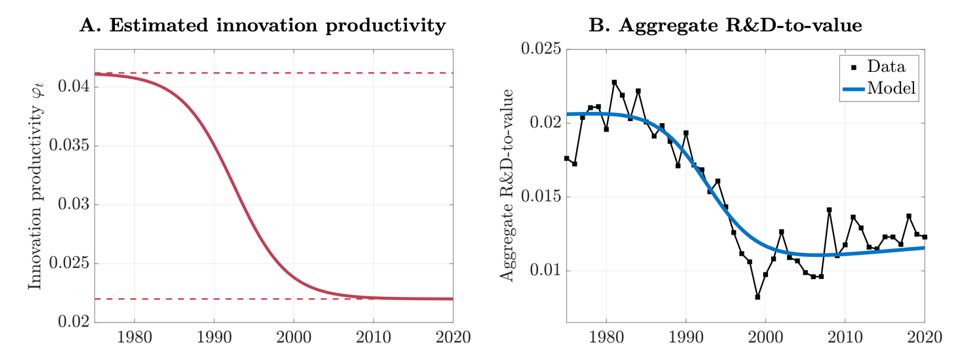

6️⃣This decline in research productivity explains most of the 📉 in growth and 📈in market value.

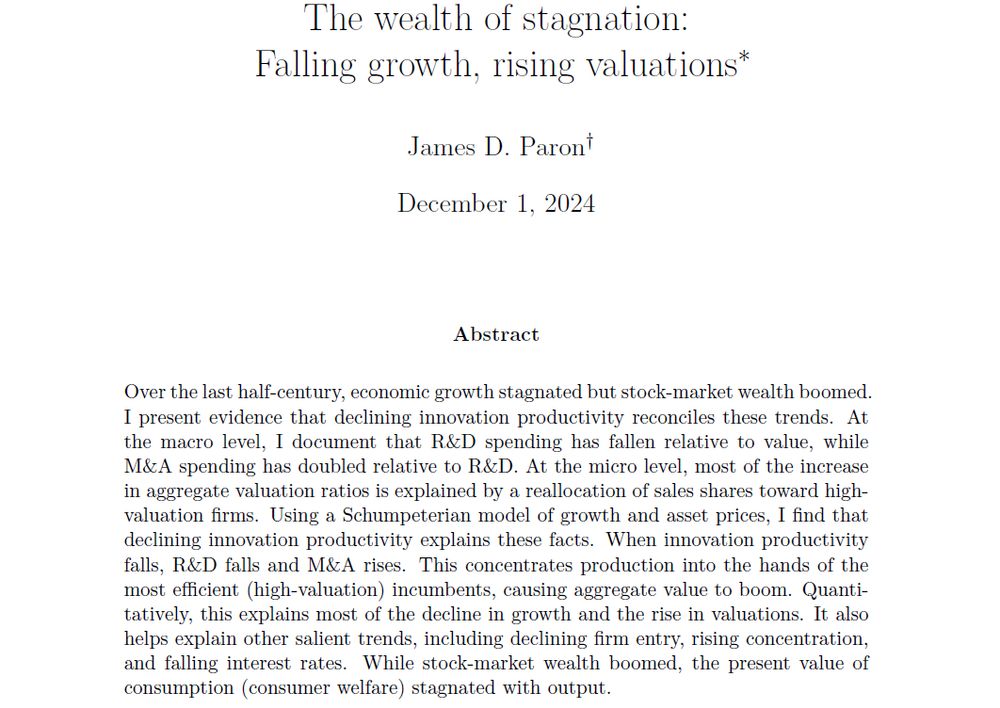

As in the data, all of the market boom comes from a reallocation to high-valuation firms.

Why? High-valuation firms shift from R&D to M&A, concentrating production in their hands

02.12.2024 13:43 — 👍 1 🔁 0 💬 1 📌 0

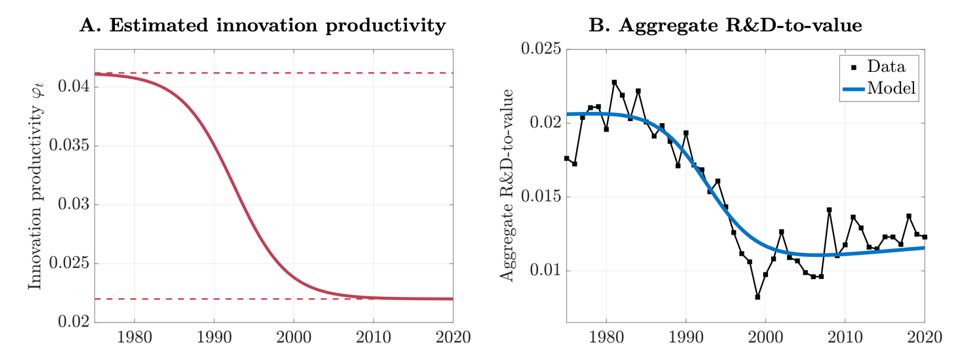

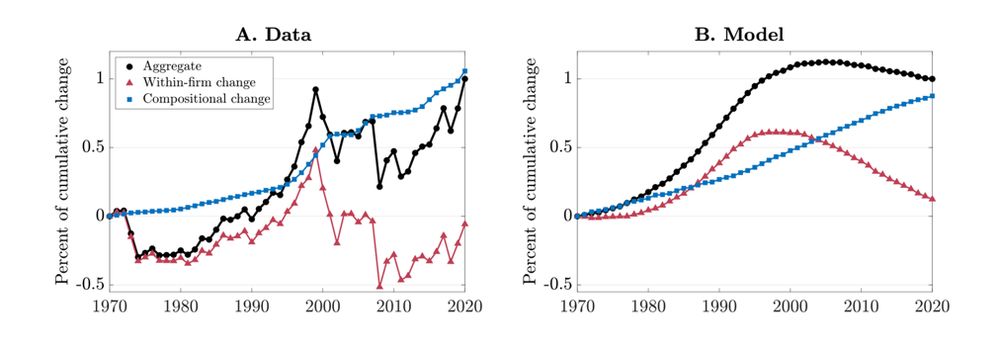

5️⃣He estimates that the decline in R&D-to-value implies that research productivity fell by ~50% since 1975.

In other words, it is half as easy to come up with a new idea today as it was 50 years ago.

02.12.2024 13:43 — 👍 0 🔁 0 💬 1 📌 0

4️⃣He builds a Schumpeterian model of growth and asset prices in which heterogeneous firms can grow through R&D and M&A.

After estimating the model, he uses it to:

– Estimate the decline in innovation productivity

– Quantify its effect on economic growth and valuations

02.12.2024 13:42 — 👍 0 🔁 0 💬 1 📌 0

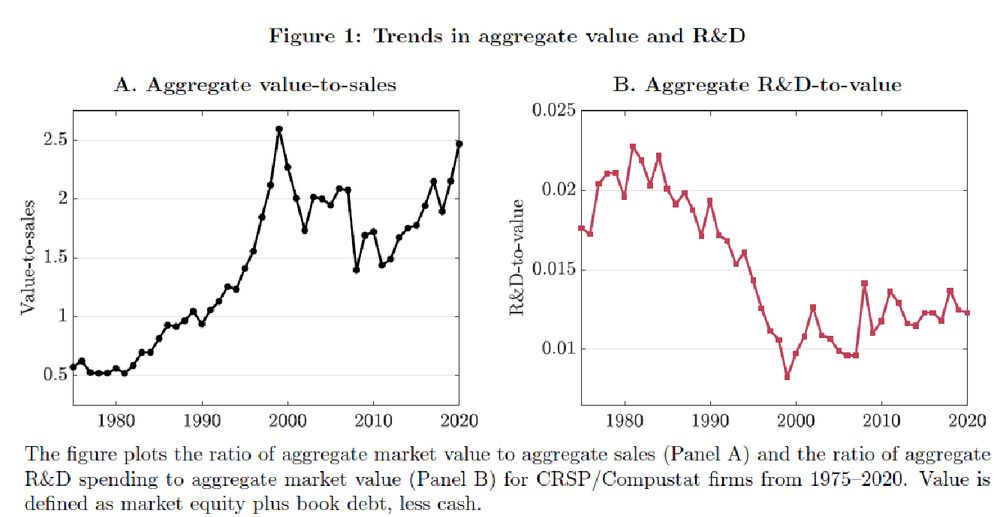

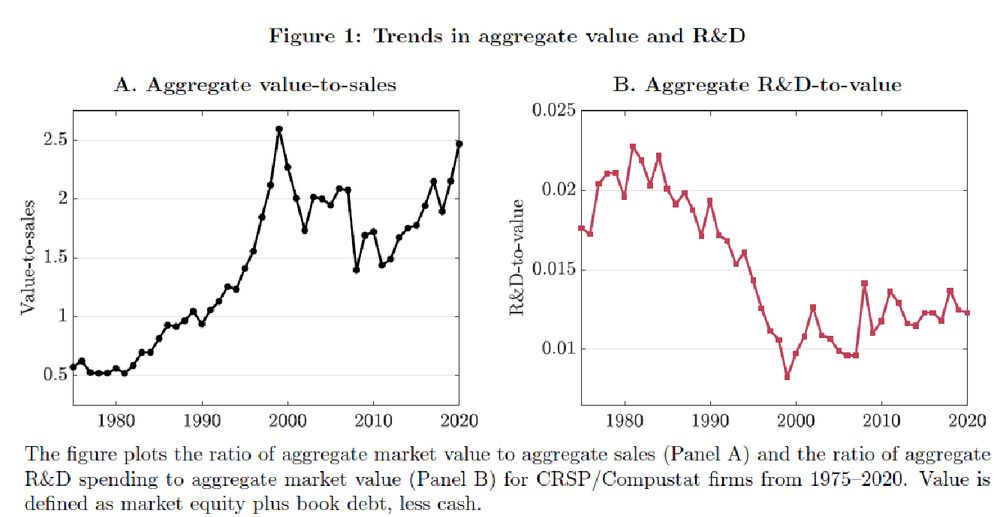

3️⃣ He documents 3 key stylized facts about 1970–2020:

– Aggregate R&D fell relative to value

– Aggregate M&A doubled relative to R&D

– A compositional change explains the rise in aggregate valuation ratios: markets are more and more dominated by firms high valuation ratios

02.12.2024 13:41 — 👍 0 🔁 0 💬 1 📌 0

2️⃣ The rising market valuation of profits since 1970 should have encouraged firms to innovate, but R&D investment fell.

🧩How do we reconcile stagnating growth (and R&D) with a booming stock market?

James solves this puzzle using micro data and a Schumpeterian growth model.

02.12.2024 13:41 — 👍 0 🔁 0 💬 1 📌 0

🧵My coauthor James Paron is on the market!

His paper reconciles apparently contradictory trends since 1970:

📉declining economic growth

📈rising stock market valuations

His explanation: Innovation got harder➡️ R&D fell, M&A rose ➡️ top firms pushed the aggregate stock market up

02.12.2024 13:40 — 👍 5 🔁 2 💬 1 📌 0

I will

02.12.2024 13:39 — 👍 0 🔁 0 💬 0 📌 0

I am not migrating from Twitter to Bluesky. Rather, I will use this account to tweet more about academic economics and mostly in English. At the same time, I will keep my Twitter account to engage with the general public, French political debates, and general trolling.

30.11.2024 21:46 — 👍 11 🔁 0 💬 4 📌 0

Finance prof at ESSEC

https://sites.google.com/site/laurentbach/

Economist, tax policy/inequality. Professional skeptic. Anti-illiberal.

http://www.columbia.edu/~wk2110/index.html

@wwwojtekk at various other websites

👨🔬 Journaliste @leparisien.fr, chef de service adjoint et (toujours !) reporter sur les sujets santé/sciences et météo/climat.

📈 Je parle (toujours) de #Covid19, mais aussi (et surtout) de beaucoup d'autres choses.

Chercheur en sciences sociales, plutôt détaché : prof. Univ. Poitiers & chef de service "études, prospective et évaluations" Région Nouvelle-Aquitaine. Compte perso.

Économiste, blogueur a l’arrêt

Associate professor in Financial Economics, Université Paris Dauphine-PSL, CEPR Research Affiliate. International Macroeconomics & Finance, Political Economy, Geoeconomics, Commodities

https://sites.google.com/site/evgeniapassari/

🇬🇷🇫🇷🇬🇧

German macroeconomist. Assistant professor at the University of Maryland. PhD from the London School of Economics.

https://econweb.umd.edu/~drechsel/

economist

@nyfedresearch

(my views, not fed views); interested in macroeconomics, finance, economic history, jazz, Bayer 04 Leverkusen, and New Yorker cartoons

Assistant Professor of Finance at Yale SOM. I study the taxation and regulation of real estate & spatial corporate finance. University of Rochester alum and Columbia Econ PhD. https://www.cameronlapoint.com/

Demography nerd at Pew Research Center

Global religious change, sociology

Ex NY Times, now author of Substack Paul Krugman. Nobel laureate and, according to Donald Trump, "Deranged BUM"

Econ prof University of Zurich.

Faculty affiliate at JPAL, CEPR, CESifo.

Board member IIPF, Helvetas, GAIN.

#EconSky

Journaliste @alternatives-economiques.fr

Actualité et/des sciences sociales, #data

Sir John Hicks Professor of Economics, LSE. Macroeconomics with distribution(s). https://benjaminmoll.com/

Economiste, DG @Rexecode.fr, chroniqueur @lesechosfr.bsky.social

Conjoncture économique worldwide, débat de politique éco France et Europe.

Graphiques en gros, demi-gros et détail

Enseignant, économiste. Il n'y a qu'un seul Dieu, c'est Antoine Dupont. 🏉

Researcher-Entrepreneur | Founder @foresight.earth and @lesenergiques.org | #Innovation #Sustainability #IT | Paris, France

Tax, economics, and law enthusiast. Opinions, if any, my own. I teach public finance and/or tax law in Saskatchewan, Canada. Just here to follow academics and data. https://papers.ssrn.com/sol3/cf_dev/AbsByAuth.cfm?per_id=2977172

Journaliste emploi/social - Le Monde

Prof. Sorbonne Université / @comedialkb.bsky.social / @lkblab.bsky.social | ENS Paris | Interested in Physics, but also imaging, computing, quantum optics and in the beauty and applications of light in general | proud dad & Husband | he/him